Bitcoin is struggling as soon as once more after dropping under $85k earlier at the moment. The most important cryptocurrency by market capitalization is heading into 2026 in bearish territory, and a few analysts are already predicting a long-term bear market. Based on a helpful analytical device referred to as BTC CVDD (Cumulative Worth-Days Destroyed), the cryptocurrency is about to hit a backside round $45,000 this time.

The BTC CVDD Metric

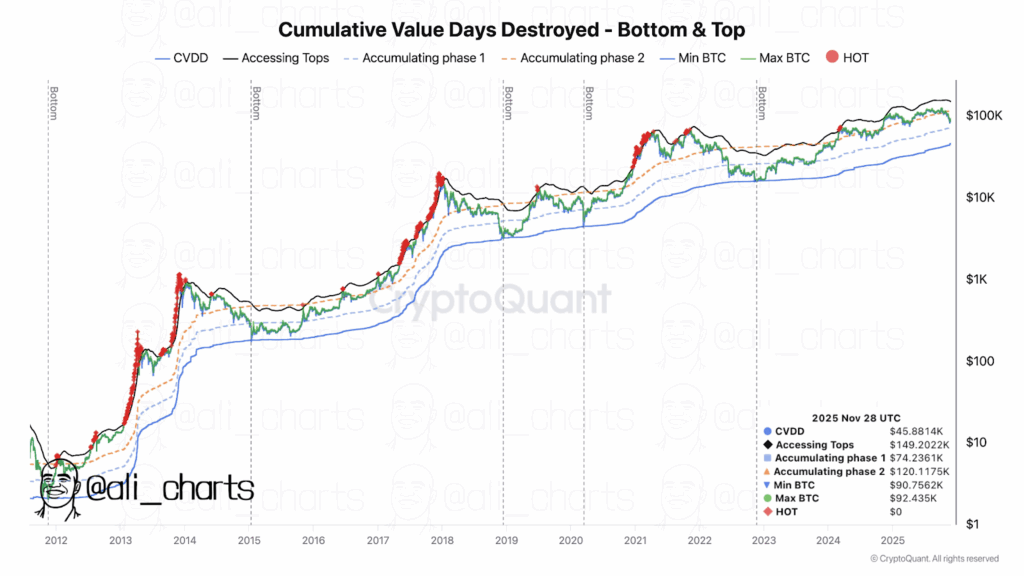

BTC CVDD is a crypto analytical device used to trace the age and greenback worth of Bitcoin offered by long-term holders. It’s the ratio of the cumulative worth of Coin Days Destroyed in USD to the market age in days, adjusted by a scaling issue. CVDD has been helpful for predicting BTC market bottoms up to now, and it may present essential ranges to observe for this time as effectively.

Standard crypto analyst Ali tweeted:

“$45,880 is what the CVDD suggests as a possible backside for Bitcoin $BTC.”

He additionally supplied an in depth evaluation of the BTC CVDD graph and confirmed the connection between previous ATHs and bottoms for the reason that first crypto halving of 2012:

TC CVDD evaluation is a useful device for predicting the underside. Nonetheless, the graph nonetheless doesn’t count on the top of a crypto bull run or a value rebound.

What to Make of the CVDD Evaluation?

BTC’s newest ATH was set lower than 2 months in the past. The digital forex has since recorded a 31% value drop and is struggling across the $85k value degree at press time. So, if the brand new ATH of this cycle has already been recorded, the CVDD evaluation predicts that we are going to see BTC depreciate to the $40k vary once more in some unspecified time in the future.

Nonetheless, there’s nonetheless a slim likelihood that the premier digital forex can get well from the bearish territory under $100k and rebound shortly to new highs. This alteration in fortunes can alter the CVDD mannequin’s calculations and yield an up to date determine.

Moreover, when the value of Bitcoin falls to or under the CVDD line, it has usually signaled a possible shopping for alternative. At the moment, the CVDD line is effectively above Bitcoin’s retail value, making it an excellent shopping for alternative for merchants. Nonetheless, lots of the traders might be searching for a possible backside, and CVDD is a superb place to start out.