We get into the center of the Q1 earnings season this week, with greater than 800 firms reporting outcomes, together with 5 of the Magnificent 7 members and virtually a 3rd of S&P 500 members. We have now Microsoft MSFT, Meta Platform META, and Alphabet GOOGL on deck to report outcomes on Wednesday, October 29th, and Apple AAPL and Amazon AMZN on Thursday, October 30th.

With Tesla’s outcomes already out, solely Nvidia stays to report Q3 outcomes, that are scheduled for November 19th.

The Magazine 7 shares as a bunch have carried out roughly consistent with the market this 12 months, although Alphabet, Meta, and Microsoft have finished a lot better, whereas Amazon and Apple have lagged, because the year-to-date efficiency chart under exhibits.

Picture Supply: Zacks Funding Analysis

Apart from Apple, the 4 Magazine 7 members reporting this week are all leaders within the synthetic intelligence area and are actively investing in organising knowledge facilities and associated infrastructure to run massive language fashions.

A giant marker within the AI debate round these firms has been the ever-rising degree of capital expenditures, a race from which Apple has been lacking in motion, serving to clarify a giant a part of the inventory’s current underperformance.

Alphabet shares have loved favorable momentum these days. A constructive conclusion to the DOJ’s case has been the first catalyst, however Alphabet’s final two quarterly stories had been additionally very sturdy.

The market will likely be targeted on the corporate’s cloud enterprise, the place improved capability is anticipated to construct on the acceleration seen within the final quarterly report. Administration’s commentary across the cloud enterprise was very constructive in July, doubtless indicative of a really favorable demand backdrop and a few market share good points. The technical challenges confronted by Amazon’s AWS shoppers in current days had been after the Q3 reporting interval, however can even doubtless come up on the earnings calls.

One perennial market fear about Alphabet is the outlook for the search enterprise within the rising AI world, with many out there involved that Alphabet might not have the ability to maintain its dominance of this profitable area. Alphabet’s July outcomes went some methods in direction of easing these worries, however a powerful exhibiting this time will consolidate these good points.

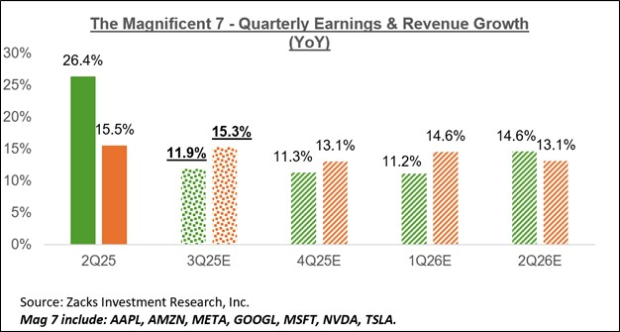

Taking a look at Q3 expectations for the group as a complete, the expectation is that Magazine 7 earnings will enhance +11.9% in 2025 Q3 from the identical interval final 12 months on +15.3% larger revenues. These expectations are a mix of Tesla’s precise outcomes and estimates for the remaining six, of which 5 are on deck to report this week.

The chart under exhibits the group’s 2025 Q3 earnings and income development expectations within the context of what was achieved within the previous interval and what’s anticipated within the coming three quarters.

Picture Supply: Zacks Funding Analysis

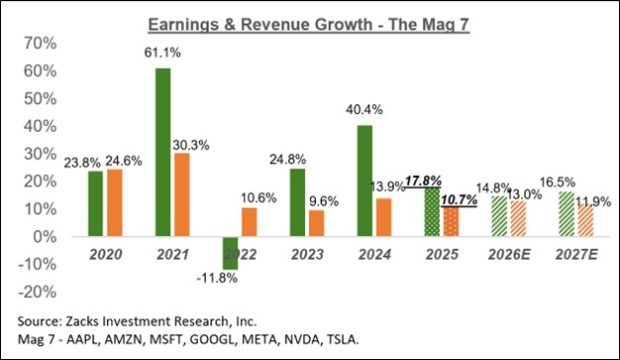

The chart under exhibits the Magazine 7 group’s earnings and income development image on an annual foundation.

Picture Supply: Zacks Funding Analysis

The group has been having fun with a steadily enhancing earnings outlook, with analysts elevating their estimates. We noticed that pattern in play forward of the beginning of the Q3 earnings season, and one thing comparable is in place for 2025 This fall as properly.

Q3 Earnings Season Scorecard

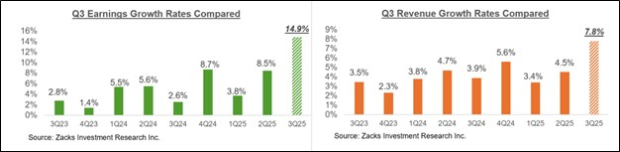

Together with all stories launched by way of Friday, October twenty fourth, we now have Q3 outcomes from 145 S&P 500 members, or 29% of the index’s whole membership. Complete earnings for these firms are up +14.9% from the identical interval final 12 months on +7.8% larger revenues, with 86.9% beating EPS estimates and 82.1% beating income estimates.

The comparability charts under put the Q3 earnings and income development charges from these firms in a historic context.

Picture Supply: Zacks Funding Analysis

The comparability charts under present the Q3 EPS and income beats percentages in a historic context.

Picture Supply: Zacks Funding Analysis

For the Finance sector, we now have Q3 outcomes for 58.6% of the sector’s market capitalization within the S&P 500 index. Complete earnings for these Finance firms are up +22.7% from the identical interval final 12 months on +11.9% larger revenues, with 97.5% beating EPS estimates and 87.5% beating income estimates.

The proportion of those Finance sector firms beating each EPS and income estimates (‘blended’ beats proportion) is 87.5%. The comparability charts under present the sector’s Q3 income development efficiency throughout current quarters and the sector’s Q3 ‘blended’ beats proportion.

Picture Supply: Zacks Funding Analysis

The Earnings Huge Image

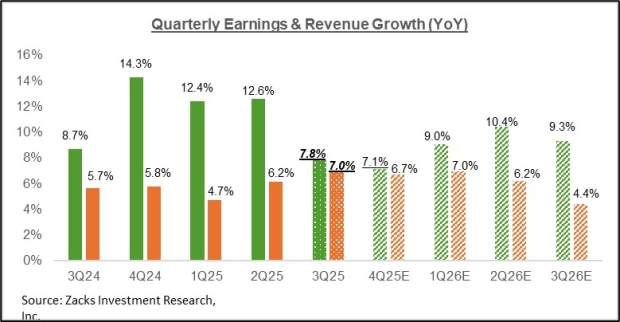

The chart under exhibits present Q3 earnings and income development expectations for the S&P 500 index within the context of the previous 4 quarters and the approaching 4 quarters.

Picture Supply: Zacks Funding Analysis

Please notice that the +7.8% earnings development charge for Q3 proven above represents the blended development charge for the quarter, which mixes the precise outcomes for the 145 firms which have reported with estimates for the still-to-come firms.

The chart under exhibits the general earnings image on a calendar-year foundation.

Picture Supply: Zacks Funding Analysis

When it comes to S&P 500 index ‘EPS’, these development charges approximate to $257.83 for 2025 and $290.48 for 2026.

For an in depth view of the evolving earnings image, please try our weekly Earnings Tendencies report right here >>>>Finance Sector Offers Flying Begin to Q3 Earnings Season

Zacks Names #1 Semiconductor Inventory

This under-the-radar firm makes a speciality of semiconductor merchandise that titans like NVIDIA do not construct. It is uniquely positioned to reap the benefits of the following development stage of this market. And it is simply starting to enter the highlight, which is precisely the place you need to be.

With sturdy earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. International semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $971 billion by 2028.

See This Inventory Now for Free >>

Amazon.com, Inc. (AMZN) : Free Inventory Evaluation Report

Apple Inc. (AAPL) : Free Inventory Evaluation Report

Microsoft Company (MSFT) : Free Inventory Evaluation Report

Alphabet Inc. (GOOGL) : Free Inventory Evaluation Report

Meta Platforms, Inc. (META) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.