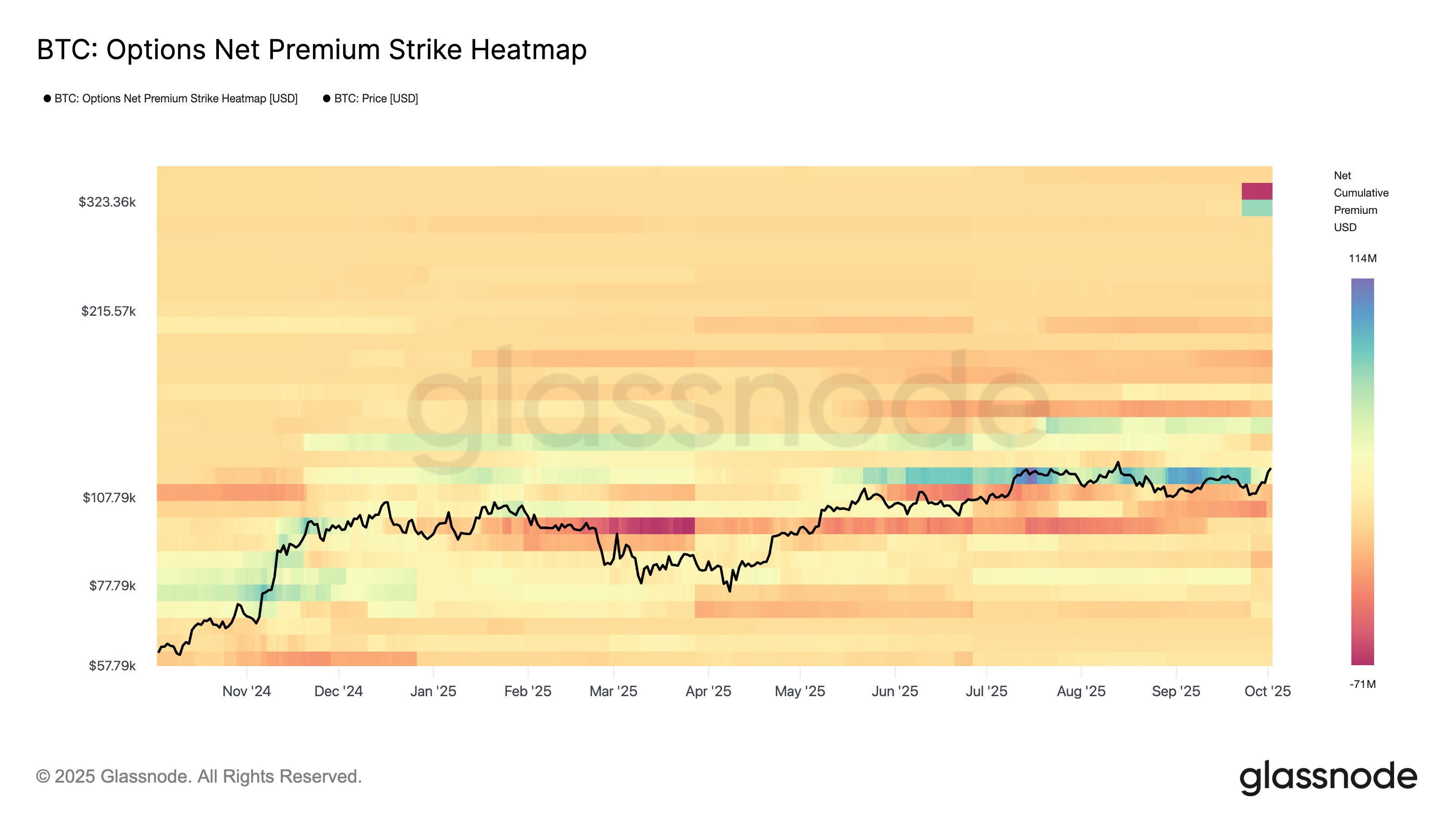

Market analytical platform Glassnode has recognized a current necessary occasion that reset Bitcoin Open Curiosity and set the stage for This fall.

Particularly, on Sept. 26, the crypto market confronted certainly one of its greatest derivatives occasions of the 12 months as $17 to $18 billion price of Bitcoin choices expired. Notably, Deribit carried most of this load with about $17 billion, whereas OKX and CME additionally noticed vital expiries.

The timing was particularly powerful for Bitcoin, which was in the course of a steep downturn that started on Sept. 18. For context, BTC dropped from $117,000 to $109,000 by the point of the expiry. Nonetheless, as soon as the contracts rolled off, Bitcoin shortly discovered its footing once more. The coin now trades at $120,995.

Choices Expiry Reset Bitcoin OI

Talking on the occasion, Glassnode defined in the present day that this expiry reset the choices market and cleared out extra hedging positions. As open curiosity has dropped, merchants now have room to put extra intentional bets on worth route and volatility moderately than simply rolling positions tied to expiry.

Furthermore, volatility information additionally reveals how the market modified. Based on Glassnode, short-dated implied volatility dropped. One-week at-the-money implied volatility fell about three factors from the height every week earlier, whereas the two-week measure eased by roughly two factors.

In the meantime, longer-term contracts held between 40% and 43%. The agency stated this brought about the volatility curve to steepen, exhibiting decreased short-term strain however warning additional out.

As well as, the choices skew additionally flipped. Notably, Glassnode stated the one-week 25-delta danger reversal swung from an 18.5-volatility put premium to a 4-point name premium.

Skew shifted sharply. 1W 25Δ RR moved from an 18.5 vol put premium to a 4 vol name premium. That’s a serious swing away from draw back hedging. Longer maturities flattened too, pointing to a extra balanced danger outlook. pic.twitter.com/dKFwQHqToD

— glassnode (@glassnode) October 3, 2025

This transfer indicators that merchants stopped closely defending in opposition to draw back and began leaning towards the upside as a substitute. Even longer-dated contracts flattened out, which factors to a extra balanced view of danger total.

Hedging Flows Received’t Return Till Subsequent Main Expiry

In accordance to Glassnode, patrons lifted upside calls with premiums clustering between $136,000 and $145,000 strikes. Nonetheless, at larger ranges, merchants bought calls, which reveals they need publicity to potential positive factors however don’t anticipate excessive costs anytime quickly.

Seller positioning additionally modified after expiry. Particularly, Gamma publicity turned barely lengthy on either side, which helps stabilize the market, although solely to a restricted extent. Glassnode famous that significant hedging flows gained’t return till the subsequent main expiry later within the quarter.

In the meantime, in a separate report, the agency highlighted indicators of contemporary demand. Its Pattern Accumulation Rating confirmed that mid-sized holders are shopping for strongly, whale promoting has slowed, and smaller traders stay impartial. It concluded that this habits factors to new structural demand constructing.

The Pattern Accumulation Rating highlights a shift in current days. Mid-sized $BTC holders are accumulating strongly, whale distribution has moderated, and smaller entities stay impartial. This factors to contemporary structural demand rising regardless of continued giant holder promoting. pic.twitter.com/KnqpCdN9qx

— glassnode (@glassnode) October 3, 2025

Bitcoin in a Favorable Place

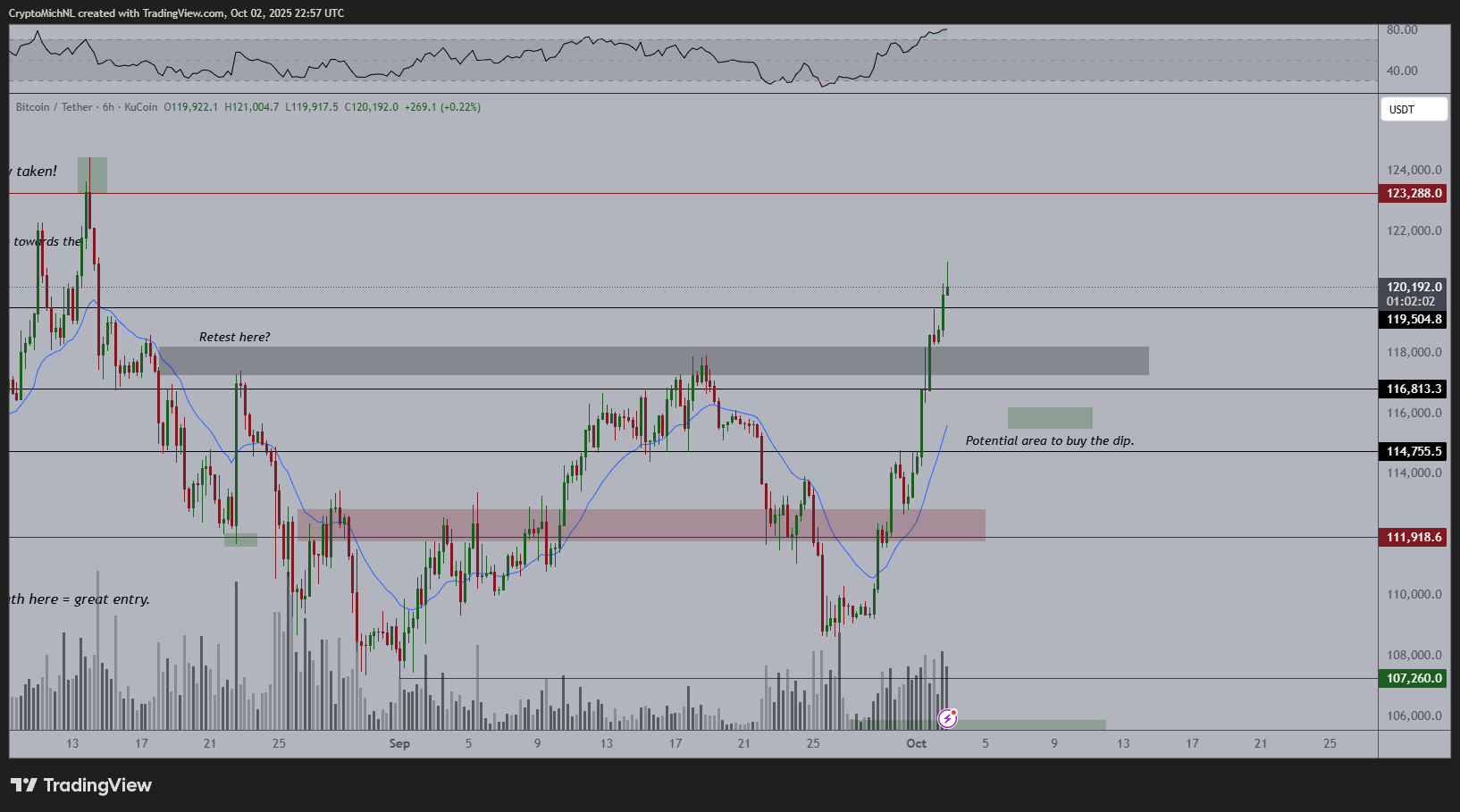

Curiously, market analysts have shared their views amid Bitcoin’s current restoration push. As an illustration, Ted Pillows stated the most recent rally stalled at $121,000. If Bitcoin breaks via this resistance, he believes a brand new all-time excessive may comply with. If not, he expects a pullback to $117,000.

$BTC obtained rejected from the $121,000 resistance degree.

If Bitcoin reclaims this degree quickly, a brand new ATH may occur.

In any other case, BTC may drop in the direction of $117,000 within the coming days. pic.twitter.com/BVVQJbejgU

— Ted (@TedPillows) October 3, 2025

In one other be aware, he identified that Bitcoin usually bottoms in September, stating it has executed so seven instances since 2016. He stated the current $107,000 dip, adopted by a 12% rebound, may imply the underside is already in.

Additionally, Veteran dealer Michaël van de Poppe stated Bitcoin has already taken out earlier highs and now sits inside attain of a contemporary document. He expects a brand new all-time excessive inside weeks as soon as Bitcoin consolidates, calling this the sign for the subsequent breakout section.

DisClamier: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article might embrace the writer’s private opinions and don’t replicate The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Primary shouldn’t be liable for any monetary losses.