Be part of Our Telegram channel to remain updated on breaking information protection

Technique Government Chairman Michal Saylor has proposed the creation of Bitcoin-backed digital banking merchandise that would entice as much as $50 trillion as his agency buys one other $962 million value of BTC.

That’s as Bitcoin slipped greater than 1% previously 24 hours to commerce at $89,907.39 as of 1:08 a.m. EST, in accordance with knowledge from CoinMarketCap.

Bitcoin-Backed Digital Banking System May Supply Shoppers Increased Yields

Talking on the Bitcoin MENA occasion in Abu Dhabi, Saylor stated that international locations may use overcollateralized BTC reserves and tokenized credit score devices to create regulated digital financial institution accounts, which he says will have the ability to supply larger yields than conventional deposits.

The Technique Government Chairman famous that financial institution deposits in Japan, Switzerland, and Europe supply little to no yield to account holders. In the meantime, euro money-market funds pay roughly 150 foundation factors, and US money-market charges are nearer to 400 foundation factors, he added.

Saylor argued that these low yields are the rationale traders are turning to the company bond market, which he says wouldn’t even exist if “individuals weren’t disgusted with their checking account.”

He went on to stipulate a construction by which digital credit score devices make up roughly 80% of a fund, mixed with 20% in fiat forex and a ten% reserve buffer to assist cut back volatility.

Saylor stated that if such a product had been supplied via a regulated entity, depositors could find yourself sending billions of {dollars} to establishments to get entry to the upper yields on supply.

Ought to a rustic supply such an account, Saylor predicted that the transfer may result in “$20 trillion or $50 trillion” in capital flows. He additionally argued {that a} nation adopting the mannequin may see it change into the “digital banking capital of the world.”

Proposed BTC-Backed Accounts Mirror Technique’s Personal Choices

Saylor’s pitch of a high-yield, low-volatility digital financial institution product is just like a few of Technique’s personal choices.

In July, the corporate launched its STRC providing, which is a money-market-style most well-liked share with a variable dividend charge of roughly 10%.

Whereas the product has grown to about $2.9 billion in market cap, it has been met with some skepticism.

I’ll rephrase this: Each inventory of STRC he sells offers Saylor the duty to pay 10% with extra seemingly MSTR inventory yearly, perpetually.

This will increase the danger of promoting BTC in some unspecified time in the future.

— Daniel Muvdi (@DanielMuvdiYT) December 5, 2025

That’s primarily as a result of Bitcoin’s unpredictable short-term volatility has led to questions across the viability of BTC-backed, high-yield credit score devices.

Technique Provides Extra BTC To Its Reserves

Technique is the biggest company Bitcoin holder globally. The corporate began buying BTC again in 2020 as a part of a digital asset treasury plan. Over time, the agency has persistently added BTC to its reserves.

Technique’s most up-to-date buy was introduced yesterday. Saylor stated on X that his firm purchased 10,624 BTC for round $962.7 million final week.

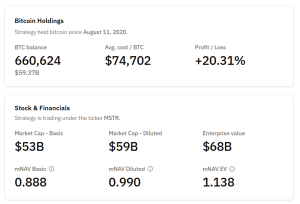

The newest Bitcoin purchase has pushed the corporate’s reserves to 660,624 BTC, knowledge from Bitcoin Treasuries exhibits.

Technique BTC holdings (Supply: Bitcoin Treasuries)

Technique’s continued BTC accumulation comes whilst the corporate’s share worth has traded in a downtrend in current months. Knowledge from Google Finance exhibits that Technique’s inventory (MSTR) has plummeted greater than 53% previously six months.

The corporate additionally faces a possible elimination from MSCI, which may set off billion-dollar outflows for MSTR, analysts warn. A call will likely be made on Jan. 15.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection