In solely 11 buying and selling days up to now this 12 months, Sandisk Company SNDK inventory is already up a blazing +70% to over $400 a share, making the clear argument for the most well liked tech inventory to pursue in 2026.

To that time, Sandisk’s explosive rally isn’t popping out of nowhere however as a substitute is the results of a shortage within the reminiscence chip market, particularly for non-volatile flash reminiscence known as NAND.

Being a significant NAND producer, Sandisk is immediately benefiting from this shortage as AI infrastructure requires monumental quantities of high-performance flash storage and is pushing NAND costs increased with firms racing to construct out AI capability.

Sandisk Efficiency Overview

Notably, Sandisk was spun off from Western Digital WDC to separate its enterprise into two centered, unbiased firms — one for hard-disk drives (HDDs) and one for flash reminiscence. The flash enterprise turned Sandisk Company after a strategic overview from Western Digital concluded that its HDD and flash/NAND divisions had totally different markets, development profiles, and capital wants.

AI infrastructure demand for enterprise HDD has been off the charts as effectively, however there was a broader industry-wide shortage for NAND, which has catapulted Sandisk inventory over +700% since turning into its personal publicly traded firm in February 2025, with Western Digital shares up greater than +300% throughout this era.

Picture Supply: Zacks Funding Analysis

How NAND Works

Aforementioned, NAND is a kind of non-volatile flash reminiscence, that means it retains knowledge even when the ability is off, and is taken into account the inspiration of most fashionable storage gadgets.

As a storage know-how, NAND flash is utilized in SSDs, USB drives, SD playing cards, smartphones, and tablets. It’s referred to as “NAND” as a result of its inner construction is predicated on the NOT-AND logic gate, which determines how knowledge is saved in every reminiscence cell.

NAND makes use of floating-gate transistors to lure electrons and signify knowledge bits, and since it doesn’t want energy to retain these electrons, it’s thought of non-volatile. Moreover, NAND is optimized for top density, quick speeds, sturdiness, and low energy consumption, which is why it dominates client storage.

Relating to the present AI and data-center increase, solid-state drives (SSDs) constructed on NAND are important for feeding knowledge to graphic processing items (GPUs) and different AI chips, accelerators, or servers.

Sandisk’s Sturdy Monetary Figures

Sandisk shouldn’t be a typical spinoff firm, which tends to create worth over time, however not instantly. Whereas spinoffs can outperform, it is from assured, with Sandisk’s sturdy prime and backside traces being the exception, not the rule.

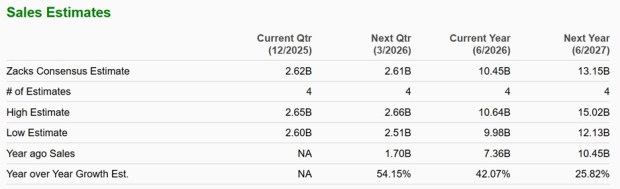

Based mostly on Zacks estimates, Sandisk’s gross sales are anticipated to soar 42% in fiscal 2026 to $10.45 billion versus $7.36 billion final 12 months. Plus, FY27 gross sales are projected to climb one other 26% to $13.15 billion.

Picture Supply: Zacks Funding Analysis

Extra spectacular, annual earnings are anticipated to skyrocket 350% this 12 months to $13.46 per share from EPS of $2.99 in 2025. Higher nonetheless, FY27 EPS is forecasted to soar one other 93% to a whopping $25.94.

Propelling the relentless rally in Sandisk inventory is that FY26 and FY27 EPS revisions are up over 10% within the final 60 days and have now risen effectively over 100% within the final three months from estimates of $6.31 and $10.39, respectively.

Picture Supply: Zacks Funding Analysis

SNDK is Nonetheless Pretty Valued

Contemplating Sandisk has a stronghold on a pivotal know-how, SNDK remains to be buying and selling at an inexpensive 30X ahead earnings a number of regardless of its unprecedented rally within the final 12 months. This isn’t a noticeable stretch to the benchmark S&P 500 and is roughly on par with Western Digital and their Zacks Pc-Storage Gadgets Trade common of 29X ahead earnings.

Picture Supply: Zacks Funding Analysis

Backside Line

Sandisk is actually making the argument for the most well liked tech inventory to pursue in 2026, with SNDK presently boasting a Zacks Rank #1 (Sturdy Purchase) based mostly on the blazing development of rising EPS revisions. Though a pointy pullback would current a extra perfect entry level, the accelerating demand for NAND suggests extra upside, particularly with Sandisk inventory nonetheless being fairly valued by way of P/E.

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unimaginable demand for knowledge is fueling the market’s subsequent digital gold rush. As knowledge facilities proceed to be constructed and continuously upgraded, the businesses that present the {hardware} for these behemoths will develop into the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to benefit from the subsequent development stage of this market. It focuses on semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is precisely the place you wish to be.

See This Inventory Now for Free >>

Sandisk Company (SNDK) : Free Inventory Evaluation Report

Western Digital Company (WDC) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.