Be a part of Our Telegram channel to remain updated on breaking information protection

A Spanish analysis institute is ready to money in on a forgotten $10,000 Bitcoin purchase from 2012 that’s surged 1,000x to $10 million

The Institute of Expertise and Renewable Energies (ITER), run by the Tenerife Island Council, acquired 97 BTC over a decade in the past as a part of a blockchain analysis challenge, in keeping with a report by the Spanish-language newspaper El Día.

Tenerife’s innovation councillor Juan José Martínez mentioned the council is now finalizing plans for the sale with an accredited Spanish monetary establishment. Proceeds will fund new ITER analysis, together with work on quantum applied sciences.

Analysis Institute’s Bitcoin Stash Skyrockets 100,000%

Bitcoin’s value has soared since 2012, leaving the institute with a 100,000% improve on its funding.

In early October, when Bitcoin’s value reached a brand new all-time excessive (ATH) round $126,198, the stash was price greater than $12.2 million.

Institute’s Bitcoin Purchase Wasn’t An Funding

Martínez informed the information outlet that the 2012 buy was by no means meant as an funding however moderately as a part of an experimental challenge geared toward understanding Bitcoin’s underlying blockchain know-how.

Extra particularly, a computing crew at ITER explored how the Bitcoin mining course of works.

“It was one of many quite a few analysis tasks ITER has undertaken to discover and experiment with new technological techniques,” Martínez mentioned.

ITER is at present working with a Spanish monetary establishment that’s approved by the Financial institution of Spain and the Nationwide Securities Market Fee (CNMV) to facilitate the Bitcoin sale.

Martinez mentioned he expects the transaction to be accomplished within the coming months.

Main US Tutorial Establishments Make investments In Bitcoin

Whereas ITER has mentioned that its Bitcoin buy was not meant to be an funding, different main tutorial establishments have began to spend money on the biggest crypto by market cap.

Harvard Administration Firm, which oversees the college’s $50 billion endowment, disclosed a $116 million place in BlackRock’s iShares Bitcoin Belief (IBIT) in one in every of its latest quarterly filings with the US Securities and Alternate Fee (SEC).

Did You Know?

Harvard College’s portfolio holds extra Bitcoin ETFs than Google shares. pic.twitter.com/iiPWbEr2Cq

— Bitinning (@bitinning) September 19, 2025

The funding offers Harvard oblique publicity to Bitcoin’s value actions via BlackRock’s regulated spot BTC ETF (exchange-traded fund). It’s additionally one of many college’s prime 5 publicly disclosed fairness positions, behind Microsoft, Amazon, Reserving Holdings, and Meta.

Harvard’s funding got here after US spot Bitcoin ETFs acquired the regulatory inexperienced mild for launch in 2024. They’ve since attracted billions of {dollars} in funding, and provides conventional traders a well-known car to realize BTC publicity.

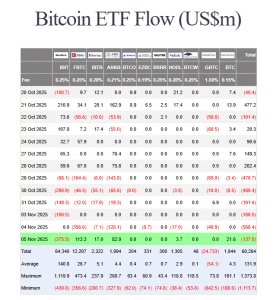

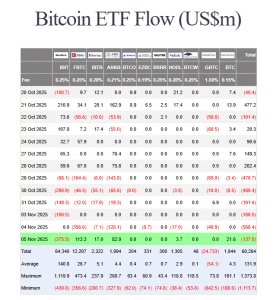

Of these ETFs, BlackRock’s IBIT has been the preferred, and has attracted $63.34 billion in cumulative inflows up to now, in keeping with information from Farside Traders.

US spot Bitcoin ETF flows (Supply: Farside Traders)

Brown College additionally reported that it held roughly $4.19 million price of IBIT shares as of the center of this 12 months. Earlier this 12 months, the College of Austin in Texas introduced a devoted $5 million “bitcoin fund” inside its endowment. The proceeds might be held in BTC for at least 5 years.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection