As conventional monetary companies evolve, crypto-based banking platforms are more and more being evaluated as options to legacy techniques. Rising account closures, greater charges, and stricter compliance necessities have prompted renewed curiosity in blockchain-enabled monetary instruments. Inside this panorama, tasks equivalent to Ripple (XRP) and Digitap ($TAP) characterize two distinct approaches to crypto banking.

Ripple continues to give attention to institutional-grade infrastructure, whereas Digitap positions itself round retail accessibility by an omni-bank mannequin. This distinction has led analysts and market observers to match how every ecosystem addresses banking performance, consumer entry, and long-term adaptability.

XRP’s Institutional Banking Focus and Its Limitations

XRP has traditionally positioned itself as a bridge asset for cross-border funds, focusing on monetary establishments, liquidity suppliers, and settlement networks. This institutional orientation helped set up XRP’s early relevance inside enterprise cost techniques, however it has restricted direct engagement with retail customers.

Ripple’s current strategic strikes, together with acquisitions and a broader give attention to custody, treasury, and brokerage companies, additional reinforce its institutional path. Whereas this infrastructure performs an necessary position in enterprise finance, its advantages stay largely oblique for on a regular basis customers.

From a market perspective, XRP’s worth exercise has typically mirrored macroeconomic developments or regulatory information somewhat than constant user-driven demand. This dynamic highlights how adoption inside a slim institutional hall can affect development traits over time.

Digitap’s Retail-Centric Banking Mannequin

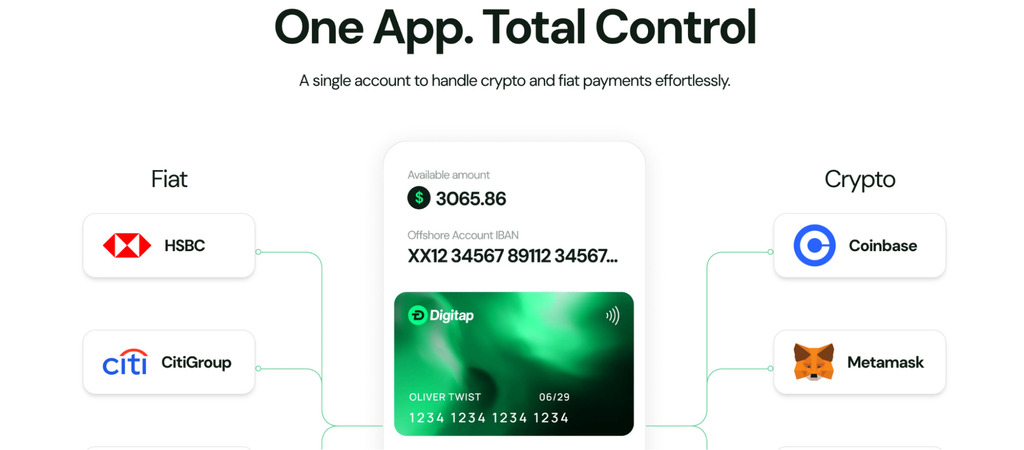

Digitap approaches crypto banking from a distinct angle, emphasizing direct usability for people and small companies. Its platform is designed to combine crypto and fiat companies inside a single software, permitting customers to handle transfers, balances, and funds with out counting on third-party intermediaries.

The Digitap app is at present accessible on main cell platforms and gives tiered verification choices relying on consumer wants and jurisdictional necessities. This versatile onboarding construction is meant to assist a variety of customers, together with freelancers, distant professionals, small enterprises, and people in areas with restricted entry to conventional banking.

Somewhat than specializing in backend settlement techniques, Digitap emphasizes front-end performance, positioning itself as a consumer-facing monetary platform somewhat than an institutional settlement layer.

Completely different Token Fashions, Completely different Use Circumstances

The distinction between XRP and Digitap additionally extends to token design and ecosystem construction. XRP operates inside a centralized provide framework managed by Ripple Labs, reflecting its enterprise-oriented deployment technique. Token utility is carefully linked to institutional liquidity and settlement use circumstances.

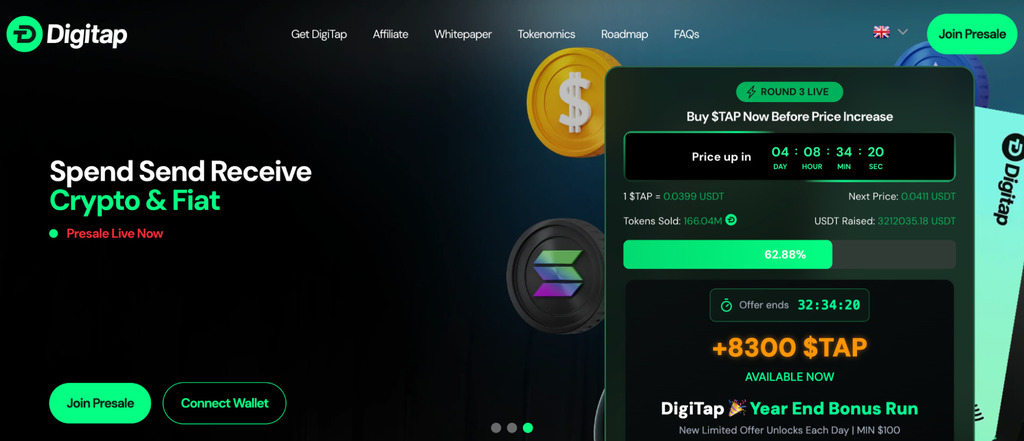

Digitap’s mannequin, by comparability, hyperlinks its token to platform exercise inside its banking ecosystem. In accordance with undertaking documentation, a portion of platform revenues is allotted towards ecosystem mechanisms designed to align consumer exercise with token circulation. This construction emphasizes participation and utilization somewhat than speculative holding, although outcomes rely upon broader adoption and execution.

Evolving Banking Wants and Crypto Options

Whereas Ripple’s know-how continues to serve an outlined function inside institutional finance, broader shifts in consumer expectations are influencing how crypto banking platforms are evaluated. Growing demand for accessible, digital-first monetary instruments has pushed curiosity in omni-bank fashions that mix usability with blockchain infrastructure.

Digitap displays this development by specializing in shopper accessibility and built-in monetary companies, somewhat than performing as a middleware layer for banks. This strategy aligns with the rising curiosity in various monetary platforms that function alongside or independently of conventional banking techniques.

XRP and Digitap: Two Paths Inside Crypto Finance

XRP stays a well-established asset inside cross-border settlement infrastructure, providing effectivity enhancements for institutional finance. Nonetheless, its reliance on enterprise adoption shapes each its utility and development dynamics.

Digitap represents another strategy centered on retail performance and built-in banking companies. Its presale has drawn consideration from observers monitoring rising monetary platforms, although, as with every early-stage undertaking, outcomes rely upon adoption, regulatory alignment, and long-term execution.

Study Extra About Digitap:

Presale: https://presale.digitap.app

Web site: https://digitap.app

Social: https://linktr.ee/digitap.app

Promotion: https://gleam.io/bfpzx/digitap-250000-giveaway

This text incorporates details about a cryptocurrency presale. Crypto Economic system shouldn’t be related to the undertaking. As with all initiative inside the crypto ecosystem, we encourage customers to do their very own analysis earlier than collaborating, fastidiously contemplating each the potential and the dangers concerned. This content material is for informational functions solely and doesn’t represent funding recommendation.