Aurora Hashish ACB sits on the intersection of a shifting regulatory panorama because the Trump administration strikes to reclassify marijuana. Whereas the choice marks a constructive step for the hashish trade, its monetary implications are uneven throughout operators.

Notably, ACB inventory has misplaced over 5% previously month regardless of the constructive regulatory growth, suggesting buyers are weighing company-specific fundamentals extra closely than sector-wide coverage momentum.

Let’s delve into the corporate’s fundamentals to realize a greater understanding of find out how to play the inventory amid this current growth.

Aurora’s Medical Hashish Technique Units It Aside

Aurora Hashish continues to derive the vast majority of its development from its medical hashish phase, underscoring the corporate’s strategic deal with higher-margin, regulated markets. For the six months of fiscal 2026 (12 months ended March 2026), Aurora delivered stable top-line development, pushed primarily by report efficiency in international medical hashish.

Medical hashish revenues rose practically 25% 12 months over 12 months to C$135.3 million, accounting for 72% of complete revenues. Progress was fueled by larger gross sales in worldwide markets like Australia, Germany, Poland and the UK, in addition to elevated revenues in Canada from insurance-covered and self-paying sufferers.

The upper gross sales additionally helped enhance adjusted gross margin numbers for the medical hashish phase. Whereas Aurora didn’t disclose these numbers on a six-month foundation, it reported a year-over-year enchancment in medical hashish margins in every of the primary two quarters of fiscal 2026, reflecting a good mixture of worldwide gross sales, premium merchandise and ongoing manufacturing efficiencies.

These margin positive factors, mixed with disciplined value management, helped adjusted EBITDA rise 92% 12 months over 12 months to C$26.2 million for the six months ended September 2025, highlighting the working leverage embedded in Aurora’s medical-focused mannequin.

Wanting forward, Aurora expects the pattern of development in worldwide medical hashish gross sales to proceed within the fiscal third quarter, supported by new product introductions and market growth initiatives. It additionally expects to generate constructive money circulate throughout the quarter, pushed by improved working money yield.

Aurora’s Declining Hashish Client Gross sales

Aurora Hashish continues to face strain in its client hashish enterprise, at the same time as its medical phase delivers constant development. Persistent value compression and intense competitors in Canada’s adult-use market have weighed on revenues and margins, limiting the phase’s contribution to total efficiency.

In response, Aurora Hashish has intentionally scaled again its publicity to low-margin leisure merchandise and redirected sources towards higher-value alternatives. It’s now prioritizing the manufacturing and provide of GMP-certified medical hashish, the place pricing energy and regulatory obstacles assist extra engaging margins and larger earnings visibility.

This strategic realignment displays administration’s deal with profitability over quantity. Whereas the weaker client hashish efficiency stays a near-term headwind, Aurora’s emphasis on premium medical choices and ongoing value optimization is predicted to assist stabilize earnings and cut back reliance on Canada’s challenged leisure market.

Different Gamers within the Hashish House

Aurora Hashish operates in a extremely aggressive market the place development alternatives stay restricted and fragmented. It faces stiff competitors from its friends like Cover Progress CGC and Tilray Manufacturers TLRY, each of that are additionally targeted on worldwide growth and value effectivity.

As ACB continues to increase its presence in regulated medical hashish markets, aggressive responses from CGC and TLRY are prone to intensify. This might result in extra aggressive strikes from these friends and probably additional consolidation within the sector.

ACB Inventory Efficiency & Valuation Estimates

The inventory has outperformed the trade previously 12 months, as seen within the chart beneath.

Picture Supply: Zacks Funding Analysis

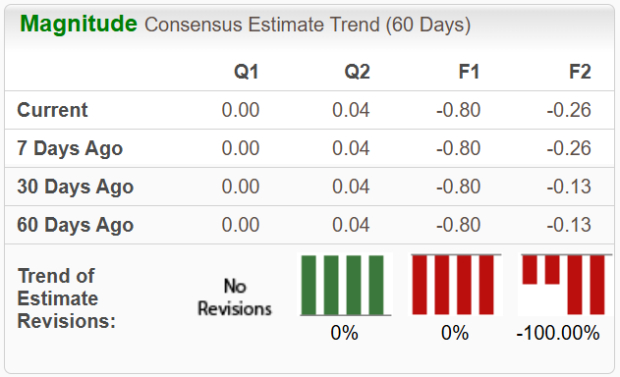

Whereas loss per share estimates for fiscal 2026 have remained unchanged at 80 cents within the final 30 days, these for 2027 have widened from 13 cents to 26 cents throughout the identical timeframe.

Picture Supply: Zacks Funding Analysis

Play ACB Inventory?

Whereas marijuana reclassification is predicted to favor medical hashish, the advantages are uneven throughout the trade. Aurora Hashish, regardless of being listed in america, has minimal working publicity to the U.S. market, limiting its capability to profit straight from potential federal reforms.

On the similar time, valuation alerts stay blended. Loss estimates for fiscal 2027 have widened sharply, doubling over the previous month. This shift factors to a extra cautious analyst outlook and suggests rising uncertainty across the sustainability of earnings momentum past the close to time period.

Given these elements, buyers could wish to maintain off on initiating or including to positions till Aurora stories its fiscal fourth-quarter outcomes. A cautious strategy towards this Zacks Rank #3 (Maintain) inventory stays warranted.

You may see the whole record of at present’s Zacks #1 Rank (Sturdy Purchase) shares right here.

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unbelievable demand for knowledge is fueling the market’s subsequent digital gold rush. As knowledge facilities proceed to be constructed and always upgraded, the businesses that present the {hardware} for these behemoths will turn into the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to reap the benefits of the subsequent development stage of this market. It focuses on semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is precisely the place you wish to be.

See This Inventory Now for Free >>

Cover Progress Company (CGC) : Free Inventory Evaluation Report

Tilray Manufacturers, Inc. (TLRY) : Free Inventory Evaluation Report

Aurora Hashish Inc. (ACB) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.