Be a part of Our Telegram channel to remain updated on breaking information protection

The worth of Technique’s Bitcoin holdings has exceeded the market caps of a number of main international banks in addition to the gross home product (GDP) of some nations after BTC returned to above $120K.

Bitcoin’s value rose over 1% up to now 24 hours to commerce at $120,050.92 as of two:27 a.m. EST, knowledge from CoinMarketCap exhibits. The main crypto was in a position to soar to a 24-hour excessive of $121,086.41, however has since retraced to commerce at its present stage.

Regardless of the latest pullback, BTC is now up greater than 9% over the previous week.

Worth Of Technique’s Bitcoin Holdings Hits New File

Technique, led by Bitcoin maxi Michael Saylor, is the biggest company holder of BTC globally. The agency began its accumulation of the biggest crypto by market cap again in August of 2020, and has since continued so as to add to its reserves.

Information from Bitcoin Treasuries exhibits that the agency holds 640,031 BTC on its steadiness sheet.

Prime ten largest company BTC holders (Supply: Bitcoin Treasuries)

That’s greater than 10X the holdings of the second-largest company holder MARA Holdings with its reserves of 52,477 BTC.

Technique’s most up-to-date Bitcoin buy was firstly of this week. With this acquisition, the corporate purchased 196 BTC for round $22.1 million at a median buy value of roughly $113,048 per Bitcoin.

The mix of the continued purchases and Bitcoin’s restoration to again above $120K noticed the worth of Technique’s BTC holdings attain $77.4 billion, in line with Saylor.

Our journey started with $0.25 billion in Bitcoin — and a right away $0.04 billion unrealized loss. At this time, we closed at a brand new all-time excessive: $77.4 billion in BTC NAV. pic.twitter.com/9k5VkAaG8p

— Michael Saylor (@saylor) October 2, 2025

That locations the worth of the corporate’s holdings above the market caps of a number of main international banks together with BNY Mellon, US Bancorp, Sberbank, CIBC, ING, Barclays, Deutsche Financial institution, ANZ Financial institution and Lloyds.

Technique’s holdings are actually additionally valued at greater than the GDPs of countries reminiscent of Uruguay, Sri Lanka and Slovenia.

Technique Share Worth Pumps 4% Whereas Q3 Earnings Put It On S&P 500 Radar

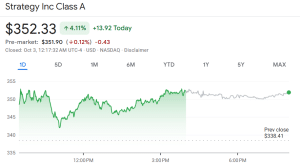

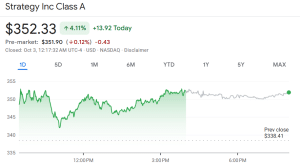

Technique’s Bitcoin holdings hovering to a brand new report excessive was accompanied by the agency’s share value rising over 4% up to now 24 hours. This has added to the inventory’s beneficial properties up to now week and month. In consequence, Technique shares (MSTR) are up greater than 16% up to now week and over 6% on the month-to-month timeframe, knowledge from Google Finance exhibits.

Technique share value (Supply: Google Finance)

The achieve by the Bitcoin value additionally places Technique on monitor to publish income for a second quarter in a row, in line with Try Chief Threat Officer Jeff Walton. This is able to once more qualify Technique for inclusion within the coveted S&P 500 index.

Q3 2025 Closed$MSTR will report it is second quarter in a row of constructive earnings, on account of its Bitcoin holdings

Est. Q3 Internet Earnings: $2.9 Billion

Est. Q3 2025 EPS: $10/share

Final 4 quarter EPS summed collectively: $22.80

All eyes on S&P committee going into This fall

🟩👆🏼 pic.twitter.com/8pfZ1tpjfd

— Jeff Walton (@PunterJeff) September 30, 2025

In line with Walton, Technique would have earned about $2.9 billion, which equates to $10 per share as a consequence of Bitcoin’s transfer from $107K to $114K in direction of the tip of the quarter. Which means MSTR could have earned roughly $22.80 per share over the previous 4 quarters.

Walton’s evaluation components in an estimated deferred tax legal responsibility of $970 million, which leaves the corporate with a web estimate of $2.9 billion.

The evaluation additionally concludes an estimated trailing twelve-month earnings per share (EPS) of $22.8. This displays a constructive EPS for the second quarter of this yr in addition to an estimated EPS in Q3, which offset the unfavourable outcomes the corporate posted in This fall 2024 and Q1 2025.

One of many necessities for the S&P 500 inclusion is a constructive trailing twelve-month EPS. Different standards embody a constructive newest quarter, over 50% public float, and common day by day buying and selling quantity above 250,000 shares. MSTR meets all of those necessities.

Nevertheless, the S&P 500 committee nonetheless has the ultimate say whether or not an organization is included within the index. The fourth quarter 2025 S&P 500 rebalancing is scheduled to take impact after the market closes on Dec. 19.

Technique had met the necessities for S&P 500 inclusion within the earlier rebalancing, however the committee finally determined to exclude the agency.

Why wasn’t $MSTR allowed into the S&P 500 Index regardless of assembly all the standards? As a result of the ‘Committee’ stated no. You need to notice SPX is basically an lively fund run by a secret committee. We intv’d the dude who used to run this committee on Trillions. Test it out. pic.twitter.com/w334JrX9VO

— Eric Balchunas (@EricBalchunas) September 5, 2025

Regardless of the exclusion, the corporate continues to be listed on the Nasdaq.

Associated Articles

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection