On-chain knowledge reveals ERC-20 stablecoins are at present seeing the very best variety of trade withdrawal transactions since Could 2021.

Buyers Are Withdrawing Their Stablecoins From Exchanges

In a brand new publish on X, CryptoQuant neighborhood analyst Maartunn has shared concerning the newest pattern within the Trade Withdrawing Transactions for the Ethereum-based stablecoins. This indicator measures, as its identify implies, the entire variety of transfers associated to an asset or a bunch of property flowing from wallets linked to centralized exchanges to self-custodial addresses.

Typically, buyers take their cash into self-custody when they’re planning to carry them in the long run, or no less than, not instantly trying to commerce them away. As such, a excessive worth of the Trade Withdrawal Transactions is usually a sign that buyers aren’t trying to promote the cryptocurrency proper now.

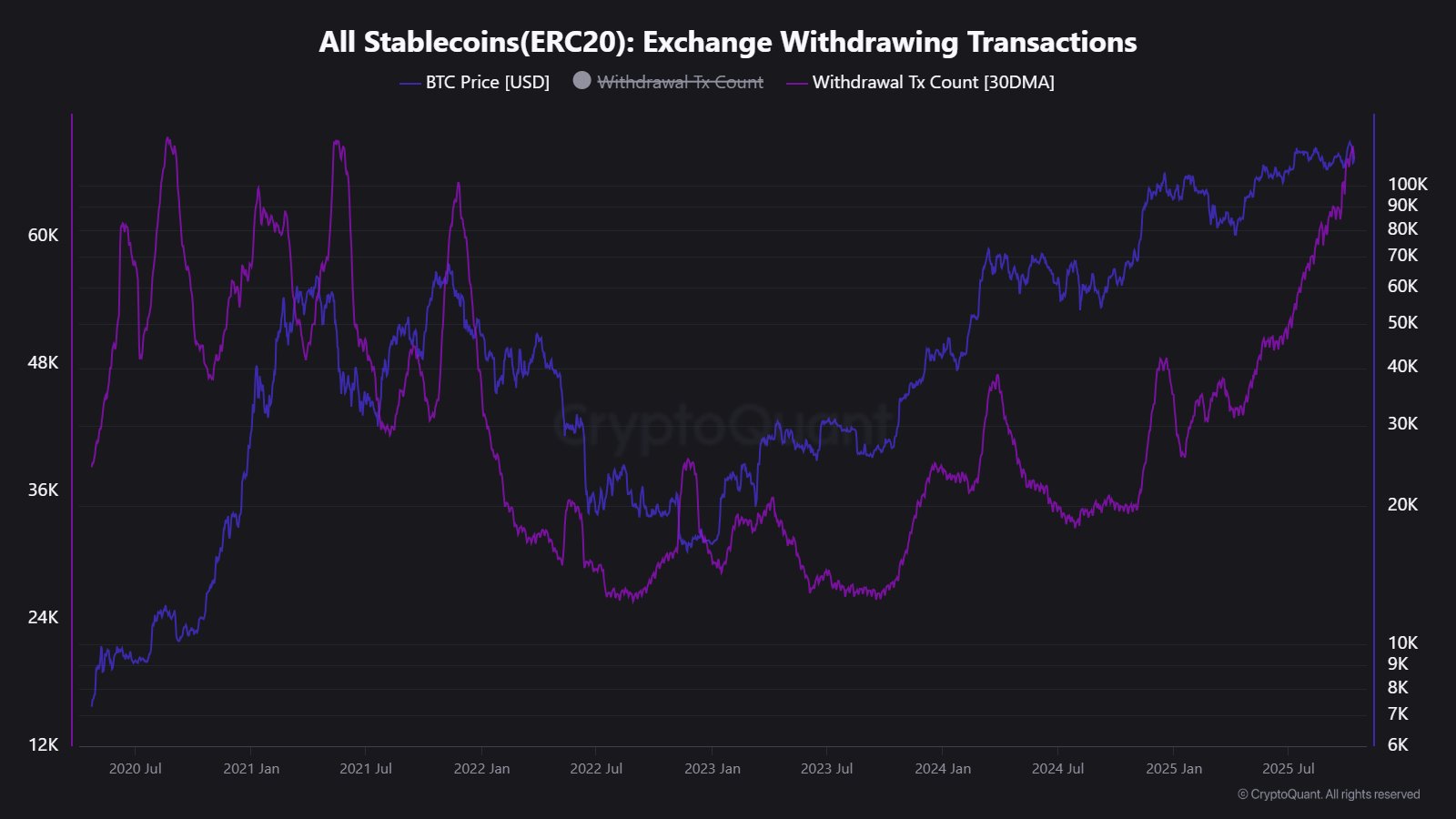

Now, here’s a chart that reveals how the 30-day shifting common (MA) of the stablecoin Trade Withdrawing Transactions has fluctuated since 2020:

The 30-day MA worth of the metric seems to have been climbing in latest months | Supply: @JA_Maartun on X

As displayed within the above graph, the Trade Withdrawing Transactions for the ERC-20 stablecoins has seen its 30-day MA worth observe a pointy uptrend lately. This means an growing quantity of transfers are occurring to take stables away from the custody of exchanges.

If a unstable asset like Bitcoin had been concerned right here, this pattern would have naturally been bullish for its worth. However as stablecoins have their worth fixed round a fiat foreign money, promoting or shopping for doesn’t have an effect on their worth in the identical method.

As a substitute, what buyers do with stables can impact the unstable aspect of the market. When holders deposit these fiat-tied tokens to exchanges, it may be a sign that they wish to purchase into Bitcoin and different cryptocurrencies.

Then again, their shifting the cash away from exchanges is usually a signal that they wish to maintain their capital nonetheless within the security of the stablecoins for some interval.

Following the latest fast development within the stablecoin Trade Withdrawal transactions, its worth has reached the 67,384 mark, the very best degree since Could 2021. This earlier spike in Could 2021 occurred as holders offered Bitcoin for stables in the course of the notorious crash that month.

Whereas the newest spike within the metric’s 30-day MA worth is extraordinary in scale, it’s nonetheless simply the primary surge in demand for withdrawing stablecoins within the present cycle to this point. The earlier cycle witnessed a number of spikes of the same scale earlier than the music stopped for the bull run.

BTC Worth

Bitcoin has seen one other setback in the course of the previous day as its worth has returned to the $110,900 degree.

Seems like the worth of the coin has retraced its restoration | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.