- The 2026 token-offering query traders face

- IPO Genie ($IPO) vs Bitcoin Hyper vs Nexchain (Fast Comparability)

- What Every Token Providing is Presenting to Buyers

- 1) IPO Genie ($IPO): The “Personal Markets + AI” angle and positioning for 2026

- 2) Bitcoin Hyper (HYPER): The next-beta Bitcoin L2 narrative with early protection

- 3) Nexchain (NEX): AI Layer-1 and gas-fee reward mechanics

- Which has the strongest positioning for 2026?

- FAQs

The 2026 token-offering query traders face

If Bitcoin can rise within the morning and nonetheless really feel “unsure” by dinner… how do you decide a token providing that survives the noise and stays related in 2026?

Proper now, the market is reminding everybody how shortly sentiment flips. For instance, on 20 Dec 2025 BTC was reported round $87,906 and ETH close to $2,953 throughout a broad inexperienced session, whereas some analysts flagged fragile conviction beneath the bounce.

In the meantime, US lawmakers have reportedly pushed ultimate consideration of a crypto market-structure invoice into early 2026, conserving regulatory readability on “pause” longer than many traders had anticipated.

Because of this, members are extra selective. Token choices that stand out have a tendency to emphasise a defensible use case, clear demand drivers, and on-chain utility slightly than advertising and marketing alone.

This comparability focuses on three initiatives receiving consideration heading into 2026: IPO Genie ($IPO), Bitcoin Hyper (HYPER), and Nexchain (NEX).

IPO Genie ($IPO) vs Bitcoin Hyper vs Nexchain (Fast Comparability)

| Venture | What it’s aiming to win | Proof factors being mentioned publicly | Token demand driver | Greatest danger (actual speak) |

|---|---|---|---|---|

| IPO Genie ($IPO) | Tokenized entry to private-market offers with AI deal scoring | The mission states it’s an official sponsor of occasions, ran a Dubai giveaway, and frames platform utility in public messaging | Tier unlocks, deal entry, staking and governance are framed as potential demand drivers | Deal high quality and execution over time, as famous in protection |

| Bitcoin Hyper (HYPER) | Bitcoin L2 “quick lane” and BTC DeFi use circumstances | Protection has referenced a multi-million-dollar increase and staking incentives; figures are project-reported and unverified | Potential L2 utilization and DeFi demand if adoption happens | Bridge/safety dangers and dependence on market cycles |

| Nexchain (NEX) | AI-focused Layer-1 with throughput and gas-fee rewards | The mission claims excessive throughput (usually cited at 400k TPS) and a gas-fee distribution mechanism to holders | Community utilization and reward mechanisms as described in mission supplies | Adoption challenges inside a crowded Layer-1 panorama |

What Every Token Providing is Presenting to Buyers

Every mission targets a special lane within the evolving crypto ecosystem:

- IPO Genie ($IPO): The mission describes itself as offering AI-powered entry to private-market and pre-IPO offers, with tiered participation and on-chain transparency.

- Bitcoin Hyper (HYPER): Described as a Bitcoin Layer-2 idea utilizing SVM-style execution, with staking incentives and positioning for BTC-based DeFi.

- Nexchain (NEX): Introduced as an AI-focused Layer-1 that emphasizes throughput and a holder rewards mannequin tied to gasoline charges.

Somewhat than asking “who reveals the biggest short-term value transfer,” a extra sturdy query is who stays significant when consideration shifts and customers demand measurable utility.

1) IPO Genie ($IPO): The “Personal Markets + AI” angle and positioning for 2026

IPO Genie positions itself as a gateway to institutional-style enterprise and pre-IPO deal entry. The crew states it makes use of AI deal scoring and a token-gated mannequin to prioritize deal discovery and entry.

The Core Thought: Entry + Verification, Not Vibes

IPO Genie’s circulate is described as specializing in deal discovery and token-mediated entry.

In communications the crew hyperlinks the token to advantages comparable to decrease charges, staking mechanics, early deal entry, and tier unlocks; these are introduced by the mission as platform utility.

Mainstream visibility efforts cited by the mission

The mission states it turned an official sponsor of a Misfits Boxing occasion in Dubai and ran a fight-week giveaway that included journey and VIP entry; marketing campaign supplies and protection referenced an occasion window round Dec 19–22, 2025.

These logistics are cited in protection as proof of an on-the-ground advertising and marketing marketing campaign slightly than a purely on-line launch.

Occasion Schedule & Preparations (as shared within the marketing campaign context):

- Friday, nineteenth December – Official Weigh-In: 10:00 AM, Studio 2, The Creekside Lodge (closed doorways)

- Friday, nineteenth December – Ceremonial Weigh-In: 8:00 PM, The Secret Backyard, The Creekside Lodge (TV cameras + ultimate face-off)

- Saturday, twentieth December – Battle Night time: Doorways 8:00 PM, Dubai Obligation Free Tennis Stadium

Token providing stage and reported pricing

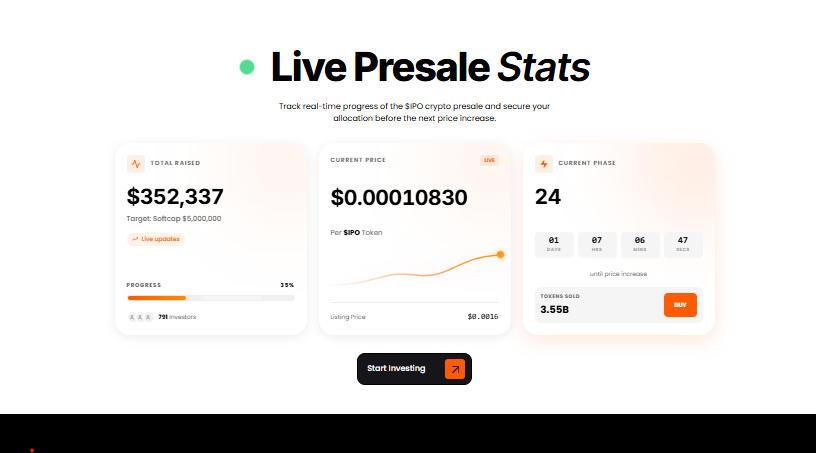

On the time of writing, the mission reported that the token providing had reached Stage 24 and listed a project-reported value of $0.00010830 per $IPO; some market posts referenced early traction and reported fundraising figures. These figures come from mission supplies and media protection and haven’t been independently verified.

In abstract, the mission frames its proposition as: AI filters offers, token membership unlocks entry, and mainstream visibility is meant to broaden attain. Protection and a few analysts have highlighted this mix as a differentiated positioning heading into 2026.

2) Bitcoin Hyper (HYPER): The next-beta Bitcoin L2 narrative with early protection

Bitcoin Hyper is described in some writeups as a Bitcoin Layer-2 supposed for quicker execution and BTC-focused DeFi, utilizing SVM-like execution fashions.

Protection has referenced a multi-million-dollar increase and cited staking incentives; particular figures have been reported in some articles however are project-reported and unverified in unbiased sources.

The trade-offs are acquainted: a bigger increase can present sources for growth and advertising and marketing, however it could additionally replicate capital already allotted that would have an effect on future market dynamics. Bitcoin Hyper’s longer-term case depends upon adoption of BTC Layer-2s and the safety of cross-chain bridges and integrations.

3) Nexchain (NEX): AI Layer-1 and gas-fee reward mechanics

Nexchain positions itself as an AI-oriented Layer-1 with throughput claims (generally cited at 400k TPS in mission supplies) and a revenue-sharing mechanic the place a portion of gasoline charges is distributed to holders, in line with mission supplies.

Protection has mentioned stage-based pricing and itemizing assumptions; these stories summarize the mission’s tokenomics and said mechanics however don’t assure outcomes. Nexchain’s worth proposition depends upon adoption in a aggressive Layer-1 market and on delivering on throughput and reward mechanisms in follow.

Which has the strongest positioning for 2026?

All three choices are speculative and carry project-specific dangers. This comparability notes the place every mission frames its worth:

- IPO Genie: Emphasizes entry to non-public markets and AI-driven discovery as its core differentiator, and it has pursued mainstream visibility in occasions cited by the mission.

- Bitcoin Hyper: Emphasizes Bitcoin-native execution and DeFi potentialities, with protection noting sizable reported fundraising and staking mechanics.

- Nexchain: Focuses on throughput and holder reward fashions as a part of its tokenomics, in line with mission supplies.

The article’s evaluation suggests IPO Genie occupies a differentiated lane by combining access-oriented messaging, AI-based deal scoring, and broader visibility; different observers and protection might draw completely different conclusions relying on which dangers and metrics they prioritize.

Be taught extra about IPO Genie Presale Immediately!

FAQs

Is IPO Genie ($IPO) positioned as a notable token providing for 2026?

The mission positions itself that manner as a result of it targets private-market entry and describes token-linked platform advantages comparable to tier unlocks, staking, and governance. These descriptions come from mission supplies and public protection.

What makes IPO Genie completely different from generic “AI” initiatives?

The mission frames its AI round deal discovery and scoring for early-stage alternatives and pairs that with token-mediated entry and on-chain transparency, in line with its supplies and public communications.

Why does “crypto utility” matter when evaluating token choices?

As a result of market consideration can shift, observers usually search for on-chain use circumstances and measurable demand drivers that would help longer-term adoption slightly than narratives alone.

This text comprises details about a cryptocurrency presale. Crypto Economic system is just not related to the mission. As with every initiative inside the crypto ecosystem, we encourage customers to do their very own analysis earlier than taking part, fastidiously contemplating each the potential and the dangers concerned. This content material is for informational functions solely and doesn’t represent funding recommendation.