Technique Inc. MSTR continues to deepen its identification because the world’s largest company Bitcoin holder, with 2025 marking a decisive acceleration in Bitcoin accretion. In 2025, the corporate has meaningfully stepped up its accumulation tempo, increasing holdings to roughly 671,000 BTC, together with a current 10,645 BTC buy in mid-December. With its Bitcoin possession exceeding 3% of the worldwide provide, Technique’s accumulation has advanced into an ongoing course of moderately than opportunistic trades.

That momentum is clearly mirrored in key working metrics. BTC Yield reached 26% 12 months so far, whereas BTC Acquire climbed to 116,555 BTC, marking a pointy rise from earlier quarters. Importantly, Bitcoin per share continued to rise whilst new fairness was issued, indicating that capital raises stay including worth on a per-share foundation. These metrics recommend that Bitcoin accumulation is being executed with self-discipline.

The sturdiness of this momentum is additional supported by current structural tailwinds. Regulatory readability following IRS steering on fair-value taxation reduces uncertainty for long-term Bitcoin holders, whereas the corporate’s new S&P B- credit standing expands entry to international high-yield capital markets. On the similar time, rising institutional adoption of Bitcoin through ETFs and derivatives has improved liquidity and decreased volatility, making a extra supportive macro backdrop for treasury adoption.

Trying forward, administration reaffirmed its goal of a 30% BTC yield and $20 billion in BTC greenback earnings for 2025, indicating confidence in sustaining this trajectory. Whereas Bitcoin stays risky, the corporate’s expanded entry to capital helps extra sustainable compound development.

MSTR Faces Rising Stress From Crypto Rivals

MARA Holdings MARA challenges MSTR with a essentially totally different crypto technique. MARA Holdings blends Bitcoin manufacturing and accumulation, leveraging large-scale mining alongside strategic purchases. On the finish of the third quarter of 2025, MARA Holdings held 52,850 BTC, supported by an energized hash fee of 60.4 EH/s, indicating scalable, long-term aggressive strain.

Riot Platforms RIOT presents a rising risk to MSTR by monetizing Bitcoin by large-scale mining operations. RIOT strengths embody price effectivity and strategic enlargement, and digital infrastructure supporting the Bitcoin community immediately. On the finish of the third quarter of 2025, RIOT held 19,287 BTC, produced 1,406 BTC and deployed a 36.5 EH/s hash fee. With $180.2 million in revenues and $104.5 million in internet earnings, RIOT highlights rising aggressive strain on MSTR.

MSTR’s Worth Efficiency, Valuation & Estimates

MSTR has considerably underperformed each its sector and key opponents. Shares of Technique have plunged 54.1% over the previous 12 months towards a 15.7% achieve within the Zacks Finance sector. Riot Platforms rose 23.4% throughout the identical interval, whereas MARA Holdings declined 49.7%.

MSTR’s One-12 months Worth Efficiency

Picture Supply: Zacks Funding Analysis

MSTR has a Worth Rating of F. It’s presently buying and selling at a Worth/E book ratio of 0.9X in comparison with the sector’s 4.28X.

MSTR’s Valuation

Picture Supply: Zacks Funding Analysis

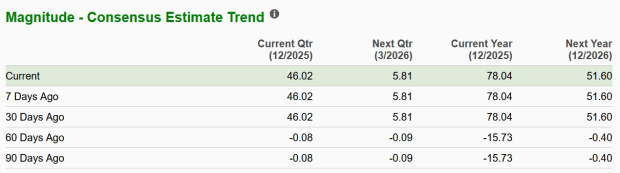

The Zacks Consensus Estimate for MSTR’s 2025 earnings is pegged at $78.04 per share, unchanged over the previous 30 days. The estimate additionally signifies a powerful year-over-year restoration from a lack of $6.72 per share.

Picture Supply: Zacks Funding Analysis

MSTR inventory presently carries a Zacks Rank #3 (Maintain). You possibly can see the entire checklist of at the moment’s Zacks #1 Rank (Robust Purchase) shares right here.

Zacks’ Analysis Chief Names “Inventory Most More likely to Double”

Our crew of consultants has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime choose is a little-known satellite-based communications agency. Area is projected to grow to be a trillion greenback trade, and this firm’s buyer base is rising quick. Analysts have forecasted a significant income breakout in 2025. After all, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Hims & Hers Well being, which shot up +209%.

Free: See Our High Inventory And 4 Runners Up

Technique Inc (MSTR) : Free Inventory Evaluation Report

Marathon Digital Holdings, Inc. (MARA) : Free Inventory Evaluation Report

Riot Platforms, Inc. (RIOT) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.