Kimberly-Clark Company’s KMB give attention to innovation, consumer-centric strategy and strategic investments in product improvement have been strengthening its place and market share growth. KMB’s Powering Care technique is a core pillar of its transformation, focusing on accelerated progress, operational effectivity and enhanced organizational alignment.

Kimberly-Clark’s Powering Care technique facilities on three priorities: accelerating innovation, optimizing margin construction and restructuring the enterprise for progress. This strengthens KMB’s world class management by balancing investments in high-growth segments and enhancing operational productiveness.

Administration’s dedication to delivering distinctive and higher-value merchandise ought to drive premiumization, catering to evolving client calls for whereas enhancing its model energy. This innovation technique is predicted to take care of client loyalty and help top-line progress throughout key classes.

The corporate seems to bolster progress by way of innovation, premiumization, brand-building efforts and digital advertising. Innovation stays central to Kimberly-Clark’s technique, with new product introductions spanning all value tiers. The launch of Pores and skin Necessities, highlighting skincare advantages, has resonated properly with shoppers. By tailoring its portfolio to each premium and value-conscious segments, the corporate is successfully broadening its market attain.

In a nutshell, Kimberly-Clark’s Powering Care technique underscores a disciplined but growth-oriented transformation agenda. With innovation fueling client engagement, a volume- and mix-led mannequin driving sustainable top-line progress and a relentless give attention to productiveness enhancing margins, the corporate is well-positioned to drive balanced progress.

KMB’s Value Efficiency, Valuation and Estimates

Kimberly-Clark’s shares have misplaced 8.7% 12 months so far in contrast with the business’s 10% drop.

Picture Supply: Zacks Funding Analysis

From a valuation standpoint, KMB trades at a ahead price-to-earnings ratio of 16.76X in contrast with the business’s common of 18.73X.

Picture Supply: Zacks Funding Analysis

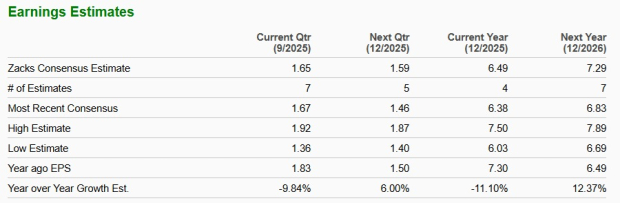

The Zacks Consensus Estimate for KMB’s 2025 earnings per share (EPS) signifies a year-over-year decline of 11.1% whereas that of 2026 reveals progress of 12.4%. The corporate’s EPS estimates for 2025 and 2026 have moved down up to now 30 days.

Picture Supply: Zacks Funding Analysis

Kimberly-Clark at present carries a Zacks Rank #3 (Maintain).

Shares to Take into account within the Client Staples House

United Pure Meals UNFI is a key distributor of pure, natural and specialty meals and non-food merchandise. It at present sports activities a Zacks Rank #1 (Sturdy Purchase). You possibly can see the entire checklist of in the present day’s Zacks #1 Rank shares right here.

The Zacks Consensus Estimate for United Pure Meals’ present financial-year gross sales and earnings signifies progress of two.4% and 167.6%, respectively, from the prior-year ranges. UNFI delivered a trailing four-quarter earnings shock of 416.2%, on common.

Celsius Holdings, Inc. CELH, which focuses on dietary purposeful meals, drinks and dietary dietary supplements, starches and diet components, at present sports activities a Zacks Rank of 1.

The Zacks Consensus Estimate for Celsius’ present financial-year earnings is predicted to rise 54.3% from the corresponding year-ago reported determine. CELH delivered a trailing four-quarter earnings shock of 5.4%, on common.

Put up Holdings POST, which is a consumer-packaged items holding firm, at present carries a Zacks Rank #2 (Purchase). POST delivered a trailing four-quarter earnings shock of 21.4%, on common.

The Zacks Consensus Estimate for Put up Holdings’ present financial-year earnings signifies progress of 11% from the year-ago quantity.

Quantum Computing Shares Set To Soar

Synthetic intelligence has already reshaped the funding panorama, and its convergence with quantum computing might result in essentially the most vital wealth-building alternatives of our time.

As we speak, you have got an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Past AI: The Quantum Leap in Computing Energy, you may uncover the little-known shares we imagine will win the quantum computing race and ship large positive aspects to early buyers.

Kimberly-Clark Company (KMB) : Free Inventory Evaluation Report

United Pure Meals, Inc. (UNFI) : Free Inventory Evaluation Report

Put up Holdings, Inc. (POST) : Free Inventory Evaluation Report

Celsius Holdings Inc. (CELH) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.