Cryptocurrency-based treasury reserves have develop into a extremely adopted initiative within the sector, with Ethereum and Bitcoin main the cost. Although the initiative kicked off with Bitcoin, Ethereum treasury reserves have witnessed exponential development as accumulation grows amongst massive corporations previously few months.

Institutional Ethereum Adoption Nonetheless Rising

Amid the brand new wave of crypto adoption within the monetary panorama, Ethereum’s function as a premier institutional asset is gaining traction, with treasury reserves holding ETH increasing at a speedy tempo. In latest months, company and cryptocurrency-native treasuries have each elevated their holdings, indicating a rising conviction in Ethereum’s long-term worth and utility.

Nevertheless, Ted Pillows, a crypto fanatic and investor, has reported a cooling down in ETH accumulation amongst treasury corporations in September. Such a growth hints at a possible pause within the accumulation development.

Following months of aggressive ETH allocations, this cooling development raises the query of whether or not treasuries are taking a break or ready for the market to reevaluate. Knowledge shared by Ted exhibits that corporations have acquired over 816,000 ETH within the month alone. Whereas it could seem to be a big amount, this can be a 50% decline when in comparison with August’s accumulation.

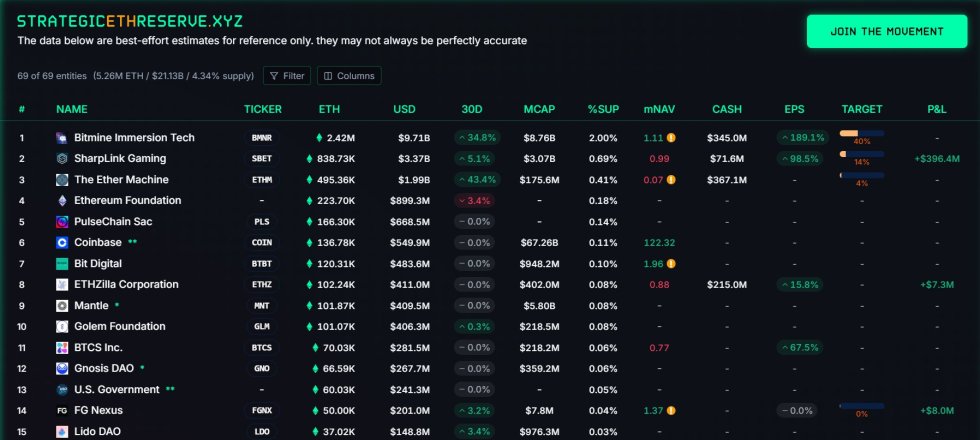

This drop in half marks one of many steepest month-to-month pullbacks of this 12 months. Regardless of the pullback in institutional accumulation, Ethereum treasury reserves stay elevated, with over 5 million ETH held in complete by corporations.

In response to the professional, there at the moment are 5,255,246 ETH held by treasury reserve companies, signaling rising confidence in Ethereum’s long-term worth and utility. With these monumental holdings, ETH is positioned as a key element of treasury diversification methods throughout the globe, highlighting not solely its rising status as a retailer of worth but additionally its pivotal function in decentralized finance and staking economies.

ETH Being Hailed As The Asset To Drive The Subsequent Enterprise Technique

Forbes has proclaimed that the ETH treasuries might be the following large enterprise technique within the monetary sector. What was as soon as seen as a high-risk experiment is now being reconsidered as a forward-looking enterprise technique, with enterprise and traders exploring ETH holdings as a hedge and a development engine.

The agency’s daring assertion is pushed by its perception that ETH treasuries are yield-bearing belongings, not like Bitcoin, which generally sits idle on company stability sheets. Moreover, Forbes acknowledged that the assertion is just not from a speculative view as a result of ETH is stability sheet engineering. By staking or lending ETH, treasury funds can decrease circulating liquidity and generate new income streams.

On the time of writing, ETH’s worth was buying and selling again above $4,100, demonstrating a virtually 3% enhance within the final 24 hours. Bullish sentiment is step by step returning to the market, as evidenced by a rise in its buying and selling quantity. Knowledge from CoinMarketCap exhibits that the buying and selling quantity has spiked by greater than 50% within the final day.

Featured picture from iStock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.