The This autumn earnings season bought off to a constructive begin with JPMorgan JPM and Delta Air Strains DAL main the way in which and delivering favorable quarterly outcomes on Tuesday.

Regardless of exceeding This autumn expectations, each shares fell over 2% after giving cautiously optimistic insights into the economic system. After not too long ago hitting 52-week highs earlier within the month, JPM and DAL at the moment are greater than 5% from their one-year highs of $337 and $73 a share, respectively.

JPMorgan & Delta’s Financial Perception

JPMorgan CEO Jamie Dimon praised the U.S. economic system as resilient however warned that geopolitical tensions stay a critical menace that markets will not be absolutely pricing in. Dimon additionally cautioned that inflation might not fall as easily as markets anticipate, at the same time as December’s CPI report confirmed an easing in lots of shopper classes outdoors of meals costs.

In the meantime, Delta said the patron is splitting into two economies, noting that premium journey stays very sturdy, with high-income vacationers persevering with to spend freely, however price-sensitive customers are weakening, exhibiting “important fatigue” within the broader market.

JPMorgan’s This autumn Outcomes

Posting This autumn gross sales of $45.79 billion, JPMorgan’s prime line stretched 7% from $42.76 billion within the prior 12 months quarter and edged expectations of $45.69 billion. A 17% uptick in market income was the important thing driver, which incorporates actions throughout mounted revenue, currencies, commodities (FICC), and equities.

Nonetheless, funding banking was softer, persevering with a multi-quarter stoop concerning capital and advisory companies for M&A exercise, fairness issuance, and debt underwriting.

JPMorgan additionally absorbed a $2.2 billion credit score loss tied to the Apple card “takeover,” during which it’ll substitute Goldman Sachs GS because the issuer of Apple’s AAPL unique bank card that’s designed to work primarily via the iPhone’s Pockets app.

When together with the Apple card-related prices, JPMorgan’s internet revenue got here in at $13 billion or adjusted EPS of $5.23, beating This autumn earnings expectations of $4.87 per share by 7% and rising 9% from $4.81 a 12 months in the past. Relating to lending actions, JPMorgan’s internet curiosity revenue (NII) was up 7% throughout This autumn to $25.1 billion.

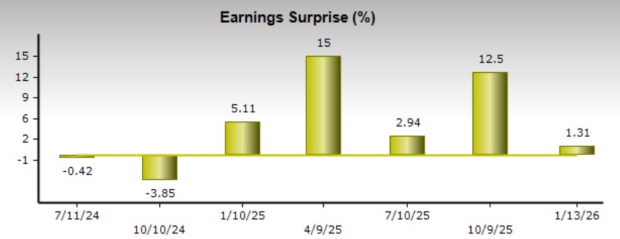

Picture Supply: Zacks Funding Analysis

Delta’s This autumn Outcomes

Though the Authorities shutdown within the U.S. between October and November decreased Delta’s home income by 2%, This autumn gross sales nonetheless rose 3% to $16 billion and comfortably exceeded estimates of $15.62 billion by 2%.

Benefiting from report vacation journey, Delta’s premium, cargo, and upkeep companies grew 7% 12 months over 12 months, accounting for 60% of its complete income. Delta reported This autumn internet revenue of $1.22 billion or adjusted EPS of $1.55, which dropped from $1.85 per share in a troublesome to compete towards comparative quarter however edged estimates of $1.53 by 1%.

Picture Supply: Zacks Funding Analysis

Full 12 months Outcomes & Steering

General, JP Morgan’s gross sales elevated 3% in fiscal 2025 to $185.6 billion, with full-year EPS growing 1% to $20.02. Full-year NII was up 3% YoY to $95.5 billion. Whereas JPMorgan doesn’t usually present formal steering, the banking large expects FY26 NII to extend to $103 billion with the $8 billion uptick attributed to decrease funding prices from price cuts. Based mostly on the most recent Zacks Consensus, JPMorgan’s FY26 gross sales are projected to extend 3% to $190.86 billion, with FY26 EPS anticipated to rise 5% to $20.97.

As for Delta, full-year gross sales had been up 2% to a report $63.4 billion, with administration emphasizing sturdy free money circulation era of $4.6 billion and stability sheet enchancment. Delta’s FY25 EPS dipped to $5.82 versus $6.16 in 2024 as gasoline and working prices stay elevated.

That mentioned, Delta expects FY26 EPS at $6.50-$7.50, implying 20% or extra progress with the present Zacks EPS Consensus at $7.24 or 24% progress. Delta forecasts Q1 EPS at $0.50-$0.90, anticipating a 5-7% improve in Q1 gross sales, however didn’t present a particular full-year FY26 income steering vary. Zacks estimates name for Delta’s FY26 gross sales to rise 3% to $65.28 billion.

Conclusion & Strategic Ideas

Making it tempting to purchase the post-earnings selloff is that these business leaders are attractively valued, with JPM buying and selling at 15X ahead earnings and DAL at 9X. Holding present positions might be worthwhile, and for now, JPMorgan and Delta inventory land a Zacks Rank #3 (Maintain).

Including to or beginning a place in JPM or DAL might grow to be enticing if analysts aren’t too deterred by their considerably cautious financial outlook and FY26 EPS revisions don’t noticeably lower within the coming weeks.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our staff of consultants has simply launched the 5 shares with the best likelihood of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime choose is a little-known satellite-based communications agency. Area is projected to grow to be a trillion greenback business, and this firm’s buyer base is rising quick. Analysts have forecasted a significant income breakout in 2025. In fact, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Hims & Hers Well being, which shot up +209%.

Free: See Our High Inventory And 4 Runners Up

JPMorgan Chase & Co. (JPM) : Free Inventory Evaluation Report

Delta Air Strains, Inc. (DAL) : Free Inventory Evaluation Report

The Goldman Sachs Group, Inc. (GS) : Free Inventory Evaluation Report

Apple Inc. (AAPL) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.