The U.S. Bureau of Labor Statistics (BLS) will launch the Shopper Value Index (CPI) knowledge on Friday, regardless of the U.S. authorities shutdown. Traders are bracing for the U.S. Federal Reserve’s most popular inflation gauge, in search of additional cues on whether or not crypto market might crash once more.

How US CPI Estimates by JPMorgan and Different Wall Avenue Giants

The crypto market now awaits the important thing Shopper Value Index knowledge later right now for additional cues on path as uncertainty and volatility rise amid the U.S. authorities shutdown. Whereas Fed officers, together with Chair Jerome Powell, hinted at an extra charge lower this month, the US CPI knowledge print will tremendously affect the FOMC’s determination.

Economists anticipate the month-to-month CPI to return in at 0.4%, the identical as August’s 0.4% print. This may make the annual CPI inflation rise to three.1%, larger than the two.9% print final month.

In the meantime, the core CPI is projected to rise 0.3% month-on-month, the identical as within the earlier month. The market is projecting the annual core CPI to stay regular at 3.1%.

The Wall Avenue Journal’s Nick Timiraos mentioned the median of 18 Wall Avenue giants’ expectations confirmed the core client value index rising 0.30%. In addition to, the median estimate for headline CPI is 0.39%, corresponding to three.1% YoY. Notably, Barclays, BNP Paribas, Citigroup, Deutsche Financial institution, Morgan Stanley, and Nomura estimated core CPI above 0.40%. JPMorgan estimated month-to-month headline and core rising 0.30% and 0.39%, respectively.

Financial institution of America, Barclays, BNP Paribas, Citigroup, Deutsche Financial institution, Make use of America, First Belief, Goldman Sachs, JPMorgan, Moody’s, Morgan Stanley, Nomura, TD Securities, UBS, and Wells Fargo anticipate the annual CPI to return in at 3.1%.

Is Crypto Market Crash Imminent Forward of Fed Price Determination?

The CPI print beneath the forecast will assist gasoline the Fed charge lower expectations. Consequently, BTC value might reclaim above $112K-$115K and even to $120K amid huge upside momentum. At current, the cooling CPI inflation sentiment has triggered Bitcoin shopping for sentiment amongst merchants as value rebounds above $110K.

If inflation figures come in step with economists’ projections, BTC value will consolidate between $106K-$110K. The crypto market might witness a crash as promoting stress will proceed to persists and focus flip in direction of Fed charge lower determination.

Nonetheless, Bitcoin can dip to $102K-$104K degree once more if the CPI inflation knowledge is available in scorching. Broader crypto market crash could occur as anticipated by derivatives merchants.

Consultants’ Prediction on Bitcoin, Ethereum, and Attainable Crypto Crash

Based on the newest report by 10x Analysis, merchants are bracing for short-term volatility in Bitcoin and Ethereum, with possibility markets signaling warning. Skews have flipped sharply bearish after October’s liquidation, with a rise in put demand and hedging exercise.

BTC’s implied volatility nonetheless trades above the realized value, rewarding possibility sellers. In the meantime, ETH has dropped beneath its realized value, making its choices low-cost to purchase. 10x Analysis recommends structured trades shorting BTC and shopping for longer-period ETH choices.

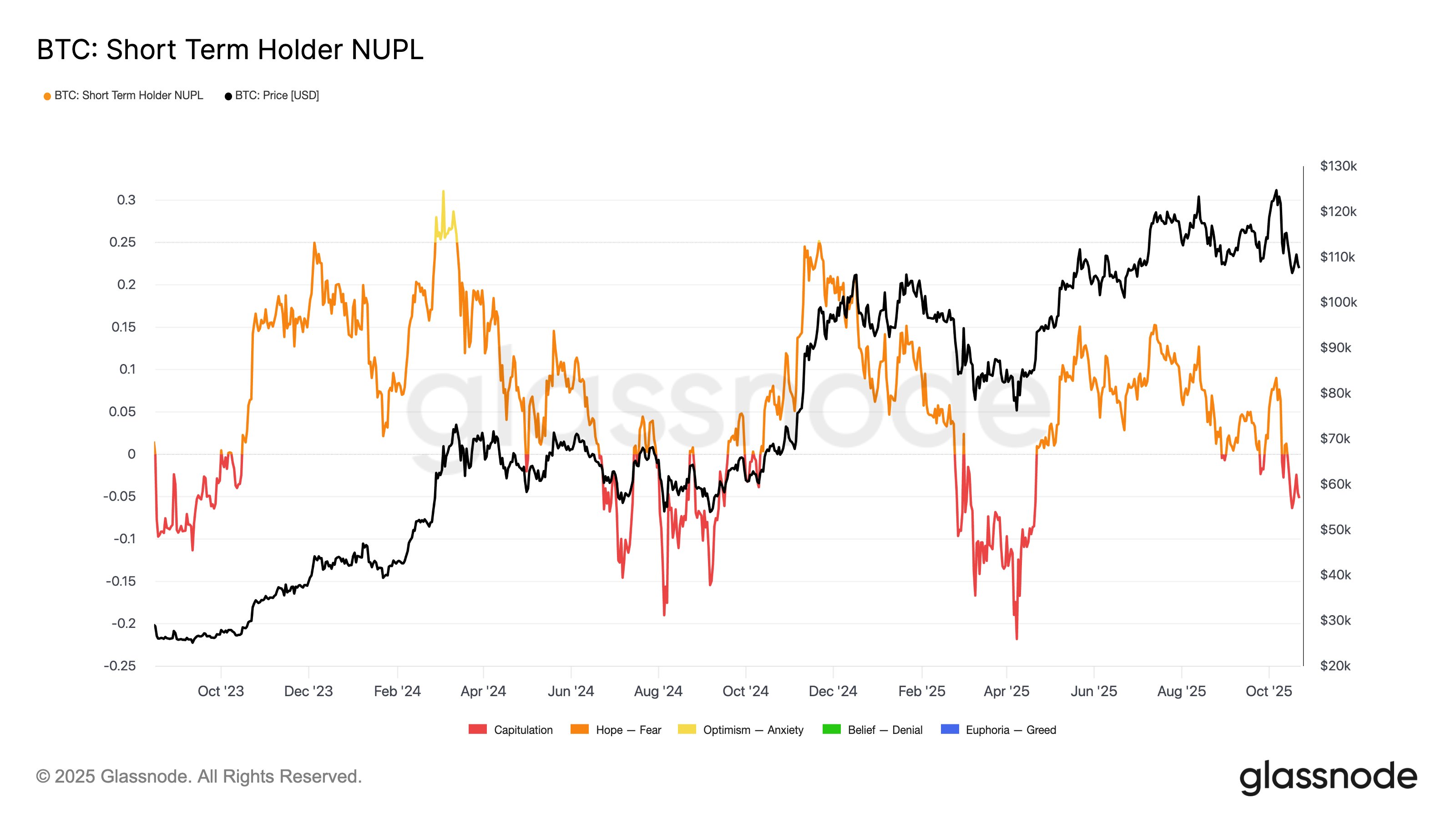

In a put up on X, Glassnode highlighted Brief-Time period Holder NUPL knowledge signaled capitulation, with rising stress amongst current consumers. Traditionally, such a short-term holder ache has aligned with more healthy market restoration.

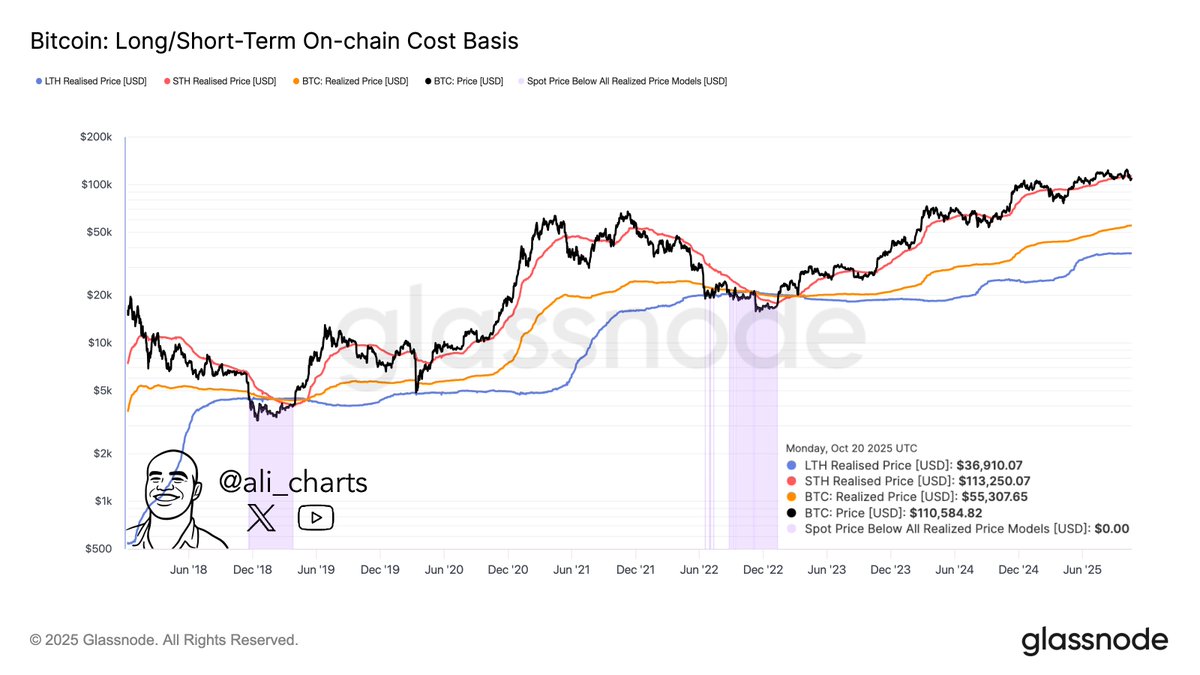

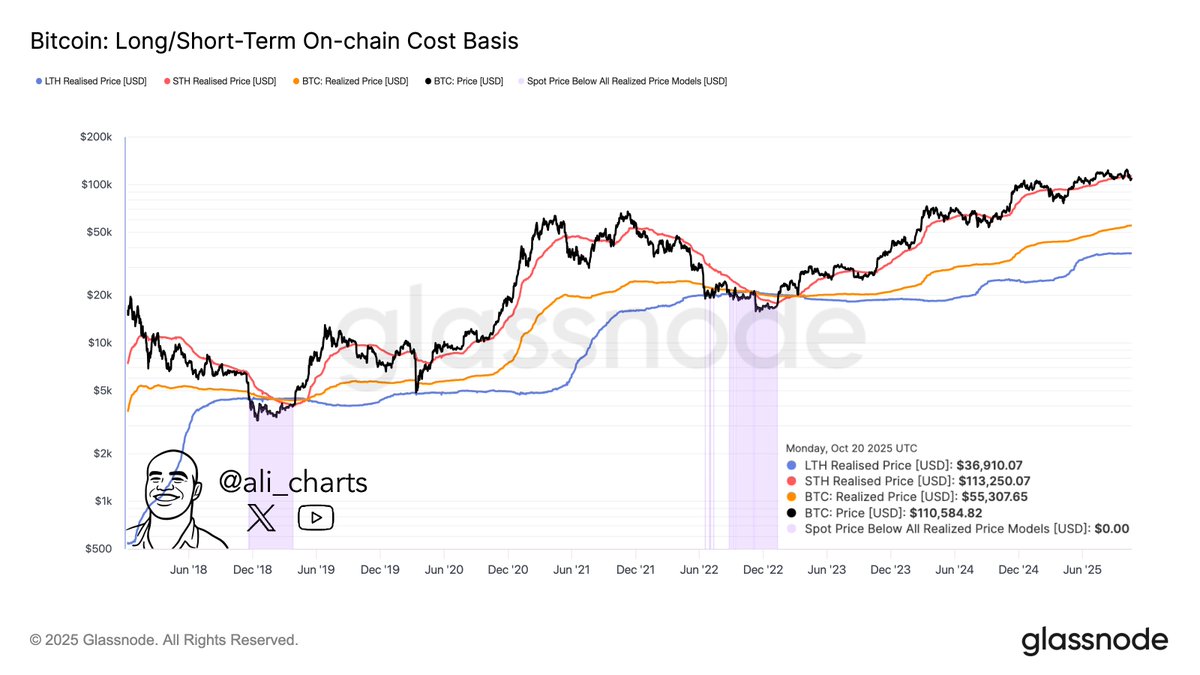

Analyst Ali Martinez identified that when Bitcoin broke beneath the STH realized value traditionally, it principally fell below the LTH realized value. The LTH realized value is now sitting at $37,000.