Key takeaways

- Wall Road expects softer This autumn Tesla deliveries.

- EV tax credit score pull-forward and macro pressures could weigh on gross sales.

- TSLA value motion suggests a slowdown is already priced in.

Tesla This autumn gross sales preview

Zacks Rank #3 (Maintain) inventory Tesla ((TSLA – Free Report) ) is anticipated to announce fourth quarter gross sales numbers in late January 2026 (seemingly round January 27 or 28th if historical past is any information). Sometimes, the main electrical automobile producer releases a brief press launch that features supply and manufacturing numbers earlier than earnings (due January 28th after the U.S. fairness market closes).

Wall Road has low expectations for Tesla’s This autumn gross sales numbers

Final quarter, Tesla introduced file deliveries of ~500,000 autos and a sturdy manufacturing quantity ~447,000. Nonetheless, Tesla’s November month-to-month gross sales information confirmed a big drop-off. Tesla offered roughly 40K autos in November, representing a 23% year-over-year slowdown. Under are the expectations for This autumn supply numbers:

- Wall Road This autumn Tesla Expectations: FactSetconsensus information suggests that almost all Wall Road analystsanticipate slower supply numbers that may are available at ~450,000. In the meantime, Bloomberg consensus information suggests the same gross sales variety of ~455,000.

- Tesla Steering: Earlier within the yr, Tesla CEO Elon Musk steered gross sales might return to double-digit progress in 2025. Nonetheless, the corporate has not produced steerage, and Elon Musk has not talked about his gross sales expectations lately.

- Betting Markets: Polymarket means that the almost definitely final result is that This autumn Tesla gross sales will are available ~400-425k (44% probability).

Picture Supply: Zacks Funding Analysis

Why are Tesla’s This autumn gross sales anticipated to gradual?

Over the previous few years, EV demand has slowed. Different components contributing to slowing gross sales embrace model weak spot (because of Elon Musk’s involvement in “DOGE”), weak shopper sentiment and macro pressures, and elevated competitors from Chinese language EV makers like BYD ((BYDDF – Free Report) ) and Nio ((NIO – Free Report) ). Lastly, the principle offender for an anticipated drop in Tesla gross sales is the “pull ahead” impact of the EV tax credit score. Numerous Tesla demand was pulled ahead into Q3 as prospects appeared to reap the benefits of the $7,500 tax credit score earlier than it expired.

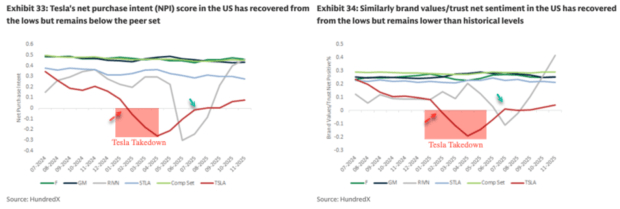

On the optimistic facet, information from predictive perception agency HundredX suggests that point has healed Tesla’s model woes. The information means that Tesla’s internet buy intent (NPI) and model worth/ belief have absolutely recovered after slumping in early 2025.

Picture Supply: HundredX

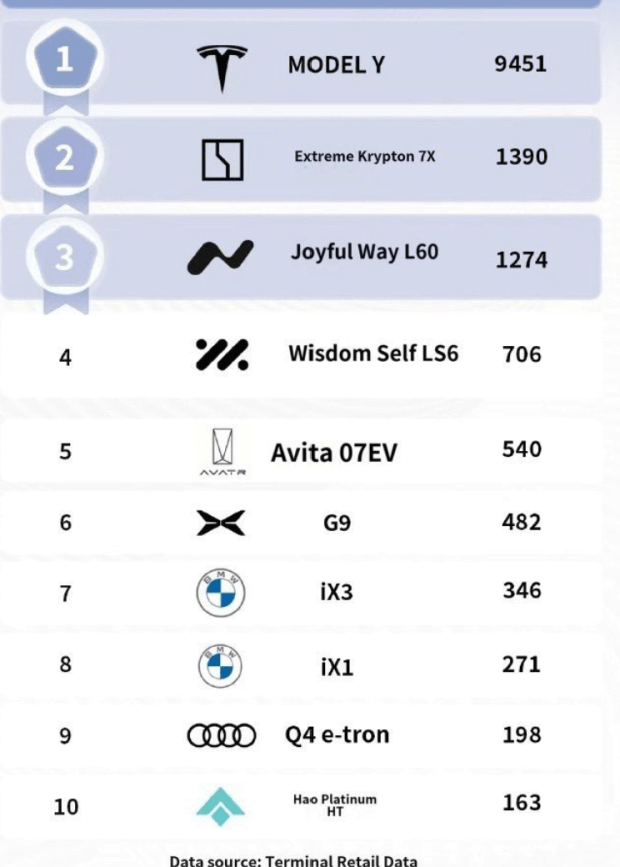

Moreover, the most recent China information means that Tesla has turned the nook. Final week, the refreshed Mannequin Y was the top-selling automobile in China.

Picture Supply: Zacks Funding Analysis

In the meantime, the Mannequin Y L, Tesla’s premium SUV, is gaining momentum in China’s premium section. The dearer Mannequin Y L accounted for 27% of complete Mannequin Y gross sales in China, regardless of a 28% premium over the base-level Mannequin Y – suggesting an urge for food for premium EVs amid a recovering economic system.

Tesla value motion offers refined clues

Though gross sales predictions and information are sometimes adopted by most traders in a vacuum, value motion in relation to information tells the actual story. Within the case of TSLA shares, the worth motion speaks for itself. Tesla shares lately notched a recent all-time closing excessive regardless of decrease gross sales expectations and a shaky market. In different phrases, the “seaside ball underneath” water value motion suggests {that a} gross sales slowdown is already priced into shares and traders are discounting the longer term. Moreover, traders are clearly bullish and excited in regards to the information of the primary Tesla robotaxi noticed in Austin, Texas, and not using a security rider. Tesla’s breakout of a weekly bull flag on heavy quantity turnover means that the subsequent cease could also be within the mid-500s.

Picture Supply: TradingView

Backside line

With expectations for Tesla’s This autumn gross sales reset meaningfully decrease, the risk-reward now hinges much less on the headline supply quantity and extra on how traders interpret the longer term. Bettering model metrics, renewed China power, and bullish value motion suggest that traders are wanting previous near-term softness and discounting Tesla’s long-term progress narrative.

Need the most recent suggestions from Zacks Funding Analysis? Obtain 7 Greatest Shares for the Subsequent 30 Days. Click on to get this free report