Hitting a brand new all-time excessive of $345 a share, Taiwan Semiconductor TSM inventory made headlines on Thursday after posting report This autumn outcomes and offering bullish steering and commentary on the outlook for AI.

Because the world’s largest built-in circuit foundry supplier, Taiwan Semi is seeing robust demand for its nanometer nodes in reference to the manufacturing know-how it gives to assist construct superior AI chips for Nvidia NVDA and others.

Taiwan Semi’s Robust This autumn Outcomes

Posting report This autumn gross sales of $33.71 billion, Taiwan Semi’s prime line stretched 25% from $26.88 billion within the prior 12 months quarter and beat estimates of $33.26 billion by 1%. Extra spectacular, Taiwan Semi’s This autumn EPS hit a peak of $3.14, beating expectations of $2.82 by 11% and hovering 35% from a 12 months in the past.

Picture Supply: Zacks Funding Analysis

Taiwan Semi’s Bullish Steering & AI Outlook

The foundry big didn’t present full-year income steering however tasks Q1 income within the vary of $34.6-$35.8 billion, which got here in pleasantly above Wall Avenue’s expectations of $33.27 billion or 24% development. This is likely one of the strongest income outlooks Taiwan Semi has ever issued, pushed primarily by continued demand for AI and high-performance computing chips.

Taiwan Semi usually solely gives full-year CapEx steering, and issued one of the aggressive capital-spending forecasts in semiconductor historical past at $52-$56 billion. Notably, this is able to be up greater than 27% from CapEx of $40.9 billion in 2025.

CEO Che-Chia Wei emphasised that AI demand is actual, huge, and driving report spending. Wei acknowledged that he’s additionally very nervous about how a lot Taiwan Semi is investing in AI, however regardless of the warning, the corporate’s steering indicated continued explosive AI chip demand.

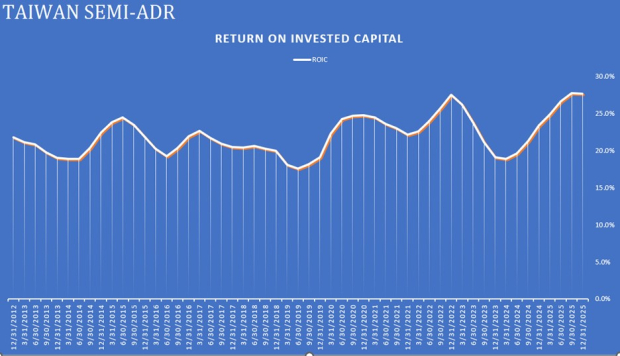

Taiwan Semi’s Reassuring ROIC

One of many clearest indicators of long-term shareholder worth is the power to show invested capital into earnings, and Taiwan Semi has a really spectacular return on invested capital (ROIC) share of 27.6%, with the customarily admirable degree being 20% or increased. It’s additionally noteworthy that analysts usually view excessive ROIC and rising CapEx as a robust sign of aggressive benefit.

Picture Supply: Zacks Funding Analysis

Monitoring Taiwan Semi’s Valuation

Whereas Taiwan Semi does command a relatively excessive price-to-forward gross sales premium of 14X in comparison with the benchmark S&P 500’s 5X, this has been regular for shares with AI-driven development catalysts, with Nvidia, for instance, having a P/S ratio of 23X. That mentioned, TSM has a ahead P/E a number of of 26X, which continues to be close to the benchmark’s 23X.

Picture Supply: Zacks Funding Analysis

Backside Line

Buying and selling at an all-time excessive, Taiwan Semi inventory lands a Zacks Rank #3 (Maintain) for the time being. Nevertheless, a purchase ranking and the plausibility of upper highs may definitely be on the way in which, on condition that EPS revisions are more likely to rise for TSM following the spectacular This autumn outcomes and bullish AI outlook.

Zacks Names #1 Semiconductor Inventory

This under-the-radar firm makes a speciality of semiconductor merchandise that titans like NVIDIA do not construct. It is uniquely positioned to reap the benefits of the following development stage of this market. And it is simply starting to enter the highlight, which is strictly the place you wish to be.

With robust earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $971 billion by 2028.

See This Inventory Now for Free >>

Taiwan Semiconductor Manufacturing Firm Ltd. (TSM) : Free Inventory Evaluation Report

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.