Vitality Fuels Inc. UUUU and Cameco Company CCJ are main gamers within the uranium trade, every well-positioned to assist the worldwide nuclear power provide chain.

Uranium costs just lately pulled again to $77 per pound after touching a 14-month excessive of $84 final month, as earlier provide considerations eased. Costs are down 3% over the previous 12 months. The long-term outlook for uranium, nevertheless, stays sturdy, pushed by the rising push for clear power. The U.S. Geological Survey’s addition of uranium to its 2025 Essential Minerals Checklist additional highlights its strategic significance for nationwide safety and home provide chains.

For traders on this area, lets analyze which uranium inventory is best positioned for upside, Vitality Fuels or Cameco. A better have a look at their fundamentals, progress drivers and key dangers can supply readability.

The Case for Vitality Fuels

Vitality Fuels has been the main U.S. producer of pure uranium focus lately, accounting for two-thirds of home manufacturing since 2017. Its White Mesa Mill in Utah is the nation’s solely totally licensed and working typical uranium processing facility.

The Pinyon Plain mine in Arizona continues to shine, delivering ore with a median grade of 1.27% uranium within the third quarter. Per the corporate, it is among the highest-grade uranium mines in U.S. historical past.

Throughout the quarter, the corporate mined ore containing roughly 465,000 kilos of uranium from its Pinyon Plain and La Sal mines, resulting in a complete of roughly 1,245,000 kilos of contained uranium up to now this 12 months. Pinyon has appreciable exploration upside, with Vitality Fuels at present extracting ore from solely about 25% of the vertical extent of the goal zone.

For full-year 2025, Vitality Fuels expects to mine 55,000–80,000 tons of ore containing 875,000–1,435,000 kilos of uranium from Pinyon Plain, Pandora and La Sal. Backed by the stable numbers up to now and extra ore anticipated within the fourth quarter, the corporate is positioned to satisfy or exceed the excessive finish of this steering. Completed uranium manufacturing might attain as much as 1,000,000 kilos for the 12 months.

Throughout the third quarter, Vitality Fuels bought 240,000 kilos of uranium at a median worth of $72.38 per pound, producing $17.4 million in revenues. Complete revenues had been up 337.6% 12 months over 12 months, pushed by larger uranium gross sales, which offset the decline in costs. Regardless of the income surge, elevated bills resulted in a lack of seven cents per share, unchanged from final 12 months’s third quarter.

Vitality Fuels ended the third quarter with $298.5 million of working capital, together with $94 million of money and money equivalents, $141.3 million of marketable securities, $12.1 million of commerce and different receivables, $74.4 million of stock and no debt.

The corporate expects to promote 160,000 kilos of uranium within the fourth quarter beneath its present portfolio of long-term utility contracts. In 2026, the corporate expects to promote between 620,000 and 880,000 kilos of uranium beneath its present long-term contracts.

Vitality Fuels can also be advancing heavy uncommon earth component (HREE) separation at White Mesa, the place it’s piloting manufacturing of Dy, Tb and different HREE oxides, with industrial output anticipated in 2026. Its Donald Undertaking in Australia is among the richest deposits of HREEs on the earth and is anticipated to begin manufacturing within the second half of 2027. The Toliara Undertaking in Madagascar and the Bahia Undertaking in Brazil comprise important portions of sunshine and heavy REE oxides.

Backed by a debt-free stability sheet, Vitality Fuels is ramping up uranium manufacturing whereas creating important REE capabilities. Taking present manufacturing ranges and its growth pipeline under consideration, the corporate has the potential to provide 4-6 million kilos of uranium per 12 months.

The Case for Cameco

Cameco, primarily based in Canada, accounted for 16% of worldwide uranium output in 2024 and operates throughout the complete nuclear gas cycle, from exploration to gas companies.

Cameco reported a 2% improve in uranium manufacturing to 4.4 million kilos within the third quarter of 2025. The corporate bought 6.1 million kilos of uranium, 16% decrease than within the third quarter of 2024. This decline, considerably offset by 4% uptick within the Canadian greenback common realized worth as a result of affect of fixed-price contracts on the portfolio, led to a 12.8% drop in uranium revenues to CAD 523 million ($379 million). The Gas Companies section witnessed a 24% drop in revenues to CAD 91 million (CAD 66 million), as features from a 42% improve in common realized costs had been offset by decrease volumes.

General, Cameco’s whole revenues had been down 14.7% 12 months over 12 months to CAD 615 million ($446 million) as a result of quantity declines in each segments. Cameco’s adjusted earnings gained 17% 12 months over 12 months to 5 cents per share within the third quarter.

The corporate’s share of uranium manufacturing is as much as 20 million kilos of uranium (100% foundation) from McArthur River/Key Lake and Cigar Lake in 2025. It had lowered its expectations for the McArthur River mine on account of growth delays. Nevertheless, backed by the stable efficiency of the Cigar Lake mine and the McClean Lake mill up to now, the corporate expects to exceed its goal by as much as 1 million kilos and assist offset a number of the manufacturing shortfall at McArthur River.

Cameco revised its full-year goal of uranium deliveries to 32–34 million kilos, from its prior acknowledged 31-34 million kilos. In 2024, CCJ delivered 33.6 million kilos of uranium. The corporate has delivered 21.8 million kilos of uranium up to now in 2025. CCJ plans to provide between 13 million and 14 million kgU in its gas companies section in 2025.

On the finish of the third quarter, CCJ had C$779 million ($565 million) in money and money equivalents, and C$1 billion ($725 million) in long-term debt and a $1 billion ($725 million) undrawn revolving credit score facility. The corporate’s whole debt to whole capital was 0.13 as of Sept. 30, 2025.

Cameco plans to keep up the monetary power and adaptability vital to spice up manufacturing and capitalize on market alternatives. Work is underway to increase the mine life at Cigar Lake to 2036. CCJ can also be growing manufacturing at McArthur River and Key Lake to its licensed annual capability of 25 million kilos (100% foundation).

How do Estimates Examine for Vitality Fuels & Cameco?

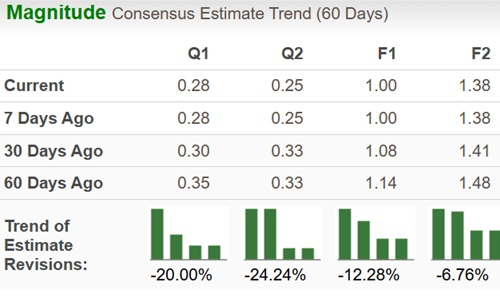

The Zacks Consensus Estimate for Vitality Gas’s 2025 revenues point out a year-over-year drop of 39.8%. The corporate is anticipated to incur a lack of 35 cents per share in 2025, narrower than the lack of 28 cents reported in 2024. The Zacks Consensus Estimate for UUUU’s revenues for 2026 signifies a year-over-year acquire of 85% to $87 million. The estimate for earnings for 2026 is at a lack of six cents per share.

Each the earnings estimates for fiscal 2025 and monetary 2026 for UUUU have moved down over the previous 60 days.

Picture Supply: Zacks Funding Analysis

The Zacks Consensus Estimate for Cameco’s 2025 revenues implies year-over-year progress of 6.2%. The consensus mark for earnings of $1.00 per share signifies a year-over-year upsurge of 104%. The Zacks Consensus Estimate for Cameco’s 2026 revenues signifies year-over-year progress of 6.5%, with EPS anticipated to achieve 38% to $1.38 per share.

Each the EPS estimates for fiscal 2025 and monetary 2026 have been revised downward prior to now 60 days.

Picture Supply: Zacks Funding Analysis

UUUU & CCJ: Worth Efficiency & Valuation

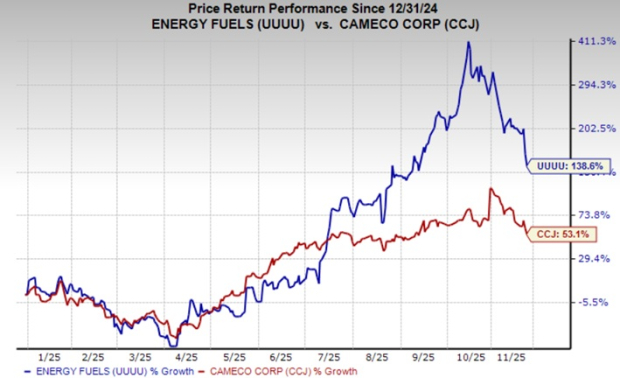

To this point this 12 months, Vitality Fuels inventory has appreciated 157.5% outperforming Cameco, which has gained 59.6%.

Picture Supply: Zacks Funding Analysis

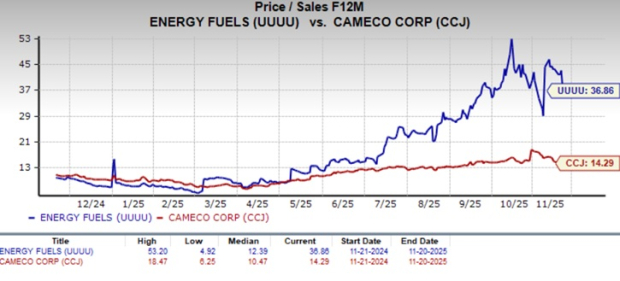

Vitality Fuels is buying and selling at a ahead price-to-sales a number of of 36.86X, whereas CCJ’s ahead gross sales a number of sits at 14.29X.

Picture Supply: Zacks Funding Analysis

Conclusion

Each firms face short-term income headwinds from unstable uranium costs. Whereas Cameco advantages from its strong gas companies enterprise and long-term contracts, Vitality Fuels gives diversification by heavy mineral sands and uncommon earths.

With a debt-free stability sheet, sturdy liquidity and distinctive share-price momentum, Vitality Fuels seems higher positioned for progress regardless of its premium valuation. Its diversified asset base and advancing REE initiatives improve its long-term potential.

Based mostly on present fundamentals and outlook, Vitality Fuels, a Zacks Rank #3 (Maintain) gives a extra compelling risk-reward profile than Cameco, which carries a Zacks Rank #4 (Promote).

You possibly can see the whole checklist of immediately’s Zacks #1 Rank (Sturdy Purchase) shares right here.

5 Shares Set to Double

Every was handpicked by a Zacks skilled because the #1 favourite inventory to achieve +100% or extra within the coming 12 months. Whereas not all picks could be winners, earlier suggestions have soared +112%, +171%, +209% and +232%.

A lot of the shares on this report are flying beneath Wall Avenue radar, which gives an important alternative to get in on the bottom ground.

Immediately, See These 5 Potential Dwelling Runs >>

Cameco Company (CCJ) : Free Inventory Evaluation Report

Vitality Fuels Inc (UUUU) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.