Though they’re among the many world’s most worthwhile corporations and have robust steadiness sheets, the immense spending on numerous AI investments from the hyperscalers within the Magazine 7 has been scrutinized.

This contains Amazon AMZN, Alphabet GOOGL, Meta Platforms META, and Microsoft MSFT, that are constructing and working huge global-scale cloud infrastructures which are wanted to run AI fashions and large knowledge workloads.

There is no such thing as a doubt that “hyperscaling” is the one approach to run AI, cloud, and data-intensive companies on the final pace and accuracy that’s now anticipated, however buyers have began to ponder whether or not these corporations are overspending on questionable and value-destroying initiatives.

Exterior of valuation, this has led to the necessity to analyze the capital effectivity of the Magazine 7 hyperscalers, notably return on invested capital (ROIC). To that time, ROIC illustrates the flexibility to return invested capital into earnings and is among the clearest indicators of long-term shareholder worth.

Microsoft Headlines CapEx Issues

Notably, the Magazine 7 hyperscalers are all anticipated to exceed $100 billion in annual capital expenditures for AI-related infrastructure by 2026.

In the intervening time, the best single-year CapEx determine at the moment goes to Microsoft. The software program large is now projected to spend $80 billion on knowledge facilities this yr and has seen its trailing twelve-month CapEx balloon to over $69 billion.

Picture Supply: Zacks Funding Analysis

ROIC Comparability

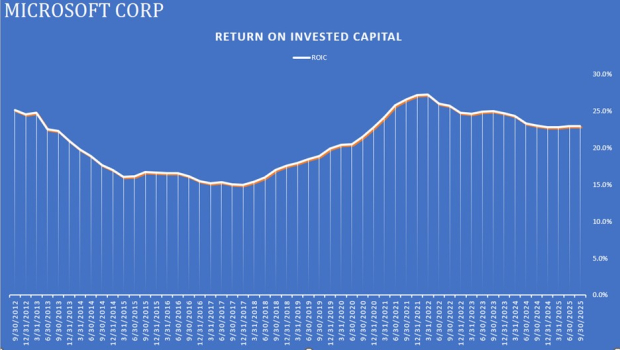

With Microsoft being the prime instance of extraordinarily elevated CapEx ranges, its ROIC has truly stabilized and remained flat over the previous couple of quarters after noticeably declining lately to 23% though that is nonetheless above the admirable stage of 20% or greater.

Picture Supply: Zacks Funding Analysis

Surprisingly, Meta, Alphabet, and Amazon have seen a rise in ROIC, suggesting the market’s worries about their elevated CapEx could also be overdone, a minimum of for now.

Amazon’s sharp uptick has definitely been reassuring as its ROIC has edged nearer to twenty% with Meta at 29% and Alphabet having the excessive at 31%.

Picture Supply: Zacks Funding Analysis

EPS Revisions & Worth Efficiency

Magnifying the promising rise in ROIC, Amazon’s elevated profitability is standing out probably the most. Benefiting from a pleasing development of constructive earnings estimate revisions, it is noteworthy that during the last 60 days, Amazon’s FY25 and FY26 EPS estimates are nonetheless up over 4% and a couple of% respectively, as proven beneath.

Picture Supply: Zacks Funding Analysis

Whereas Alphabet has skilled a fair sharper uptrend in EPS revisions, this seems to have already been priced into its inventory, with GOOGL spiking over 20% within the final three months.

As for Microsoft, CapEx issues are taking away from a slight rise in FY25 and FY26 EPS estimates. That stated, Meta inventory has been the laggard in current months, which correlates with what has been an 18% drop in FY25 EPS estimates during the last 60 days, regardless that FY26 EPS revisions are up greater than half a share level.

Picture Supply: Zacks Funding Analysis

Conclusion & Remaining Ideas

Amazon inventory at the moment sports activities a Zacks Rank #2 (Purchase), with the opposite Magazine 7 hyperscalers touchdown a Zacks Rank #3 (Maintain). Optimistically, these huge tech shares aren’t buying and selling at a stretch to the benchmark S&P 500’s 26X ahead earnings a number of, and their EPS development has remained commendable and justifiable of a slight premium to the broader market.

Nonetheless, Amazon inventory may very well be the very best wager in regard to extra short-term upside when reflecting on the development of constructive EPS revisions and the rising ROIC to offset CapEx issues. Amazon may profit probably the most from AI investments, not solely by way of boosting its market-leading AWS cloud companies but additionally in streamlining its core e-commerce enterprise.

Radical New Know-how Might Hand Buyers Big Beneficial properties

Quantum Computing is the following technological revolution, and it may very well be much more superior than AI.

Whereas some believed the expertise was years away, it’s already current and transferring quick. Giant hyperscalers, corresponding to Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Prepare dinner reveals 7 fastidiously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early specialists who acknowledged NVIDIA’s monumental potential again in 2016. Now, he has keyed in on what may very well be “the following huge factor” in quantum computing supremacy. As we speak, you’ve gotten a uncommon likelihood to place your portfolio on the forefront of this chance.

See High Quantum Shares Now >>

Amazon.com, Inc. (AMZN) : Free Inventory Evaluation Report

Microsoft Company (MSFT) : Free Inventory Evaluation Report

Alphabet Inc. (GOOGL) : Free Inventory Evaluation Report

Meta Platforms, Inc. (META) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.