TL;DR

- Uniswap Labs has launched “The Compact,” an open-source system that enhances interoperability between blockchains and permits apps and digital belongings to maneuver securely.

- The system makes use of ERC6909 tokens to commit belongings for cross-chain operations or swaps, conserving customers in management whereas stopping the standard fragmentation seen within the DeFi market.

- UNI is buying and selling at $7.88 after dropping almost 20% prior to now month; breaking the $8.40 resistance may gasoline features towards $12 and $18.

Uniswap Labs launched “The Compact,” an open-source contract system designed to enhance interoperability throughout blockchains, enabling purposes and digital belongings to maneuver between totally different chains safely and seamlessly.

The new characteristic introduces a shared mechanism to forestall fragmentation throughout decentralized platforms and permits builders to use, adapt, and belief a standard infrastructure, eliminating the necessity for every challenge to construct its personal bridges or escrow programs.

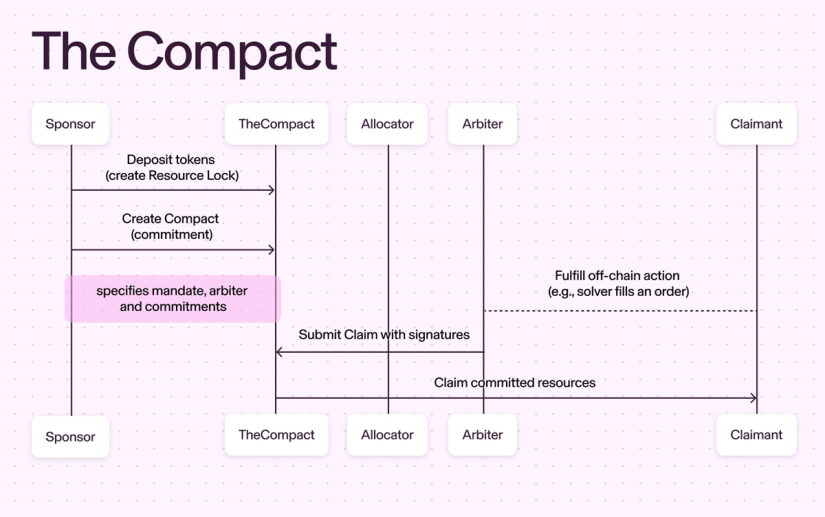

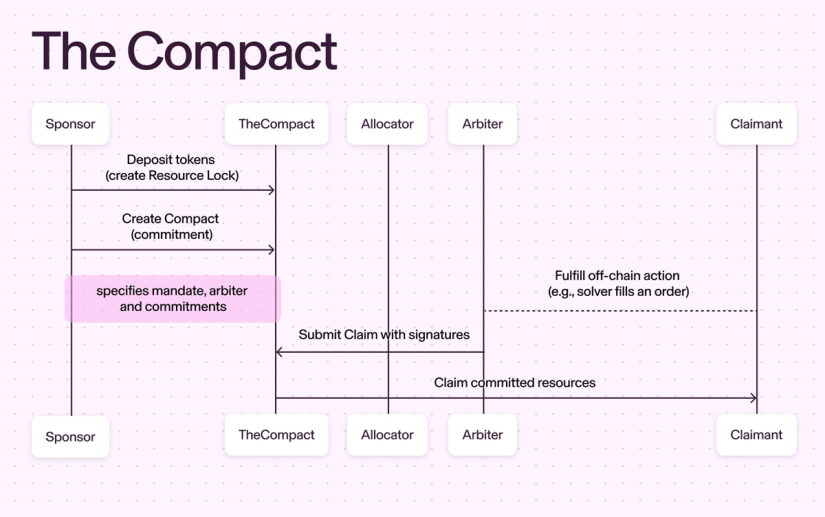

How Does ‘The Compact’ Work?

The system permits customers to “commit” tokens for particular actions, reminiscent of cross-chain operations or swaps, whereas sustaining management of the belongings via ERC6909 tokens representing the locked belongings. This structure ensures that sources can transfer freely between chains, offering easy and declarative compatibility for customers with out sacrificing decentralization or ecosystem safety.

The initiative goals to tackle the fragmentation points which have traditionally affected the DeFi ecosystem, the place a number of blockchains, sidechains, and rollups have totally different requirements and instruments, creating challenges for customers and duplicated infrastructure for builders. With The Compact, protocols can provide cross-chain functionalities with out compromising safety, enabling decentralized purposes to work together extra effectively and reliably.

Uniswap Faces Market Volatility

In the meantime, Uniswap’s token, UNI, has proven some instability not too long ago, buying and selling at $7.88 after dropping almost 20% over the previous month. Surpassing the $8.40 resistance may help a rally towards $12 and even $18