Former Million Greenback Itemizing star and actual property agent Josh Altman joins Varney & Co. to interrupt down hovering residence delistings, why patrons need turnkey properties and the way skipping mortgage charge buying is costing households hundreds.

President Donald Trump is touting enhancements in mortgage prices since he took workplace as he appears to be like to handle People’ issues about affordability amid persistent inflation within the financial system.

Trump spoke at a rally in Pennsylvania on Monday and blamed the Biden administration for prime housing prices, saying that “America is profitable once more” due to his insurance policies. The president additionally displayed a chart displaying that annual complete mortgage funds elevated over $14,600 throughout former President Joe Biden’s time period, whereas they’ve declined by greater than $2,900 since Trump returned to the White Home.

“We went down with our charges, they went up with their charges. So with us, you save $2,900 – nearly $3,000. And with them, you go up. It prices you $15,000. You do not hear that as a result of the faux information does not let you know that,” Trump mentioned.

Realtor.com analyzed the president’s declare and located that it is largely correct for brand spanking new houses, though median mortgage funds are over 80% larger than they had been on the finish of Trump’s first time period even after accounting for the current decreases.

POWELL SAYS RATE CUTS WON’T MAKE ‘MUCH OF A DIFFERENCE’ FOR STRUGGLING HOUSING SECTOR

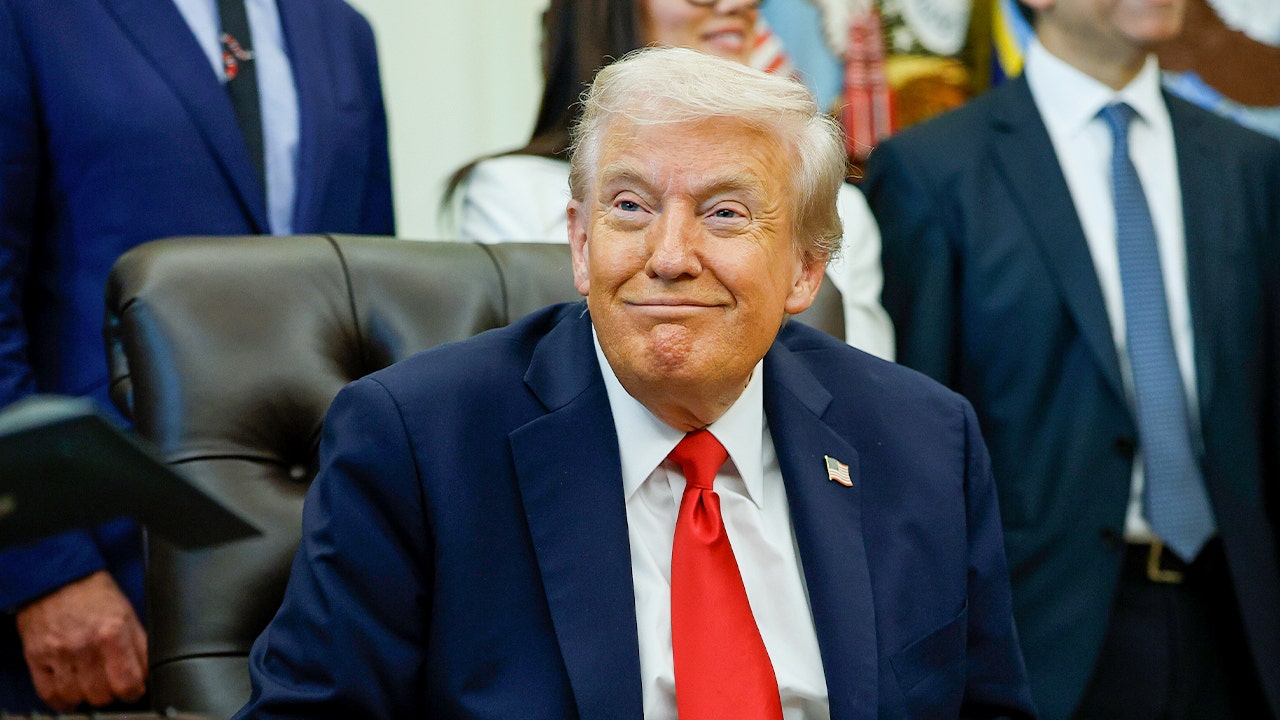

President Donald Trump touted enhancements in housing affordability throughout a speech in Pennsylvania. (Pete Marovich/Getty Photographs / Getty Photographs)

A White Home official advised Realtor.com the chart is predicated on the median buy worth of newly constructed houses, with a ten% down fee and utilizing the nationwide common mortgage charge from Freddie Mac.

Realtor.com’s evaluation yielded related findings, although it famous some variations that would have arisen concerning how mortgage charges had been averaged.

The outlet discovered that costs for present houses yielded the same enhance in mortgage funds beneath Biden, with annual funds growing about $14,600 over his time period. Evaluating that to financial savings on mortgage funds for present houses beneath Trump’s second time period yielded smaller financial savings of about $540 yearly, or $45 per thirty days.

HOME DELISTINGS SURGE AS SELLERS STRUGGLE TO GET THEIR PLACE

Mortgage charges have eased currently however stay considerably larger than they had been in 2021. (iStock)

Throughout Biden’s time period, mortgage funds surged on account of a mixture of rising residence costs and a soar in mortgage charges.

Costs for brand spanking new houses rose over 20% from January 2021 to January 2025, whereas the typical mortgage charge elevated from 2.74% to six.96% in that interval, Realtor.com discovered.

Current residence costs rose much more dramatically, growing by 48% from January 2021 to January 2025, when the worth development slowed to a mean of about 2% this yr.

THE MARKETS WHERE HOMEBUYERS MAY FINALLY GET SOME RELIEF IN 2026, REALTOR.COM SAYS

Current residence costs rose 48% from January 2021 to January 2025. (Loren Elliott/Bloomberg through Getty Photographs)

New residence costs have trended decrease since late 2022, whereas mortgage charges have eased to about 6.2% in current weeks.

“Presidential phrases are lengthy, and their influence on the financial system does not essentially begin and cease precisely because the administrations change over, which may make it simple to make use of the information to make a positive case, however tougher to show that credit score is actually because of the change in president,” mentioned Realtor.com chief economist Danielle Hale.

GET FOX BUSINESS ON THE GO BY CLICKING HERE