Be a part of Our Telegram channel to remain updated on breaking information protection

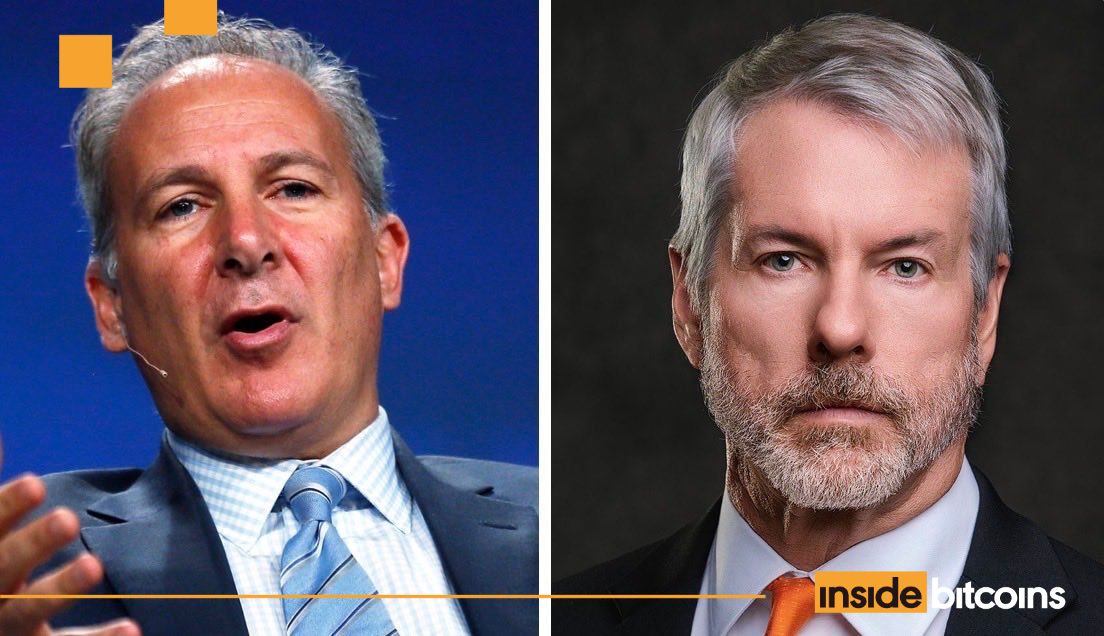

Michael Saylor’s Bitcoin treasury technique is a “fraud” that may finish in chapter, Peter Schiff mentioned.

The gold advocate and long-time Bitcoin critic slammed Saylor’s firm, Technique (previously MicroStrategy), in a sequence of posts on X, intensifying his years-long feud with the crypto trade’s most outstanding company investor.

“MSTR’s total enterprise mannequin is a fraud,” he mentioned. “No matter what occurs to Bitcoin, I imagine $MSTR will ultimately go bankrupt.”

MSTR’s total enterprise mannequin is a fraud. Saylor and I’ll each be talking at Binance Blockchain Week in Dubai in early December. I problem @saylor to debate this proposition with me. No matter what occurs to Bitcoin, I imagine $MSTR will ultimately go bankrupt. Let’s go!

— Peter Schiff (@PeterSchiff) November 16, 2025

Schiff challenged Saylor to a debate in the course of the Binance blockchain week in December, which each of them are set to attend.

MSTR ‘Demise Spiral’ Incoming

Schiff argued in one other X put up that Technique’s enterprise mannequin depends on “income-oriented funds shopping for its ‘high-yield’ most popular shares,” warning that these yields ”won’t ever really be paid.”

As soon as fund managers understand this, Schiff mentioned they’ll dump Technique’s most popular shares and the corporate received’t have the ability to situation any extra. This, the Bitcoin critic concluded, will set off an MSTR “loss of life spiral.”

Schiff’s feedback come after Technique shares plunged 30% up to now month amid a steep crypto market correction. It’s additionally down greater than 51% up to now six months, based on Google Finance.

The plunging share worth brought on Technique’s mNAV, which is the financial premium mirrored within the firm’s inventory worth over its BTC holdings, to fall under 1 earlier this month. It has since rebounded to face at 1.20, however remains to be under 2, the bottom degree that buyers see as wholesome for a crypto treasury agency.

Some analysts says Technique’s Bitcoin-accumulation mannequin makes the corporate behave like a leveraged Bitcoin car, and that the corporate’s inventory (MSTR) acts virtually like a name choice on BTC.

That leverage can multiply positive factors for buyers, however may also result in amplified losses in a market downturn. This has been seen within the broader crypto market’s newest retracement, which has put stress on MSTR’s worth.

Previously month, Bitcoin’s worth has sunk greater than 10% to commerce under the psychological $100K mark. In the meantime, MSTR has plummeted over 31% throughout the identical interval,

Saylor Hints At One other Bitcoin Purchase

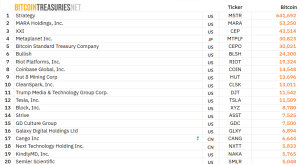

Technique has reworked itself from a business-intelligence agency into the world’s largest company holder of Bitcoin, with greater than 641,000 BTC on its stability sheet, based on Bitcoin Treasuries.

Prime 20 largest company BTC holders (Supply: Bitcoin Treasuries)

Saylor hinted yesterday that Technique is about to purchase extra Bitcoin, posting a snapshot of the SaylorTracker chart, including the caption, “₿ig Week.”

Related posts have been adopted by bulletins that Technique has purchased extra Bitcoin. The newest tweet comes after Technique final week refuted rumors that it was promoting BTC.

₿ig Week pic.twitter.com/a27eg6Kw4v

— Michael Saylor (@saylor) November 16, 2025

“Sure, massive losses for Bitcoin and MSTR possible this week,” Schiff replied to the put up.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection