- What Is Bitcoin Halving?

- Why Does Bitcoin Halving Occur?

- How Do Bitcoin Halving Work?

- Historical past of Bitcoin Halving Occasions

- What Occurs After Bitcoin Halving?

- When Is the Subsequent Bitcoin Halving?

- The Influence of Bitcoin Halving on The Market

- Frequent Myths About Bitcoin Halving

- Conclusion: Why Bitcoin Halving Issues

- FAQs

Bitcoin halving is a significant occasion within the crypto world. It’s a pre-programmed prevalence that reduces mining rewards and the quantity of Bitcoin in circulation. It’s embedded into Bitcoin’s protocol and happens roughly each 4 years or after each 210,000 blocks are mined.

These occasions exist to regulate the availability of latest bitcoins and probably result in elevated worth. Provided that Bitcoin is probably the most dominant asset within the crypto house, these halving occasions might have an effect on miners, merchants, and buyers alike.

Subsequently, to achieve success within the crypto house, it is very important know the small print of main occasions that may affect token costs and different elements. Which is why this text supplies a complete information to Bitcoin halving occasions and why they matter. It additionally explains how halving impacts miners, blockchain tasks, and buyers. Let’s dive in!

What Is Bitcoin Halving?

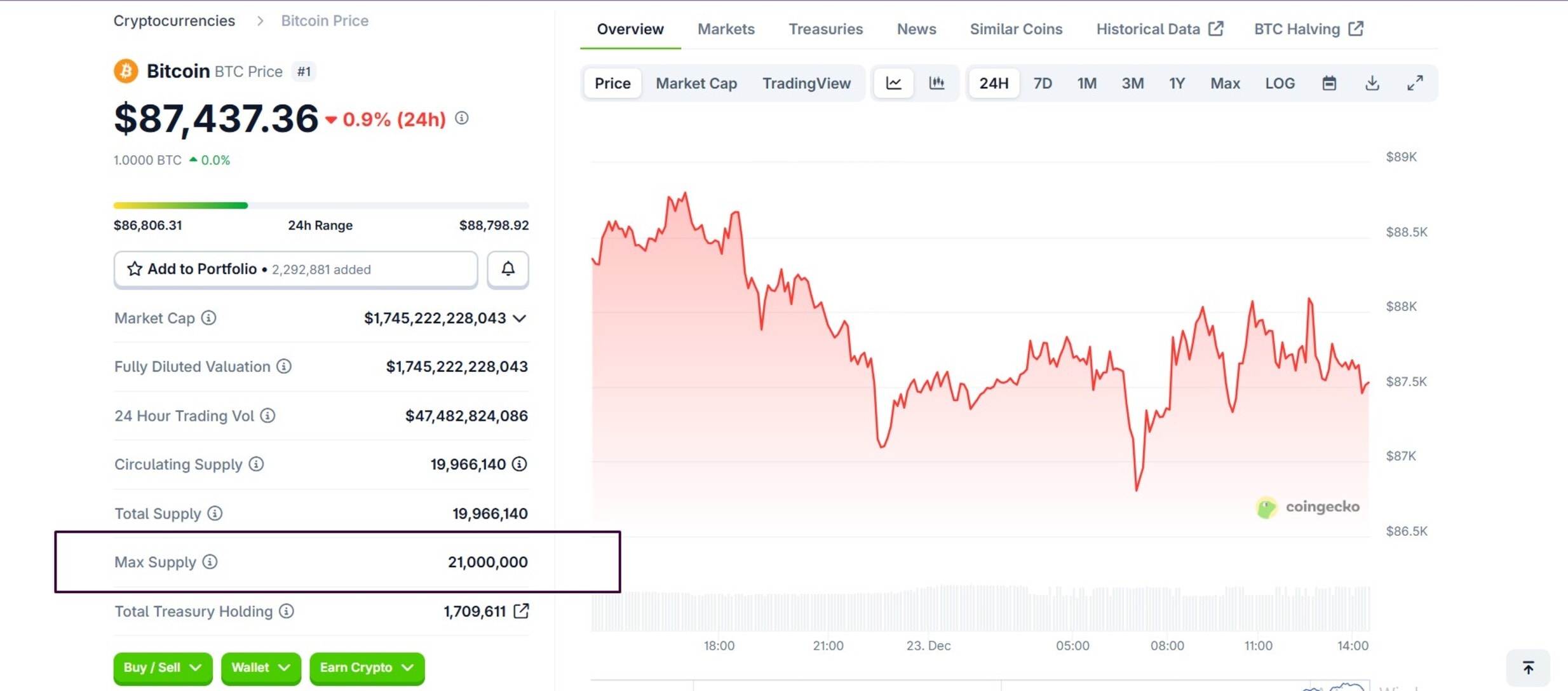

Bitcoin halving is a pre-programmed occasion that halves mining reward when miners add new blocks to the blockchain. Bitcoin has a everlasting most provide of 21,000,000 BTC. This mounted restrict is a core characteristic that forestalls inflation and will increase its potential worth over time.

To introduce extra Bitcoin into circulation, miners use high-performing machines to resolve cryptographic puzzles. By this, new Bitcoin is created as rewards for miners who validate Bitcoin transactions and add blocks to the Bitcoin blockchain.

Bitcoin halving occasions happen roughly each 4 years, or after each 210,000 blocks are mined, to regulate the availability of latest bitcoins and implement the 21 million whole cap. The Bitcoin community mechanically halves this reward and updates the cycle. There have been 4 halving occasions to date they usually embrace:

- First (2012): Diminished reward from 50 to 25 Bitcoin per block.

- Second (2016): From 25 to 12.5 BTC per block.

- Third (2020): From 12.5 to six.25 BTC.

- Fourth (2024): From 6.25 to three.125 BTC.

Since halving occasions happen each 4 years, the subsequent halving is anticipated in round 2028. This upcoming occasion will scale back Bitcoin mining rewards from 3.125 BTC to 1.5625 BTC.

Why Does Bitcoin Halving Occur?

Bitcoin halving happens to implement Bitcoin’s mounted provide cap of 21 million cash. It’s achieved by progressively decreasing the speed of latest bitcoin issuance. The halving occasions have been coded by Satoshi Nakamoto to imitate the shortage of valuable metals like gold.

The first purpose is to regulate provide and stop inflation by decreasing the accessible BTC. By halving block rewards, BTC builders have ensured a gradual distribution over about 140 years till all Bitcoins are mined.

This mechanism promotes Bitcoin as a deflationary asset, probably growing worth. And, encouraging customers to spend money on Bitcoin earlier than halving occasions by making the most of Bitcoin worth spikes.

How Do Bitcoin Halving Work?

Bitcoin halving is applied as a pre-programmed rule within the token’s protocol. It mechanically reduces the block reward for miners by 50% each 210,000 blocks. For brand new BTCs to be created, miners compete to resolve advanced cryptographic puzzles.

Once they remedy these puzzles, they validate transactions and add a brand new block to the Bitcoin blockchain. Throughout this course of, the profitable miner receives the present block reward in newly minted Bitcoin plus transaction charges.

For the reason that halving course of is pre-programmed, the Bitcoin community tracks block top. Upon reaching multiples of 210,000, it mechanically halves the subsidy (from 50 BTC initially to 25, then 12.5, and so forth).

Historical past of Bitcoin Halving Occasions

Bitcoin halvings have occurred 4 instances for the reason that token’s launch. Every decreasing the block reward by half at predetermined block heights.

Bitcoin halvings started with the community’s genesis in 2009. On the time, miners acquired 50 Bitcoins per block, with the reward halving each 210,000 blocks to cap most provide. Right here is the breakdown of final Bitcoin halving dates:

| Date | Block Top | Reward Earlier than | Reward After | Avg. BTC Value at Halving | Avg. Value 1 12 months Later |

| Nov 28, 2012 | 210,000 | 50 BTC | 25 BTC | $12 | $964 |

| Jul 9, 2016 | 420,000 | 25 BTC | 12.5 BTC | $663 | $2,550 |

| Might 11, 2020 | 630,000 | 12.5 BTC | 6.25 BTC | $8,740 | $58,250 |

| Apr 20, 2024 | 840,000 | 6.25 BTC | 3.125 BTC | $64,000 (pre-halving peak) | $82,000 |

First Halving (2012): Bitcoin adoption

On November 28, 2012, at block 210,000, the reward dropped from 50 to 25 BTC when BTC traded round $12. This marked the protocol’s first real-world take a look at of shortage mechanics. By the next yr, the worth climbed to $229 in April 2013 and $1,100 by November.

Second Halving (2016): Crypto consciousness

The second halving was on July 9, 2016, at block 420,000. This occasion decreased rewards from 25 to 12.5 BTC with BTC market worth at $663. Regardless of a short-term dip after halving, it rose to almost $20,000 by December 2017, coinciding with broader crypto consciousness.

Third Halving (2020): Institutional curiosity

After the second halving, the third one occurred 4 years later, on Might 11, 2020. On the time, the block was at 630,000, reduce from 12.5 to six.25 BTC with BTC promoting at $8,740. After this occasion, the surge hit $69,000 in 2021. This spike was amplified by institutional curiosity and pandemic stimulus.

Fourth Halving (2024): World integration

4 years later, at block 840,000, BTC halved to three.125 BTC. The value was round $64,000 pre-event. A few yr later, in October 2025, Bitcoin hit an all-time excessive of over $126,000.

This spike got here particularly from extra investor curiosity and Bitcoin ETF (exchange-traded fund) approvals. Accessibility and variety additionally performed an important position as many prime crypto exchanges now present these ETFs for buying and selling.

What Occurs After Bitcoin Halving?

Bitcoin halving triggers an speedy discount in new BTC provide, reducing miner block rewards by half and slowing the availability charge. Whereas there are numerous results, short-term results usually embrace minor changes and potential worth volatility, whereas long-term tendencies have traditionally featured bull markets resulting from shortage.

Halvings might shut down much less environment friendly miners as Bitcoin mining income halves, resulting in non permanent hashrate dips. It normally takes weeks for the cryptocurrency market to recuperate, and by then, survivors have gained market share and might spend money on higher {hardware}.

Along with these, the foremost affect that impacts buyers is worth volatility. Primarily based on historic occasions, the halvings of 2012, 2016, and 2020 noticed preliminary dips adopted by rallies. Even the 2024 occasion strengthened Bitcoin’s dominance, with sustained demand which drove worth greater.

When Is the Subsequent Bitcoin Halving?

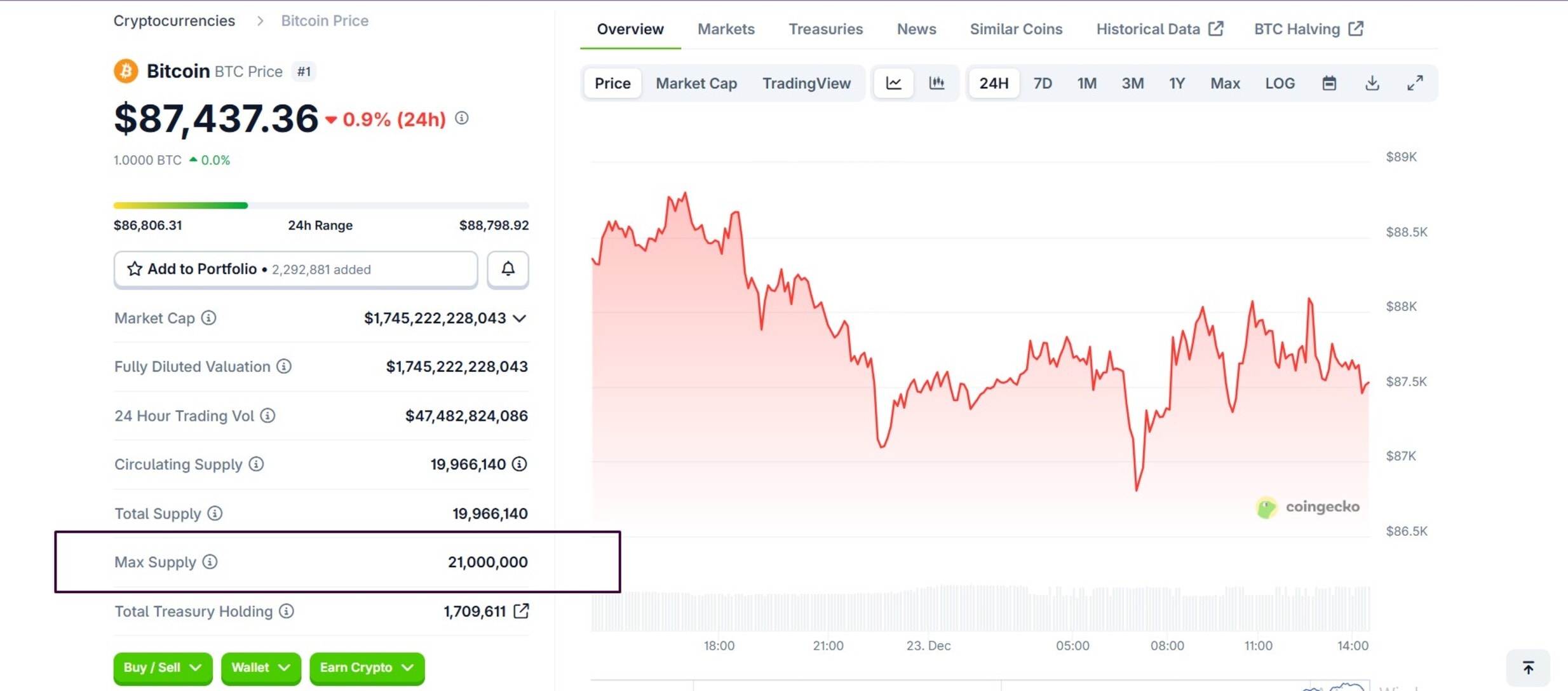

The subsequent Bitcoin halving is scheduled for block top 1,050,000. At this level, the block reward will drop from 3.125 BTC to 1.5625 Bitcoin per block. As for estimated dates, projections place it in April 2028. Nevertheless, particular estimates differ barely resulting from fluctuating block instances averaging 10 minutes. However as of December 23, 2025, roughly 829 days or 120,870 blocks stay.

The Influence of Bitcoin Halving on The Market

Bitcoin halving reduces new BTC provide by halving miner rewards, making a provide shock that, if demand holds regular, traditionally precedes worth appreciation. This shortage mechanism has pushed bull cycles following occasions, although its results differ with market maturity.

These occasions primarily affect the broader cryptocurrency market by tightening Bitcoin provide, which frequently sparks BTC-led rallies that elevate altcoins (different cryptocurrencies aside from BTC) by way of elevated liquidity and investor optimism.

Because the dominant asset (50-60% market cap), halving-driven BTC surges result in altcoin season phases. The altcoin season is a section the place altcoins (any crypto moreover Bitcoin) see vital, speedy worth surges, usually outperforming Bitcoin.

This occurs as capital rotates from BTC into riskier, high-reward altcoins. Altseason is primarily marked by a drop in Bitcoin’s market dominance and large features throughout many various cryptocurrencies.

It normally happens throughout or after a Bitcoin bull run when cash flows out of Bitcoin into smaller tokens. This causes explosive progress for a lot of tasks. As soon as 75% or extra of main altcoins outperform BTC over a sustained interval (say 90 days), it might sign altseason.

Frequent Myths About Bitcoin Halving

Bitcoin halving myths usually stem from hype round its shortage results, however many overlook market complexities and protocol design. Frequent misconceptions embrace assured worth surges and miner damage, all of that are debunked by historic patterns and Bitcoin’s adaptive mechanics. Listed below are some myths about halving occasions.

- Halving ensures speedy worth pumps: Halvings correlate with rallies resulting from decreased provide, however causation is unproven as costs rise from demand, adoption, and macro elements like ETFs, not the occasion alone. Previous cycles noticed pre-halving pumps and post-dips earlier than features.

- Bitcoin miners get on the spot earnings or damage: Rewards halve, pressuring inefficient operations to exit, however survivors improve {hardware} and rely extra on charges. It is because profitability is tied to Bitcoin worth and effectivity, not on the spot windfalls.

- Community safety declines: Hashrate might dip briefly, however issue adjusts mechanically to take care of 10-minute blocks, drawing in environment friendly miners and strengthening the community long-term.

- Mining Bitcoin turns into unprofitable after a halving: Whereas the speedy discount in block rewards can problem much less environment friendly miners, the ecosystem adapts. Miners put together for this occasion by upgrading to extra energy-efficient {hardware}, discovering cheaper power sources, and diversifying earnings streams by way of transaction charges.

Conclusion: Why Bitcoin Halving Issues

Bitcoin halving issues as a result of it’s the core mechanism implementing Bitcoin’s shortage and deflationary nature. The occasions create provide shocks that traditionally precede bull markets. It reduces miner promoting stress and inflation charges, whereas shifting reliance to transaction charges for community safety.

As well as, halvings catalyze market cycles, lifting BTC dominance and altcoins by way of liquidity flows, miner consolidation, and effectivity features. Since extra BTC halvings are anticipated within the coming years, these future occasions will proceed shaping adoption, sustainability, and the ecosystem’s maturity.

FAQs

Sure, ultimately. Bitcoin halving won’t cease abruptly however will proceed till block rewards attain zero across the yr 2140. At that time, the protocol’s mounted provide of 21 million BTC might be totally issued, leaving miners to outlive solely on transaction charges.

Primarily based on the programming of Bitcoin community, halvings will proceed for 28 extra occasions after the 4 accomplished (2012, 2016, 2020, 2024), totalling 32 cycles till rewards close to zero round 2140.

Halvings are usually bullish in the long run as a result of provide shocks scale back new BTC issuance, traditionally sparking bull runs amid shortage and demand. One main instance is the post-2020 surge of 541% in a yr. Whereas halving is bullish in the long run, the market usually experiences short-term volatility or dips earlier than the pump.

Sure, halvings ripple to different cryptocurrencies as BTC dominance usually dips post-event. This dip normally triggers what known as altcoin season or alt season, the place capital rotates into altcoins like Ethereum, Solana, XRP, and different crypto belongings.

It’s higher to purchase BTC earlier than or instantly after a halving. That is in anticipation of a sudden worth improve within the months that observe. Nevertheless, neither timing ensures success. One efficient means traditionally has been dollar-cost averaging. When achieved three months earlier than and after halvings it optimizes risk-adjusted returns.

Whereas this has labored up to now, keep away from the FOMO of pre-halving peaks or post-correction dips. As an alternative, do your personal analysis to make sure your choice is knowledgeable. Additionally, solely make investments cash you’re prepared to lose, because the crypto house is very risky and might go in opposition to you at any time.

For miners, halving cuts down rewards by 50%, squeezing margins and forcing inefficient miners to exit or improve. This causes non permanent hashrate drops that recuperate as environment friendly operations dominate and charges rise, however Bitcoin worth features usually offset losses.