Antonio Bordunovi/iStock Editorial by way of Getty Photos

Pay attention beneath or on the go by way of Apple Podcasts and Spotify

Will the market’s most vital firm shine or disappoint? (0:17) Disney again on YouTube. (2:10) Apple prepares iPhone overhaul. (2:40)

The next is an abridged transcript:

It’s the massive one.

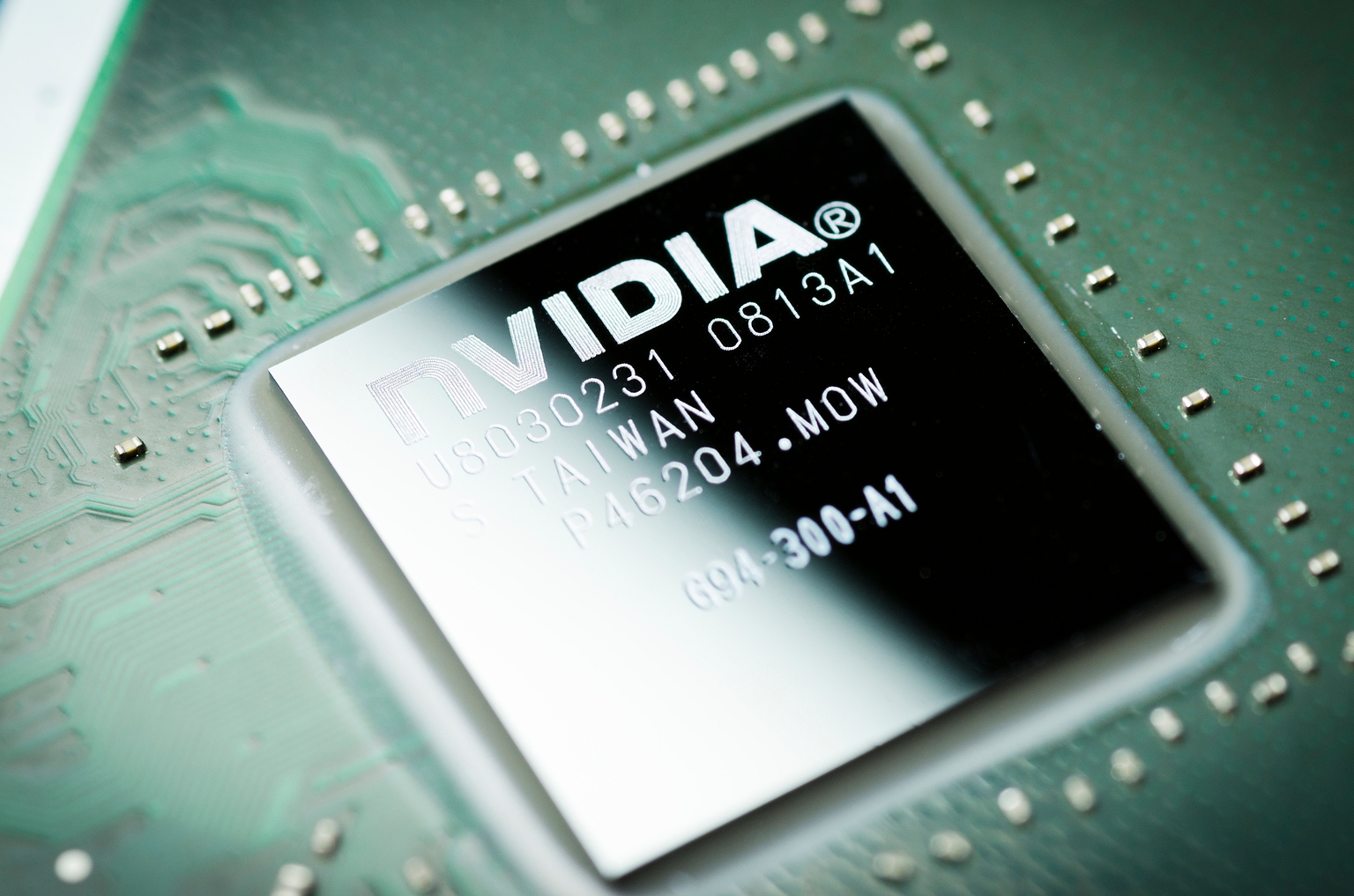

Nvidia (NVDA) reviews earnings on Wednesday and because the present saying goes: “As Nvidia goes so goes the market.”

In a case of 1 inventory changing into its personal benchmark, the S&P 500 (SP500) (SPY) (IVV) (VOO) is now extra carefully correlated to AI heavyweight Nvidia than to its personal equal-weight index (RSP), in line with Goldman Sachs.

The Avenue consensus is for EPS of $1.25 on income of $54.87 billion.

Right here’s a breakdown of how the inventory is considered:

Our Quant Score has the inventory at Maintain, solely due to the Valuation at greater than 50x non-GAAP earnings.

Wall Avenue has greater than 50 Sturdy Purchase or Purchase rankings, and only one Sturdy Promote: Jay Goldberg of Seaport Analysis.

He informed MarketWatch: “I’ve by no means informed my shoppers to ‘brief’ Nvidia. However I’ve at all times positioned my thesis as, ‘Nvidia goes to underperform the sector.’ And that has truly performed out. When you take a look at the AI sector, Nvidia has underperformed since April 1 once I launched protection.”

However Susquehanna lifted its value goal on Nvidia to $230 from $210, holding a constructive score forward of FQ3 earnings. They anticipate robust outcomes because the GB300 ramp accelerates and hyperscalers enhance capex by 69% in 2025 and 24% in 2026. Provide checks had been upbeat, with Foxconn already hitting its 2025 AI server income purpose.

As for Looking for Alpha analysts, who’re additionally within the Purchase camp, KM Capital says Nvidia is considerably undervalued and its robust fundamentals and historical past of earnings beats reinforce confidence in strong upcoming outcomes.

Within the bear camp, Mott Capital Administration warns that NVDA choices positioning is extraordinarily bullish, making choices costly and establishing a situation the place implied volatility collapse might harm name holders.

Additionally on the earnings calendar

XPeng (XPEV), Brady (BRC), Magic (MGIC) and LifeMD (LFMD) report Monday.

On Tuesday, Residence Depot (HD), Medtronic (MDT), Baidu (BIDU) and Futu (FUTU) concern numbers.

Together with Nvidia (NVDA), Palo Alto Networks (PANW), Lowe’s LOW and Goal (TGT) weigh in on Wednesday.

Walmart (WMT), Intuit (INTU) and Jacobs Engineering (J) report Thursday.

Within the information this weekend, YouTube TV and Disney have reached a deal that can restore ESPN, ABC and different channels to the platform’s 10 million subscribers after almost a two-week hiatus, the businesses introduced Friday night time.

The deal will give Alphabet’s (GOOG) (GOOGL)YouTube TV subscribers entry to ESPN’s new direct-to-consumer “Limitless” service at no further price, as a part of YouTube TV’s base plan. That’s most notable for WWE followers, as WWE’s main occasions — together with Wrestlemania — at the moment are a part of ESPN’s Limitless providing. The Limitless service will even be accessible instantly on the YouTube TV platform.

YouTube TV subscribers pay slightly greater than $80 per 30 days for the bottom plan. The rollout will likely be accomplished by the tip of 2026.

And Apple (AAPL) is enterprise its most sweeping iPhone revamp up to now, with three fully new fashions set to reach over three consecutive years.

Bloomberg says the shift comes as Apple faces criticism for leaning closely on the iPhone whereas rivals advance in synthetic intelligence and rising {hardware} classes.

Gurman on Sunday reported that Apple started rethinking the gadget final September, beginning with the introduction of the iPhone Air and redesigned iPhone 17 Professional fashions. A foldable iPhone is predicted subsequent fall, adopted in 2027 by a premium gadget that includes curved glass and an under-display digicam.

And for revenue traders, ConocoPhillips (COP) goes ex-dividend on Monday. The oil large pays out on December 1.

Utilized Supplies (AMAT) and Microsoft (MSFT) go ex-dividend on Thursday. They each pay out on December 11.