Bitcoin, Ethereum, XRP, and different altcoins tumbled amid the newest crypto market crash. Over $1.2 billion in lengthy positions had been liquidated throughout high crypto property as $200 billion obtained worn out from the market cap.

Traders now brace for a BTC and ETH choices expiry price greater than $16 billion in notional worth. Can the crypto market rebound or crash extra after the choices expiry?

Crypto Market Braces for $16B Bitcoin and Ethereum Choices Expiry

The most recent Bitcoin value correction primarily occurred because of merchants and establishments taking income because of the month-to-month crypto choices expiry on October 31. With derivatives knowledge now essential amid huge buying and selling volumes on CME, Deribit, and spot Bitcoin and Ethereum ETFs, it turns into a key indicator of crypto market path.

Throughout this month-to-month choices expiry on Deribit, greater than 123K BTC choices of notional worth $13.52 billion will expire. The put-call ratio of 0.70 and the max ache value at $114K point out room for upside on account of extra name choices as in comparison with put choices.

Within the newest 24 hours, put quantity has surpassed name quantity, with a put/name ratio of 1.35. This alerts hedging draw back safety by merchants. Additionally, BTC choices merchants are betting for a rebound above $112K after the choices expiry, in response to Deribit’s day by day choices knowledge.

In the meantime, huge 642K ETH choices with a notional worth of just about $2.5 billion are set to run out immediately. The put-call ratio of 0.68. The put quantity has doubled within the final 24 hours, 209K towards 104k calls. The put-call ratio of two confirms bearish sentiment amongst choices merchants.

Additionally, the max ache level is at $4,100, method above the present market value of $3,836. Nonetheless, the put open pursuits are increased at $4,000 and $3,600 strike costs, with merchants opening extra places for subsequent choices expiries.

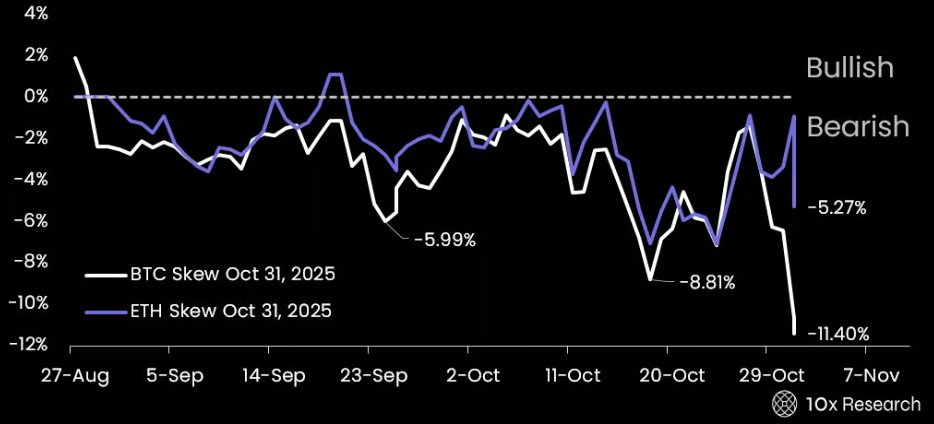

10x Analysis Recommends Promoting ETH, Cautious BTC Shopping for

10x Analysis reveals a spike in BTC’s near-term implied quantity whereas “longer maturities barely moved”, hinting a catalyst for upside. In distinction, ETH’s chart patterns are flashing structural uncertainty and a really completely different long-term payoff profile.

Whereas choices merchants hedge BTC, 10x Analysis analyst Markus Thielen recommends shorting ETH as a wise transfer. The crypto market crashed as institutional treasuries didn’t persuade, spot Bitcoin and Ethereum ETFs recorded outflows, and costs fell under the assist zone.

The emergence of ETH as a “digital treasury” mannequin turned one of the crucial highly effective narratives of this summer season. Bitmine’s technique prompted institutional buyers to build up ETH and later distribute it to retail consumers at a premium. Nonetheless, 10x Analysis claims “one thing broke alongside the way in which and it’s now having a profound affect on Ethereum.”

Whereas the agency stays cautious on Bitcoin, it turned extra unfavourable on ETH value setup. Notably, institutional buyers are responding to precise flows, not macro liquidity below present crypto market situations.