Tether’s XAUT overtook PAXG in market cap, turning into the largest tokenized gold asset.

Abstract

- Tether mints $436.94 million price of XAUT tokens

- XAUT overtakes PAXG in market cap, turning into largest tokenized gold asset

- This mint raised tokenized gold’s market cap by 20%

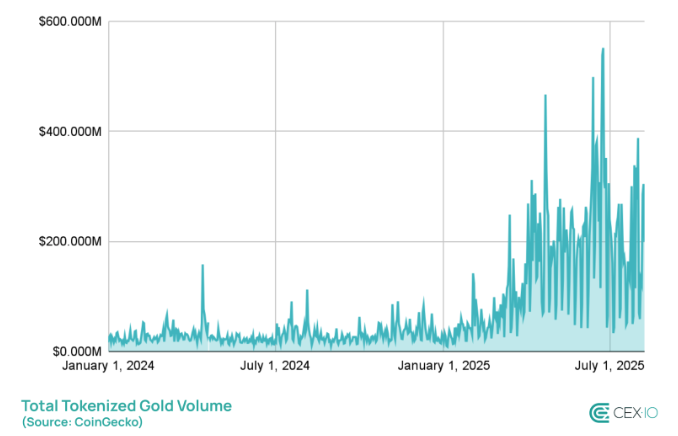

Tokenization is making an impression on how buyers are shopping for gold. On Monday, August 11, CEX.io launched a report detailing the largest developments within the tokenized gold business. The most important occasion in current months has been Tether’s XAUT surpassing Paxos Gold in market cap.

On August 8, Tether minted 129,047.917 XAUT tokens, price about $436.94 million. This not solely made it the largest gold tokenized asset by market cap, but in addition pushed the entire market cap of tokenized gold by 20%.

This mint got here as XAUT overtook PAXG when it comes to dealer engagement and energetic holders. Since July 25, XAUT’s buying and selling quantity surpassed each PAXG and KAU in day by day buying and selling quantity.

XAUT additionally dominated when it comes to new tokenized gold holders. In 2025, the variety of XAUT holders rose by 173%, in comparison with 29% for PAXG. Whereas PAXG nonetheless has a bigger userbase, with a seven-fold benefit, the hole is closing shortly.

Macroeconomic circumstances favor tokenized gold

As the unique safe-haven asset, gold has benefited from the current macroeconomic uncertainty. Particularly, since President Donald Trump introduced his tariffs on main U.S. buying and selling companions, tokenized gold volumes noticed multi-week rallies. PAXG, XAUT, and KAU volumes all benefited, with quadruple digit progress in some instances.

Tensions within the Center East, sluggish labor market progress and different unfavorable financial indicators additionally contributed to intrest. Notably, within the second quarter of 2025, tokenized gold quantity surpassed $19 billion, overtaking main gold ETFs.