The bullish pillars of surging earnings development and rate of interest cuts stay in place to start out the fourth quarter.

Even when there’s wholesome promoting to recalibrate a barely overheated market heading into Q3 earnings season in the midst of October, it must be purchased up moderately rapidly.

This backdrop is why traders doubtless need to purchase shares in October and all through This autumn. Right this moment, we discover how traders can use a Zacks display screen to assist discover a few of the greatest Zacks Rank #1 (Sturdy Purchase) shares out of a gaggle of over 200 highly-ranked corporations.

Zacks Rank #1 (Sturdy Purchase) shares outperform the market in good and dangerous instances. Nevertheless, there are over 200 shares that earn a Zacks Rank #1 at any given time.

Due to this fact, it’s useful to know how you can apply filters to the Zacks Rank to be able to slim the checklist right down to a extra manageable and tradable set of shares.

The Finest “Sturdy Purchase” Inventory Display Parameters

Clearly, there are solely three gadgets on this display screen. However collectively, these three filters can lead to some spectacular returns.

• Zacks Rank equal to 1

Beginning with a Zacks Rank #1 is usually a powerful leaping off level as a result of it boasts a mean annual return of roughly 24.4% per 12 months since 1988.

• % Change (Q1) Est. over 4 Weeks better than 0

Optimistic present quarter estimate revisions over the past 4 weeks.

• % Dealer Score Change over 4 Week equal to Prime # 5

Prime 5 shares with the perfect common dealer ranking adjustments over the past 4 weeks.

This technique comes loaded with the Analysis Wizard and is known as bt_sow_filtered zacks rank5. It may be discovered within the SoW (Display of the Week) folder.

Right here is one of the 5 shares that certified for the Filtered Zacks Rank 5 technique at the moment…

Purchase Hovering AI Knowledge Middle Infrastructure Inventory STRL Now

Sterling Infrastructure, Inc. STRL, as its identify suggests, is a number one participant within the U.S. infrastructure house, working throughout three core companies: E-Infrastructure, Transportation, and Constructing Options.

STRL is benefitting from the AI information middle growth, reshoring, vitality business enlargement, and past. The agency specializes within the first part of building, from web site choice to planning and web site prep. Sterling boasts that it could possibly “scale to fulfill any dimension venture.”

Picture Supply: Zacks Funding Analysis

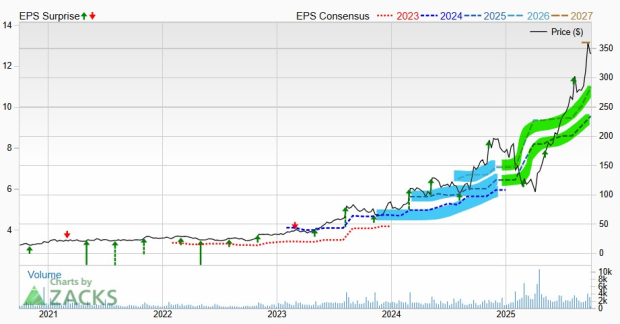

STRL’s E-Infrastructure division works straight with a few of the fastest-growing areas of the economic system, together with AI information facilities, e-commerce and distribution facilities, and past. The Texas-headquartered agency has posted spectacular income and GAAP earnings per share (EPS) development over the previous a number of years.

Picture Supply: Zacks Funding Analysis

The corporate posted a blockbuster beat-and-raise second quarter in early August. The AI information middle infrastructure firm grew its backlog by 24% YoY to shut Q2 at $2 billion, because it lands “mission-critical tasks, together with information facilities and manufacturing.”

Sterling’s EPS estimates for FY25 and FY26 climbed round 10% since its Q2 launch to earn it a Zacks Rank #1 (Sturdy Purchase) and prolong its spectacular run of upward earnings revisions.

It’s projected to develop its income by 7% in 2025 and 13% subsequent 12 months to succeed in $2.54 billion. Higher but, Sterling’s adjusted earnings are anticipated to increase by 57% this 12 months and 15% in FY26 to succeed in $10.98 a share.

Picture Supply: Zacks Funding Analysis

STRL inventory has skyrocketed 2,300% up to now 5 years as a part of a a lot bigger surge over the previous 25 years, which included a tough stretch between 2006 and 2015.

The inventory has pulled again a bit after hitting new all-time highs final week and reaching its most overbought RSI ranges over the previous 12 months. Sterling is making an attempt to carry its floor at its 21-day transferring common. On high of that, all 4 brokerage suggestions Zacks has for Sterling are “Sturdy Buys.”

Get the remainder of the shares on this checklist and begin in search of the latest corporations that match these standards. It is easy to do. And it might make it easier to discover your subsequent huge winner. Begin screening for these corporations at the moment with a free trial to the Analysis Wizard. You are able to do it.

Click on right here to enroll in a free trial to the Analysis Wizard at the moment.

Need extra articles from this creator? Scroll as much as the highest of this text and click on the FOLLOW AUTHOR button to get an electronic mail every time a brand new article is printed.

Disclosure: Officers, administrators and/or workers of Zacks Funding Analysis might personal or have offered quick securities and/or maintain lengthy and/or quick positions in choices which can be talked about on this materials. An affiliated funding advisory agency might personal or have offered quick securities and/or maintain lengthy and/or quick positions in choices which can be talked about on this materials.

Disclosure: Efficiency info for Zacks’ portfolios and techniques can be found at: www.zacks.com/performance_disclosure

See Right this moment’s Picks from Zacks’ Prime Screens – Free

You are invited to entry our assortment {of professional} inventory screens without spending a dime contained in the Analysis Wizard.

These screens have crushed the market since 2000. For instance, Small-Cap Progress averages +42.9% annual positive aspects, Filtered Zacks Rank5 returns +45.4%, and Huge Cash Zacks generates +51.8%.

Strive these screens for your self with a FREE Analysis Wizard trial. Or create your individual methods to suit your distinctive buying and selling model. No bank card wanted, no price or obligation.

Strive it for two weeks free >>

Sterling Infrastructure, Inc. (STRL) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.