Be part of Our Telegram channel to remain updated on breaking information protection

Fears that Michael Saylor’s MicroStrategy (MSTR) could also be compelled to promote Bitcoin whether it is delisted from MSCI indexes is “flat improper,” mentioned Bitwise CIO Matt Hougan.

“I perceive why bears wish to embrace the MSTR ‘doom loop’ concept,” he mentioned in a Dec. 3 observe to purchasers. “It will certainly be very dangerous for the bitcoin market if MSTR needed to promote its $60 billion of bitcoin in a single go. However with no debt due till 2027 and sufficient money to cowl curiosity funds for the foreseeable future, I simply don’t see it taking place.”

He famous that with Bitcoin’s worth at $92k, and it’s buying and selling at $92.9k as of 11:52 a.m. EST, it’s 24% above the typical worth at which Technique acquired its stash, Hougan mentioned.

”There are many issues to fret about in crypto,” he added. ”Michael Saylor and Technique promoting bitcoin just isn’t one among them.”

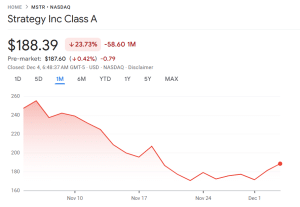

The issues come as MSTR finds itself in a funk. Google Finance knowledge exhibits that MSTR has plummeted over 23% prior to now month, and virtually 50% within the final six months.

MSTR worth (Supply: Google Finance)

MSCI And Different Index Removals Gained’t Have Such A Huge Influence, Hougan Says

MSCI introduced on Oct. 10 that it was contemplating eradicating digital asset treasury (DAT) firms from its investable indexes, with a choice due subsequent month.

JPMorgan estimates that such a delisting would seemingly lead to as much as $2.8 billion of MSTR inventory being offered, and way more if different index suppliers adopted swimsuit, with some $9 billion of MSTR held by passive fund managers.

“I’m not satisfied that elimination could be an enormous deal for the inventory,” Hougan mentioned. “$2.8 billion is a variety of promoting, however my expertise from watching index additions and deletions over time is that the impact is usually smaller than you assume and priced in nicely forward of time.”

When MSTR was added to the Nasdaq 100 Index final December, funds monitoring the index had to purchase $2.1 billion of MSTR, Hougan mentioned, including that the corporate’s inventory worth “barely moved.”

“Lengthy-term, the worth of MSTR relies on how nicely it executes its technique, not on whether or not index funds are compelled to personal it,” he argued.

In response to fears of the delisting from MSCI indexes, Saylor mentioned, ”We’re a publicly traded working firm with a $500 million software program enterprise and a novel treasury technique that makes use of Bitcoin as productive capital. Index classification doesn’t outline us.”

Response to MSCI Index Matter

Technique just isn’t a fund, not a belief, and never a holding firm. We’re a publicly traded working firm with a $500 million software program enterprise and a novel treasury technique that makes use of Bitcoin as productive capital.

This 12 months alone, we’ve accomplished…

— Michael Saylor (@saylor) November 21, 2025

Math Exhibits That Technique Has No Purpose To Promote Bitcoin

Hougan additionally mentioned the straightforward math doesn’t help the thought of doom loop for MSTR.

“MSTR has two related obligations on its debt: It must pay about $800 million a 12 months in curiosity and it must convert or roll over particular debt devices as they arrive due,” Hougan mentioned. ”Each of those obligations will not be a near-term concern for Technique.”

The curiosity funds will not be a near-term concern as a result of the corporate has $1.4 billion in money, which means it might probably make its dividend funds simply for a 12 months and a half, he mentioned.

Technique’s first debt instrument doesn’t come due till February 2027, and the quantity is just about $1 billion, which Hougan mentioned is “chump change” for a corporation that at the moment holds $60 billion in Bitcoin on its stability sheet.

Might insiders stress MSTR to promote bitcoin if its inventory continued buying and selling decrease, Hougan requested.

”Uncertain,” he mentioned. ”Michael Saylor himself controls 42% of the voting shares, and also you’d be exhausting pressed to discover a human being with extra conviction on bitcoin’s long-term worth. He didn’t promote the final time MSTR inventory traded at a reduction, in 2022.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection