- Coinbase vs Binance: A Look Comparability

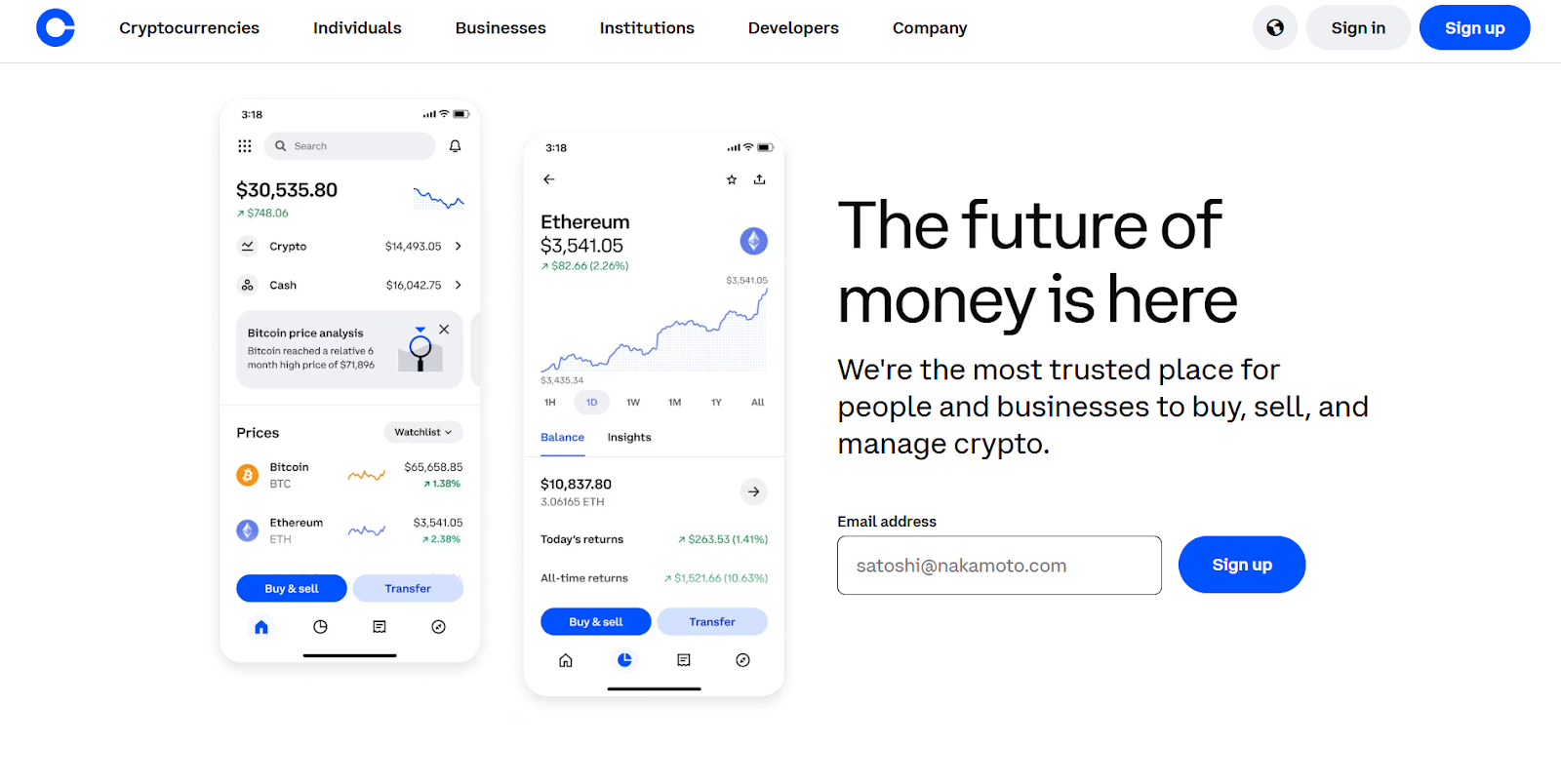

- What’s Coinbase?

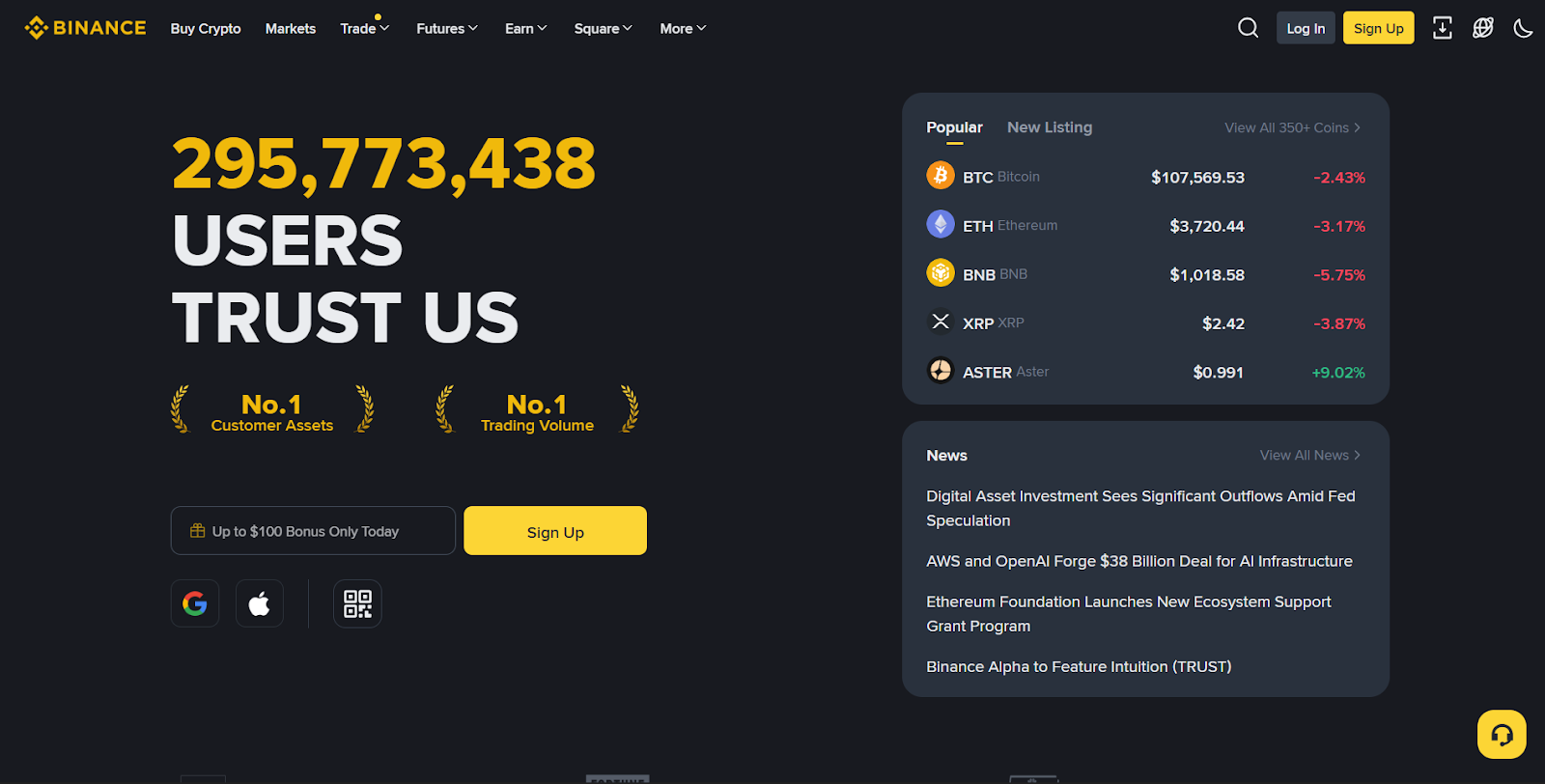

- What’s Binance?

- Binance is finest for:

- Coinbase vs Binance: Buying and selling Functions

- Coinbase vs Binance: Platform Merchandise and Companies

- Binance vs Coinbase: Charge Constructions

- Binance vs Coinbase: Cash Supported, Liquidity & Quantity

- Coinbase vs Binance: Safety Comparability

- Coinbase vs Binance: Affiliate & Referral Applications

- Binance vs Coinbase: Cell App & Consumer Expertise

- Binance vs Coinbase: Buyer Assist

- Conclusion: Which is Higher, Binance or Coinbase?

- FAQs

Coinbase vs Binance is a transparent comparability of the highest crypto exchanges in 2025 that can assist you change into an knowledgeable crypto dealer. Binance had over $100 trillion in buying and selling quantity in 2024, whereas Coinbase teamed up with 245,000 ecosystem gamers. These platforms are main gamers within the crypto world. However which one really delivers the sting you want?

On this information, you’ll uncover how Coinbase and Binance differ in charges, options, safety, and general person expertise. We’ll break down what units every platform aside and the way they match totally different buying and selling objectives. Maintain studying to search out out which trade is the smarter selection in your 2025 crypto journey.

Coinbase vs Binance: A Look Comparability

| Function | Coinbase | Binance |

| Consumer Base | Over 100 million customers globally | Nearly 300 million customers globally |

| Property Underneath Administration | Not disclosed | Greater than $187 billion |

| 24-Hour Buying and selling Quantity | Not disclosed | Greater than $55 billion |

| Cryptocurrencies Supported | Tons of of cryptocurrencies, together with Bitcoin, Ethereum, and Dogecoin | Over 500 cryptocurrencies |

| Safety | Finest-in-class chilly storage for crypto safety | $1 billion SAFU fund, 98% chilly storage |

| Buying and selling Charges | Zero charges for Coinbase One members; commonplace charges apply in any other case | 0.1% spot buying and selling (0.075% with BNB), 0.02% futures maker charges |

| Promotions | As much as $2,000 in crypto for brand new customers | As much as $100 bonus for brand new customers |

| World Attain | Obtainable in over 100 nations | Obtainable in 180+ nations |

| Distinctive Options | Coinbase One membership with zero charges and rewards | Superior buying and selling instruments, Launchpool, and NFT market |

What’s Coinbase?

Coinbase is a number one cryptocurrency trade based in 2012, designed to make crypto buying and selling accessible to everybody. It’s absolutely U.S.-compliant and have become the primary publicly traded crypto firm in 2021. Recognized for its user-friendly interface, Coinbase helps over 280 cryptocurrencies and presents options like shopping for, promoting, sending, and exchanging digital belongings.

The platform prioritizes safety with 2FA, chilly storage, and insurance coverage for warm wallets. It additionally gives a devoted Coinbase Pockets for self-custody. With its intuitive design and wide selection of fee strategies, Coinbase is a trusted selection for each new and skilled merchants, with a referral code for brand new merchants.

Execs & Cons of Coinbase

| Execs | Cons |

| Straightforward-to-use interface with easy navigation | Increased charges than rivals |

| Robust regulatory compliance and US licensing | Lacks superior instruments for knowledgeable merchants |

| Helps a variety of fee strategies, together with PayPal | Slower deposit and withdrawal processes |

| Gives insurance coverage for warm pockets storage and strong safety measures | Helps fewer cryptocurrencies than Binance |

| Academic assets and the be taught and Earn program for brand new customers | Restricted staking choices and decrease rewards |

Coinbase is finest for:

- Learners coming into the crypto market

- Customers looking for a easy, intuitive expertise

- Traders prioritizing regulatory compliance

- Merchants who want a number of fee choices, like PayPal

- People in search of safe storage with insurance coverage

- Learners concerned with academic assets and incomes alternatives

What’s Binance?

Binance is the world’s main cryptocurrency trade, trusted by over 180 million customers globally. Established in 2017, it has change into a powerhouse within the crypto house, providing unmatched liquidity, low charges beginning at simply 0.1%, and a large number of over 350 cryptocurrencies.

What units Binance aside is its versatility. Whether or not you’re new to buying and selling or extremely skilled, Binance presents intuitive instruments, enhanced buying and selling choices, and options like staking, futures, and an NFT market. Working in 180+ nations, it gives localized help and multi-language accessibility, making it a very international platform.

Safety is a high precedence at Binance with industry-leading measures just like the $1 billion SAFU insurance coverage fund, two-factor authentication, and common audits. Past buying and selling, Binance is a whole ecosystem providing academic assets, DeFi instruments, and revolutionary applications like Launchpad for early entry to promising initiatives.

Execs & Cons of Binance

| Execs | Cons |

| Low buying and selling charges starting from 0.1% | Advanced interface can overwhelm rookies |

| Helps over 350 cryptocurrencies | Regulatory challenges in some nations |

| Superior buying and selling choices together with futures, staking, and NFTs | Restricted options for Binance.US customers |

| Excessive liquidity and quick transaction speeds | Fiat withdrawal choices are restricted in sure areas |

| Robust safety measures, together with SAFU insurance coverage fund | Buyer help response occasions can range |

| World attain with operations in 180+ nations | Not accessible in some US states |

Binance is finest for:

- Merchants looking for low charges and excessive liquidity

- Customers concerned with superior buying and selling choices like futures and staking

- Traders in search of entry to 350+ cryptocurrencies

- People who worth sturdy safety measures like SAFU insurance coverage

- World customers needing multi-language help and localized options

- These exploring NFTs and revolutionary crypto initiatives by way of Launchpad

Coinbase vs Binance: Buying and selling Functions

| Function | Coinbase | Binance |

| Buying and selling Choices | Fundamental purchase/promote, recurring purchases | Spot, margin, futures, choices, P2P buying and selling |

| Superior Instruments | Restricted superior instruments | Superior charting, a number of order sorts |

| Cryptocurrency Choice | 280+ cryptocurrencies | 350+ cryptocurrencies |

| Staking | Restricted staking choices | In depth staking choices with greater rewards |

| Charges | Increased charges, particularly for small transactions | Low charges from simply 0.1% |

| Consumer Interface | Easy to navigate | Professional and Lite modes for various person ranges |

Coinbase vs Binance: Platform Merchandise and Companies

| Class | Coinbase | Binance |

| Pockets | Coinbase Pockets for self-custody | Binance Web3 Pockets with superior safety |

| NFT Market | Restricted exercise | Lively and extensively used |

| Academic Sources | Study and Earn program | Binance Academy with intensive assets |

| Passive Revenue | Fundamental staking | Staking, liquidity farming, twin funding |

| Fiat Assist | A number of fee strategies, together with PayPal | Broad fiat help with P2P choices |

| Ecosystem | Targeted on buying and selling and schooling | Complete ecosystem together with DeFi instruments |

What Coinbase Gives:

- Straightforward-to-use interface for straightforward navigation

- Assist for 280+ cryptocurrencies

- Recurring buy choices for dollar-cost averaging

- Coinbase Pockets for self-custody and DeFi entry

- Study and Earn program for academic rewards

- Superior commerce instruments with real-time order books and charting

- Zero buying and selling charges with a Coinbase One membership

- Safe chilly storage for crypto belongings

- A number of fee strategies, together with PayPal

What Binance Gives:

- Superior buying and selling choices: spot, margin, futures, and peer to look buying and selling

- Assist for 350+ cryptocurrencies and intensive buying and selling pairs

- Binance Web3 Pockets with enhanced safety features

- Complete staking and liquidity farming choices

- Low buying and selling charges from simply 0.1%

- NFT market for purchasing, promoting, and staking NFTs

- Binance Academy for in-depth academic assets

- World attain with operations in 180+ nations

- SAFU insurance coverage fund for person asset safety

- Professional and Lite modes tailor-made for various person ranges

Binance vs Coinbase: Charge Constructions

| Charge Kind | Binance | Coinbase |

| Spot Buying and selling Charges | 0.1% for each makers and takers (0.075% with BNB low cost) | As much as 0.6% for takers and 0.4% for makers (varies by quantity) |

| Futures Buying and selling Charges | 0.02% maker, 0.05% taker (reductions for greater VIP tiers) | Not accessible |

| Staking Charges | No charges for staking | 25% fee on staking rewards |

| Deposit Charges | Crypto deposits are free | Crypto deposits are free, whereas fiat deposits might embrace charges primarily based on the fee technique |

| Withdrawal Charges | Varies by cryptocurrency and community | Varies by cryptocurrency and community |

| Credit score/Debit Card Charges | 1.8% for card purchases | 3.99% for card purchases |

| P2P Buying and selling Charges | Free for patrons; 0.35% for sellers | Not accessible |

| Subscription Charges | No subscription charges | Coinbase One: $29.99/month for zero buying and selling charges and different advantages |

Binance vs Coinbase: Cash Supported, Liquidity & Quantity

| Class | Binance | Coinbase |

| Cash Supported | 350+ cryptocurrencies | 280+ cryptocurrencies |

| Buying and selling Pairs | In depth, together with spot, margin and futures buying and selling | Restricted to identify buying and selling pairs |

| Day by day Buying and selling Quantity | $55+ billion | $1.5+ billion |

| Liquidity | Excessive liquidity throughout all markets | Reasonable liquidity, targeted on main belongings |

| New Listings | Frequent, with early entry through Launchpad | Much less frequent, targeted on established belongings |

Coinbase vs Binance: Safety Comparability

Coinbase is commonly seen because the go-to platform for rookies, and its safety measures replicate that. They hold 98% of buyer funds in chilly storage, which suggests your crypto is saved offline and away from potential hackers. The remaining 2% is insured, so even when there’s a breach, you’re lined.

On high of that, Coinbase makes use of 2FA so as to add an additional layer of safety to your account. You’ll additionally discover biometric logins, like fingerprint or face recognition, for his or her cell app. And in case you’re nervous about your private info, Coinbase is absolutely compliant with US rules, which suggests it follows strict knowledge safety legal guidelines.

Binance, however, is constructed for merchants who need extra superior options with out compromising on safety. They’ve acquired a $1 billion Safe Asset Fund for Customers (SAFU), which acts as an emergency insurance coverage fund within the occasion of a serious hack. Like Coinbase, Binance additionally makes use of 2FA and shops nearly all of funds in chilly storage.

What units Binance aside is its proactive strategy to safety. They conduct common audits and even provide a bug bounty program, rewarding moral hackers who discover vulnerabilities. Plus, Binance has superior danger administration techniques that monitor transactions for suspicious exercise in actual time.

Coinbase Safety Measures:

- 98% of buyer funds are saved in offline chilly storage

- Insurance coverage protection for the remaining 2% of funds saved on-line

- Two-factor authentication (2FA) for account safety

- Biometric logins (fingerprint and face recognition) for cell app entry

- Totally compliant with US rules for knowledge safety

- Common safety audits to make sure platform integrity

- Finish-to-end encryption for delicate knowledge.

Binance Safety Measures:

- Majority of funds are saved in offline chilly storage

- $1 billion Safe Asset Fund for Customers (SAFU) for emergency safety

- Two-factor authentication (2FA) for enhanced account safety

- Superior danger administration techniques to observe suspicious transactions in actual time

- Common platform audits and penetration testing

- Bug bounty program to reward moral hackers for figuring out vulnerabilities

- Multi-layered encryption for knowledge and transaction safety

Coinbase vs Binance: Affiliate & Referral Applications

| Function | Coinbase | Binance |

| Affiliate Program | Earn 50% of charges generated by your referrals for 3 months | Earn as much as 50% of charges generated by your referrals (lifetime) |

| Referral Program | $10 bonus for each referrer and referee after a $100 commerce | As much as 40% fee on buying and selling charges primarily based on referee exercise |

| Payout Frequency | Month-to-month payouts | Actual-time payouts |

| Eligibility | Open to people and companies | Open to people, companies, and influencers |

| Customization | Restricted monitoring instruments for associates | Superior monitoring instruments and customized referral hyperlinks |

| Extra Perks | Occasional promotional bonuses | Tiered rewards for high-performing associates |

Binance vs Coinbase: Cell App & Consumer Expertise

As for cell apps and person expertise, Binance and Coinbase cater to totally different audiences, every excelling in its personal manner. Binance’s app is designed for each rookies and superior merchants, providing two modes: Lite for simplicity and Professional for superior options. Rated 4.8/5 on iOS and 4.5/5 on Android, the app gives a seamless expertise with real-time charts, a number of order sorts, and superior buying and selling instruments. Its standout options embrace a customizable interface, integration with Binance Academy for studying, and strong safety measures like biometric login and two-step verification. New customers may also join with a Binance referral code to entry unique rewards. Whereas the app’s Professional mode might really feel complicated for rookies, switching to Lite mode is a greater place to begin.

Coinbase focuses on simplicity and ease of use, making it a favourite amongst rookies. Its app, rated 4.7/5 on iOS and 4.4/5 on Android, presents a clear and intuitive design that simplifies shopping for and promoting cryptocurrencies. Whereas it lacks the superior customization choices of Binance, Coinbase compensates with options just like the Study and Earn program, which educates Coinbase customers whereas rewarding them with crypto. Safety is a precedence, with options like biometric login, 2FA, and safe chilly storage.

Binance vs Coinbase: Buyer Assist

As a dealer, having dependable buyer help could make all of the distinction, particularly when coping with time-sensitive points. Binance stands out with its 24/7 international help, providing stay chat in over 40 languages to cater to its numerous person base. For fast resolutions, it employs AI-powered prompt responses, and VIP customers get pleasure from the additional benefit of a referral code for each invite. Nevertheless, the dearth of telephone help and occasional delays throughout peak occasions could be a disadvantage for these needing instant assist.

Alternatively, Coinbase takes a extra simple strategy, specializing in readability and ease of use. Its help contains electronic mail and stay chat, complemented by a strong assist middle full of FAQs and tutorials. Whereas Coinbase’s choices are extra restricted in comparison with Binance, its user-friendly assets and emphasis on person schooling make it a reliable selection for brand new merchants. Coinbase and Binance goal to help successfully, however Binance’s multilingual and round the clock help offers international merchants a bonus.

Conclusion: Which is Higher, Binance or Coinbase?

Selecting between Binance and Coinbase primarily depends in your buying and selling wants and expertise stage. Binance is good for knowledgeable traders who worth superior instruments, intensive cryptocurrency choices, and low charges. Its Professional mode, numerous buying and selling options, and strong safety measures make it a powerhouse for these looking for a complete buying and selling platform. Nevertheless, its complexity and being a regulated monetary establishment in sure areas might deter rookies or these in search of a less complicated expertise.

Coinbase is a superb selection for rookies or informal merchants who prioritize ease of use and easy performance. Its clear interface, academic assets, and powerful regulatory compliance make it a dependable choice for these new to cryptocurrency. Whereas it lacks the superior options and decrease charges of Binance, Coinbase’s simplicity and concentrate on person schooling present a strong basis for constructing confidence in crypto buying and selling. Each platforms excel of their respective areas, so the higher selection is determined by whether or not you worth superior options and low prices (Binance) or simplicity and accessibility (Coinbase).

FAQs

What’s the distinction between Binance and Binance.US?

The important thing distinction between Binance and Binance.US lies of their scope and options. Binance is a worldwide platform with superior buying and selling instruments and a large cryptocurrency choice, whereas Binance.US is tailor-made for U.S. customers with fewer options and a restricted choice attributable to regulatory restrictions.

Is Binance a secure crypto trade?

Sure, Binance is a secure crypto trade. It employs strong safety measures, together with 2FA, chilly storage for many funds, and the Safe Asset Fund for Customers (SAFU) to guard belongings in occasion of breaches.

Is Coinbase Pockets safer than Binance?

Coinbase Pockets is safer for customers preferring self-custody, because it offers full management over non-public keys. Binance, whereas safe, depends on centralized safety measures, which require belief within the platform.

Which trade has decrease charges: Coinbase vs Binance?

The trade with decrease charges is Binance. Binance expenses a base buying and selling price of 0.1%, which might be diminished utilizing Binance Coin (BNB), whereas Coinbase charges vary from 0.5% to 4.5%, relying on the transaction kind.

Which trade is extra beginner-friendly: Coinbase or Binance?

The trade that’s extra superb for rookies is Coinbase. Coinbase presents a easy interface, straightforward purchase/promote choices, and academic assets, making it superb for brand new merchants. Binance, whereas providing a Lite mode, is best suited to customers with some buying and selling expertise.

Which trade is safer: Coinbase vs Binance?

The trade that’s safer is determined by your preferences. Coinbase emphasizes regulatory compliance and insurance coverage for on-line funds, whereas Binance presents superior safety features just like the $1 billion SAFU fund and real-time danger monitoring. Each are extremely safe in their very own methods.