The Russell 2000 is up 1.0% at the moment to a file excessive and it is main US main averages.

The index is heavy on financials, industrials and client discretionary, which implies it is a significantly better barometer of the underlying US economic system than the tech-heavy Nasdaq or (more and more) S&P 500.

There was a significant double high within the index in 2022 and 2024 that foreshadowed the the 28% decline the culminated in late March. Since then although, the index has been steadily and shortly climbing. It is now damaged out and it is a fairly image.

The drop was a false breakdown and the measured goal is 3000-3150, which is as a lot as 25% from right here. For the broader economic system, it factors to a cyclical restoration; one thing that is been brewing with the USD reacceleration commerce. It could possible include the Fed probably pushing again on the 100 bps of easing priced in over the approaching yr.

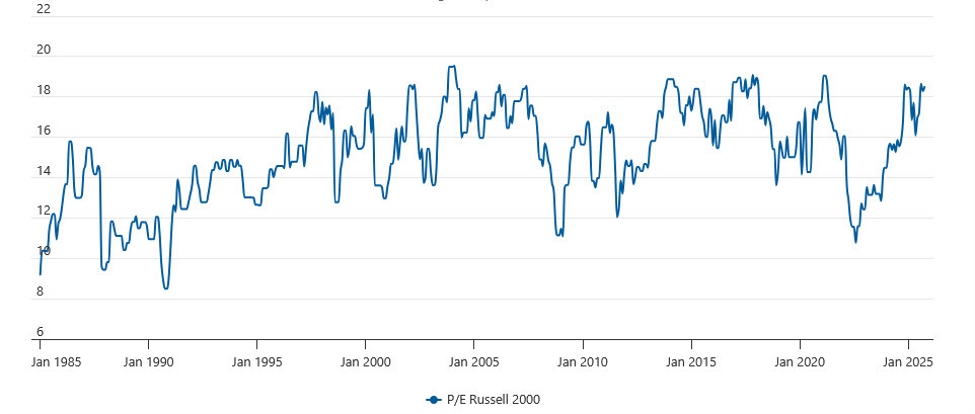

The dangers is that he index trades at 18.5 ahead earnings which is traditionally wealthy

Russell 2000 historic P/E

An enormous catalyst for the Russell 2000 could be if the US Supreme Courtroom started to dam Trump’s tariffs.