Chegg, Inc.’s CHGG core educational enterprise has been considerably impacted by the speedy adoption of generative Synthetic Intelligence (AI) and a pointy decline in Google-driven visitors. This resulted in a greater than 40% year-over-year decline in revenues within the third quarter of 2025. With AI-powered search disrupting the method of scholars accessing educational assist, CHGG’s legacy visitors has decreased by almost 50% as of the third quarter of 2025.

Given the shift available in the market developments, Chegg has been closely investing in AI to enhance effectivity, automate content material supply and improve person expertise throughout Chegg Examine, Math and Writing. These upgrades will permit the corporate to serve most pupil queries utilizing its present database of greater than 130 million questions, considerably reducing prices and capital depth. Because of this, CHGG has been in a position to slash working bills and reposition the legacy unit as a cash-generating enterprise somewhat than a development engine.

Nevertheless, with a high-quality AI-enhanced product, Chegg admits it can not compete head-on with free, embedded AI solutions supplied straight by way of search engines like google and yahoo and enormous language fashions. Notably, Chegg’s AI technique is more and more about prolonging the tail of the legacy enterprise whereas funding its pivot to Chegg Skilling. AI has enabled leaner operations, lowered capital expenditure and ensured higher margin prospects, serving to the educational phase generate money for a number of years.

Summing up, Chegg’s AI upgrades are unlikely to “repair” the collapse in legacy visitors; somewhat, they function a defensive software by stabilizing money flows and shopping for time. The developments will proceed whereas the corporate shifts its long-term development ambitions towards B2B skilling, language studying and workforce AI schooling.

Chegg’s Aggressive Place within the EdTech Market

Chegg operates in a extremely aggressive panorama, with famend names like Duolingo, Inc. DUOL and Udemy, Inc. UDMY working beside it within the ed tech market.

Duolingo dominates the language-learning area of interest with its gamified app and AI-driven engagement. With a robust cellular presence and each day person engagement, Duolingo has constructed a model synonymous with accessible, bite-sized studying. However, Udemy continues to scale its huge market mannequin, leveraging hundreds of unbiased instructors to deal with fast-changing skilled and technical studying wants.

Chegg’s problem is proving that its B2B skilling pivot can ship sturdy development, whereas Udemy continues increasing its company footprint and Duolingo deepens monetization by way of subscriptions and new product traces. In the end, Chegg, Udemy and Duolingo illustrate three divergent approaches to competing in an ed-tech market reshaped by AI, company upskilling demand and the necessity for measurable studying outcomes.

Chegg Inventory’s Value Efficiency & Valuation Development

Shares of this California-based schooling know-how firm have inched up 2.4% up to now month, outperforming the Zacks Web – Software program trade, the Zacks Pc and Expertise sector and the S&P 500 Index.

Picture Supply: Zacks Funding Analysis

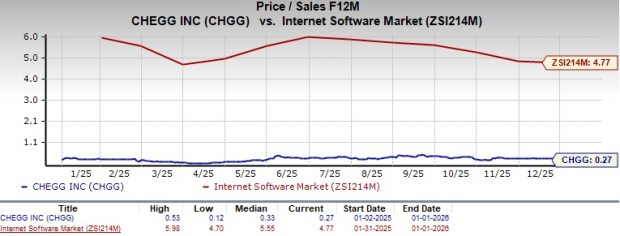

CHGG inventory is at present buying and selling at a reduction in contrast with the trade friends, with a ahead 12-month price-to-sales (P/S) ratio of 0.27, as evidenced by the chart under.

Picture Supply: Zacks Funding Analysis

Earnings Estimate Development of CHGG

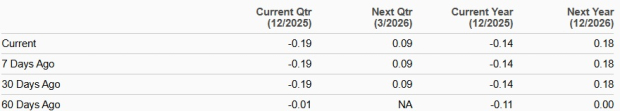

The Zacks Consensus Estimate for 2025 loss has widened up to now 60 days to 14 cents, whereas earnings estimates for 2026 have moved as much as 18 cents throughout the identical timeframe.

Picture Supply: Zacks Funding Analysis

Whereas the estimated determine for 2025 signifies a decline of 118.7% 12 months over 12 months, estimates for 2026 point out 228.6% development.

Chegg inventory at present sports activities a Zacks Rank #1 (Robust Purchase). You may see the entire checklist of at the moment’s Zacks #1 Rank shares right here.

Quantum Computing Shares Set To Soar

Synthetic intelligence has already reshaped the funding panorama, and its convergence with quantum computing might result in essentially the most vital wealth-building alternatives of our time.

In the present day, you will have an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Past AI: The Quantum Leap in Computing Energy, you may uncover the little-known shares we imagine will win the quantum computing race and ship large features to early traders.

Chegg, Inc. (CHGG) : Free Inventory Evaluation Report

Duolingo, Inc. (DUOL) : Free Inventory Evaluation Report

Udemy, Inc. (UDMY) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.