Be part of Our Telegram channel to remain updated on breaking information protection

US lawmakers deciding to restrict rewards on US-issued stablecoins would give China and others a strategic benefit, warns Coinbase’s chief coverage officer Faryar Shirzad.

“If this difficulty is mishandled in Senate negotiations in the marketplace construction invoice it might hand our international rivals a giant help in giving non-US stablecoins and CBDCs a crucial aggressive benefit on the worst attainable time,” the manager stated in a Dec. 30 X submit.

China’s Central Financial institution Overhauls CBDC Technique

The warning comes as China prepares a serious overhaul of its central financial institution digital foreign money (CBDC) technique that’s geared toward boosting the adoption of the digital yuan (e-CNY).

That digital yuan has struggled to achieve traction out there regardless of years of pilot applications and analysis. In an effort to spice up adoption of the token, the Folks’s Financial institution of China (PBOC) introduced earlier this week that it’ll enable business banks to pay curiosity on consumer’s digital yuan holdings. That is a part of a brand new framework that’s set to take impact on Jan. 1, 2026.

🚀 China is giving the Digital Yuan (e-CNY) a large improve for 2026!

The PBOC simply introduced that banks will quickly pay curiosity on CBDC holdings to drive mass adoption.Key Highlights:

💰 Curiosity-Bearing: Earn curiosity in your digital yuan pockets.

🏦 New Standing: Evolves from…— {Dollars} with Prasad (@p3prasad) December 29, 2025

Below the brand new coverage, the e-CNY will transition from functioning as digital money to working as “digital deposit foreign money,” stated PBOC Deputy Governor Lu Lei.

Debate Over Yield-Bearing Stablecoins In The US

Shirzad’s submit additionally comes after US President Donald Trump signed the GENIUS Act into regulation in July. That is the primary US stablecoin regulatory framework on the federal degree.

Below the GENIUS Act, stablecoin issuers are prohibited from providing yields on to token holders. Nonetheless, this identical ban shouldn’t be prolonged to third-party service suppliers. Critics have argued that this “loophole” permits stablecoin issuers to get across the ban.

Coinbase, as an example, provides yields on the stablecoin USDC, which is issued by Circle.

That ban on stablecoin yields has been a degree of debate in 2025, particularly on the subject of how strictly the ban must be utilized.

On one hand, crypto companies argue that limiting rewards might weaken the competitiveness of US stablecoins towards overseas alternate options and CBDCs. In the meantime, banking teams are urging regulators to implement a broad prohibition.

In a Dec. 18 letter, the Blockchain Affiliation, together with greater than 125 crypto trade individuals, urged Congress to reject the banking sector’s efforts to broaden the GENIUS Act’s prohibition on stablecoin pursuits or yields.

On the identical day, the American Bankers Affiliation printed a letter of its personal calling on lawmakers to strictly implement the GENIUS Act’s ban on yield-bearing stablecoins. It argued that some crypto exchanges are deciphering the regulation in ways in which enable incentives much like rewards. The group warned that this might undermine conventional banking exercise.

USD Stablecoins Dominate The Market

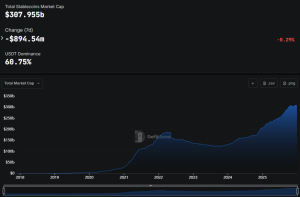

Whereas the controversy round US stablecoin yields continues, tokens pegged to the US-dollar nonetheless account for the lion’s share of the market.

Information from DefiLlama exhibits that the stablecoin market’s capitalization stands at about $307.95 billion.

Stablecoin market cap (Supply: DefiLlama)

Of that quantity, non-USD stablecoins solely make up round $1.4 billion.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection