Institutional traders’ curiosity in altcoins has nearly fully worn out as a result of delay within the U.S. SEC’s determination on a number of exchange-traded funds as a result of extended U.S. authorities shutdown. A crypto funds move report revealed huge outflow from altcoins, together with Solana, Cardano, Litecoin, and Sui.

Establishments Lose Curiosity in Solana, Cardano, Litecoin, Sui

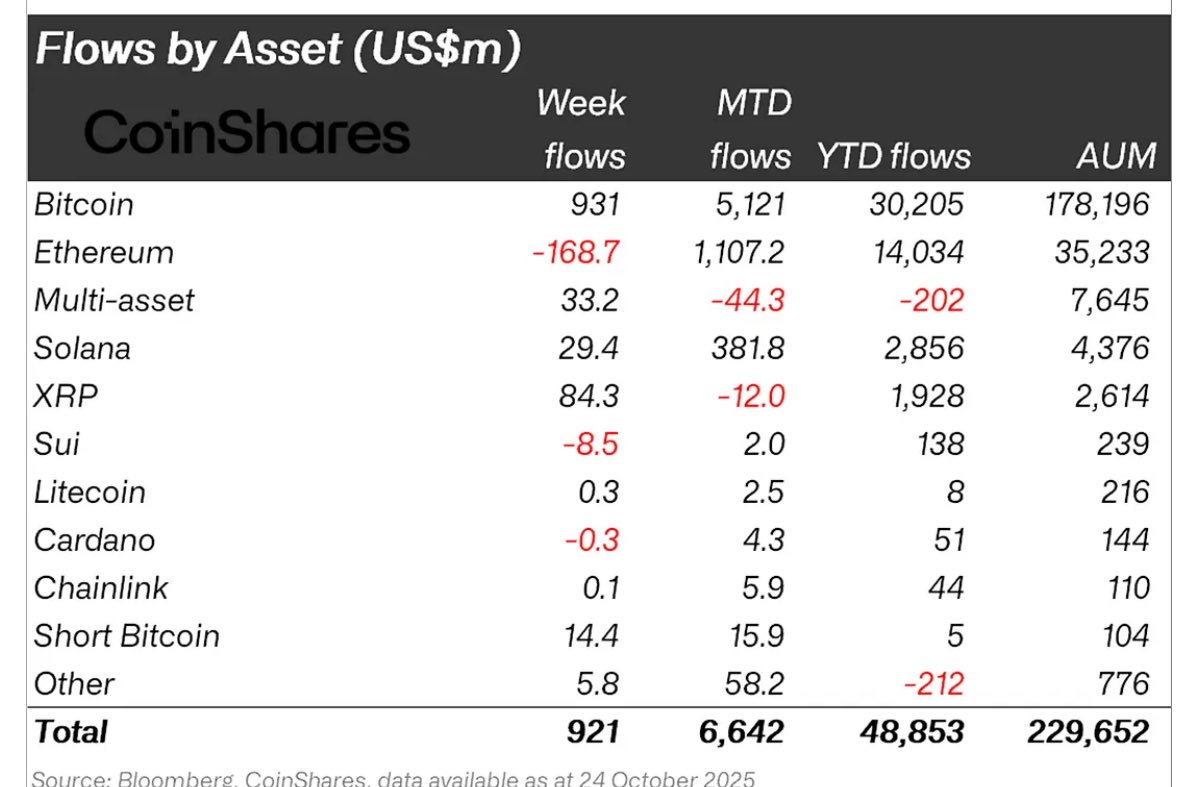

Flows in Solana and XRP have cooled within the run-up to the US ETF launches, with $29.4 million and $84.3 million, respectively, CoinShares reported on October 27. This occurs because the U.S. SEC missed ultimate selections on a number of ETFs amid the federal government shutdown.

Early October, Solana broke its weekly report, seeing inflows of $706.5 million. Whereas, XRP noticed substantive inflows of $219.4 million. Within the earlier weekly report CoinShares highlighted $156.1 million inflows into Solana and $73.9 million inflows into XRP, indicating cooling inflows amid no indicators of finish of the federal government shutdown.

Cardano noticed $0.3 million outflows, reversing from $3.7 million inflows in prior week. Sui noticed $8.5 million outflow as in comparison with $5.9 million inflows in earlier week. Altcoins reminiscent of Chainlink, Litecoin, amongst others recorded waning capital inflows from traders amid delays in ETF.

Crypto Funds Document $921 Million in Inflows

Crypto funds noticed $921 million in inflows, as investor confidence improved after lower-than-expected US CPI knowledge. Shopping for in the US and Germany supported an increase in complete belongings underneath administration (AuM) to $229.65 billion, with buying and selling quantity remained sturdy with $39 billion.

Bitcoin noticed inflows of $931 million to carry the cumulative inflows because the Fed fee lower to $9.4 billion. Buyers awaits one other 25 bps fee lower this week, which might make markets risky. BTC worth has rebounded above $116K at present amid rising optimism on the US-China commerce deal.

In the meantime, Ethereum recorded an outflow of $169 million, the primary in 5 weeks. Spot Ethereum ETFs within the U.S. noticed consecutive outflows for 3 days regardless of a rebound within the crypto market. ETH worth bounced above $4,200 however whales started revenue reserving contemplating upcoming volatility within the markets.