President Donald Trump has renewed his protection of tariffs, claiming they’re creating “nice wealth” for america. Nevertheless, market odds present buyers nonetheless anticipate no near-term Fed charge cuts.

Tariff Optimism Meets Cautious Market Sentiment

Trump posted the assertion on Fact Social, linking tariffs to stronger nationwide safety and improved financial efficiency. He additionally mentioned the commerce deficit has dropped sharply and that the economic system is rising with out inflation stress.

Trump offered tariffs as a profit to the economic system of the nation. His reasoning was that there’s a rise in progress, financial confidence is choosing up, and america is being revered as soon as once more on this planet enviornment.

His assertion follows a interval the place financial expectations maintain defining monetary market sentiment. Related information additionally established that the U.S. authorities is planning to make new adjustments to the Trump tariff construction.

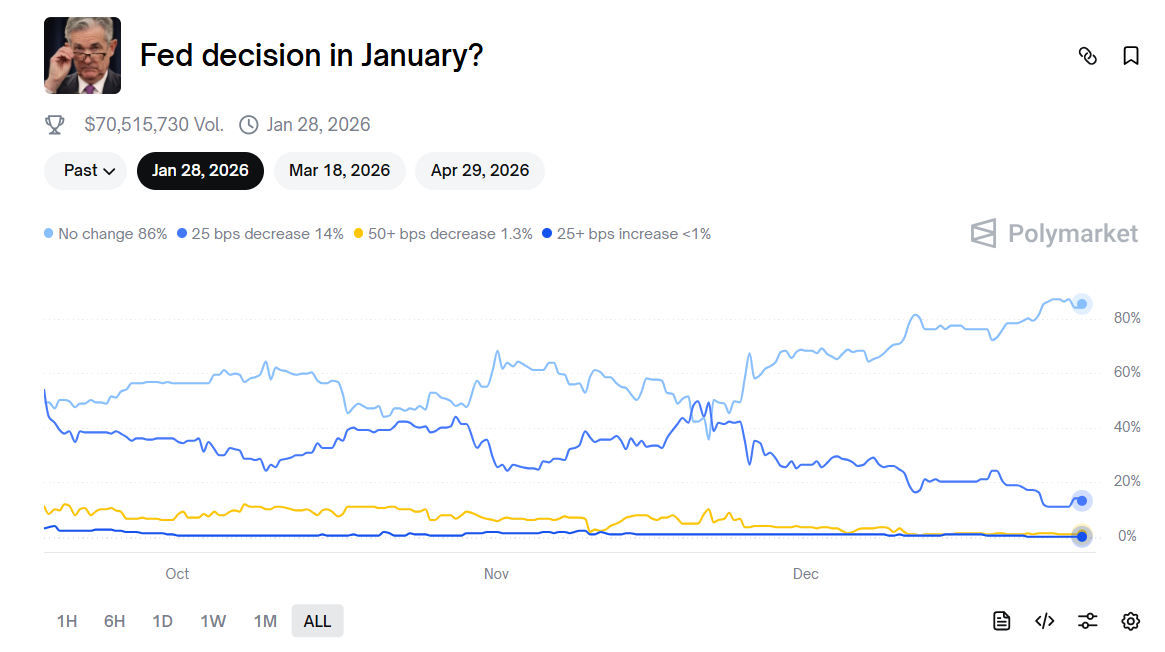

Primarily based on market data, the temper is completely different. Polymarket odds of the January Federal Reserve determination confirmed a 14% likelihood of a charge minimize. The chart signifies an 85% likelihood of the merchants that the charges won’t enhance on the subsequent assembly. With the percentages of the deeper cuts being very low, it is a sign of warning than optimism.

Will Market Temper Affect Tariff Hopes?

Commerce and output appear to be a win for Trump, however inflation dangers and financial uncertainty appear to be excessive on the agenda of buyers. Earlier on, the identical type of response occurred, because the crypto market shot up when Trump introduced a $2,000 dividend tariff for eligible Americans.

Based on market expectations, the price of borrowing will stay excessive within the long-run. This notion is a sign of the concerns on value stability and declining international financial progress.

The mismatch between the message Trump was speaking and the temper available in the market is essential. The themes highlighted in his assertion are coverage confidence and financial restoration. The market odds signifies that the policymakers and merchants are nonetheless extra concerned about ease of monetary situations.

Analysts contemplate the expectation of rate-cuts as a real-time gauge of financial belief. Lowered odds of cuts can imply an assurance that inflation is underneath management. However, it may well additionally imply that there are considerations concerning the stability of the economic system. Nevertheless, the current perspective is extra pessimistic than optimistic.