Cipher Mining’s CIFR AI and high-performance computing (HPC) growth is clearly taking form, supported by long-term contracts, seen execution and a quickly scaling pipeline that reshapes the corporate’s progress profile.

Throughout the third quarter of 2025, Cipher Mining executed two landmark AI/HPC transactions that strengthened its income visibility. The corporate signed two landmark internet hosting agreements — a 10-year AI internet hosting take care of Fluidstack, backed by Google, and a 15-year direct hyperscaler lease with Amazon Internet Companies (AWS). These agreements collectively set up Cipher Mining as a reputable HPC infrastructure developer and lock in roughly $8.5 billion of contracted AI/HPC lease funds, with revenues anticipated to start in 2026.

Execution threat has been a key concern in miner-to-HPC transitions, however Cipher Mining’s latest progress suggests the shift is advancing easily. Within the reported quarter, the corporate highlights that building on the Barber Lake website is already underway, with engineering, procurement and long-lead gear secured and supply of 168 MW of vital IT load focused for late 2026. Importantly, Cipher Mining grew its contracted AI internet hosting capability from zero to 544 MW in a single quarter, whereas sustaining a 3.2 GW growth pipeline extending by 2029 and past.

Whereas AI revenues will ramp primarily from 2026 onward, Cipher Mining’s secured hyperscaler contracts, advancing buildouts and prudent capital construction recommend the change is transferring past promise to reflection. The Zacks Consensus Estimate for 15.69% income progress in 2026 underscores expectations for accelerating contribution from the corporate’s increasing AI/HPC platform.

CIFR’s Key Rivals within the AI/HPC House

IREN Restricted IREN competes with CIFR by a extra aggressive, GPU-centric technique. IREN is constructing a large-scale GPU cloud platform, led by a $9.7 billion Microsoft contract and increasing relationships with Collectively AI, Fluidstack and Fireworks AI, introduced throughout the first quarter of fiscal 2026. These offers assist IREN’s expectations of over $500 million in AI Cloud ARR by early fiscal 2026 and a roadmap towards 140,000 GPUs powering multi-billion-dollar ARR potential.

TeraWulf WULF is rising as an AI/HPC competitor to CIFR by a long-term three way partnership with Fluidstack, positioning TeraWulf as a power-first, infrastructure-centric supplier for high-density compute. The three way partnership targets long-duration contracts and is valued at $9.5 billion over 25 years. Nonetheless, TeraWulf’s 250-500 MW annual growth is basically back-end loaded, with most capability unlikely to be on-line earlier than 2026. This timeframe overlaps with CIFR’s progress plans, intensifying competitors as each goal the identical wave of hyperscaler and AI infrastructure demand.

CIFR’s Share Worth Efficiency, Valuation & Estimate

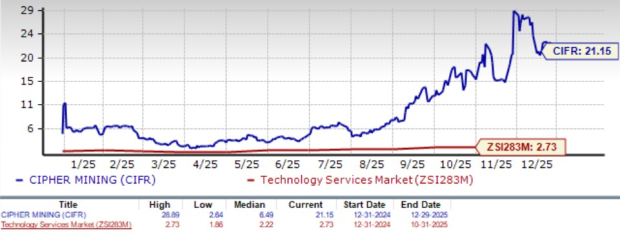

Cipher Mining shares have risen steeply by 207.7% previously six-month interval, outperforming the Zacks Expertise Companies business’s achieve of 20.9%. Nonetheless, the broader Zacks Enterprise Companies sector declined 7.8% in the identical timeframe.

CIFR’s Worth Efficiency

Picture Supply: Zacks Funding Analysis

CIFR shares are overvalued, with a ahead 12-month Worth/Gross sales of 21.15X in contrast with the business’s 2.73X. CIFR has a Worth Rating of F.

CIFR’s Valuation

Picture Supply: Zacks Funding Analysis

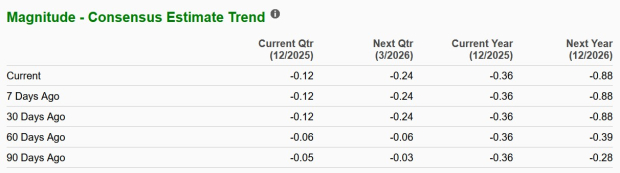

For the complete yr 2026, the Zacks Consensus Estimate for loss is at the moment pegged at 88 cents per share, and stays unchanged over the previous 30 days. CIFR reported a lack of 36 cents per share on a year-over-year foundation.

Picture Supply: Zacks Funding Analysis

Cipher Mining at the moment carries a Zacks Rank #3 (Maintain). You may see the whole checklist of right now’s Zacks #1 Rank (Robust Purchase) shares right here.

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unbelievable demand for knowledge is fueling the market’s subsequent digital gold rush. As knowledge facilities proceed to be constructed and continually upgraded, the businesses that present the {hardware} for these behemoths will develop into the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to make the most of the following progress stage of this market. It makes a speciality of semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is strictly the place you need to be.

See This Inventory Now for Free >>

Cipher Mining Inc. (CIFR) : Free Inventory Evaluation Report

IREN Restricted (IREN) : Free Inventory Evaluation Report

TeraWulf Inc. (WULF) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.