The enterprise software program panorama is present process a transformative shift as synthetic intelligence and cloud computing redefine aggressive benefits. Oracle ORCL and Adobe ADBE, two titans commanding over a trillion {dollars} in mixed market capitalization, characterize distinct approaches to capitalizing on this technological revolution. Oracle has emerged as a crucial infrastructure supplier powering the AI spine, whereas Adobe has positioned itself because the creativity and advertising platform leveraging AI to reinforce digital experiences.

Let’s delve deep and intently evaluate the basics of the 2 shares to find out which one is a greater funding now.

The Case for ORCL Inventory

Oracle’s transformation from a conventional database firm into an AI infrastructure powerhouse represents some of the outstanding company pivots in current know-how historical past. The corporate’s fiscal 2026 first-quarter outcomes showcased explosive progress that despatched shares hovering 36% in a single buying and selling session. Whole Remaining Efficiency Obligations (RPO) skyrocketed 359% 12 months over 12 months to a staggering $455 billion, signaling unprecedented future income visibility. Cloud revenues jumped 28% to $7.2 billion, with Oracle Cloud Infrastructure (“OCI”) main the cost.

The corporate’s strategic positioning as the popular infrastructure accomplice for AI leaders has created a formidable aggressive moat. Oracle introduced groundbreaking partnerships with OpenAI, together with a reported five-year $300 billion contract to host the corporate’s giant language fashions in Oracle information facilities starting in 2027. This deal alone implies annual contract worth of $60 billion, essentially remodeling Oracle’s income trajectory. CEO Larry Ellison’s current announcement of the Oracle AI Database service, enabling organizations to run AI fashions from OpenAI and different suppliers atop their Oracle-stored information, represents a game-changing integration that deepens Oracle’s entrenchment within the AI ecosystem.

Administration now initiatives $144 billion in cloud infrastructure revenues by fiscal 2030, up from $10.3 billion in fiscal 2025, representing a compound annual progress charge exceeding 50%. We count on fiscal 2026 internet gross sales to develop 15.8% from fiscal 2025.

The corporate’s huge datacenter capability growth, together with the deployment of fifty,000 AMD AI chips introduced at Oracle AI World in October 2025, demonstrates aggressive funding in capturing AI workload demand. Oracle’s OCI Zettascale10, unveiled as the biggest AI supercomputer within the cloud, delivers 10 occasions the zettaFLOPS of peak efficiency, establishing technical management in dealing with probably the most demanding AI computations.

The corporate’s partnership with Google Cloud in August 2025, bringing OpenAI’s GPT-5 mannequin to Oracle purposes, exemplifies its ecosystem technique. By turning into the infrastructure spine for a number of cloud platforms and AI firms, Oracle has positioned itself as an indispensable layer within the know-how stack. This multi-cloud technique, bolstered by the introduction of Multicloud Common Credit, permits prospects to seamlessly deploy workloads throughout Oracle, AWS, Microsoft Azure, and Google Cloud, eliminating switching prices and rising stickiness.

Oracle Company Worth and Consensus

Oracle Company price-consensus-chart | Oracle Company Quote

The Case for ADBE Inventory

Adobe delivered respectable fiscal third-quarter 2025 outcomes, whereby the corporate raised its full-year income steering to $23.65-$23.70 billion and expanded its digital media annualized income progress forecast to 11.3% from 11%. AI-influenced Annual Recurring Income (ARR) surpassed $5 billion, demonstrating tangible monetization of generative AI capabilities embedded throughout Adobe’s product portfolio. We count on fiscal 2026 internet gross sales to develop 8.5% from fiscal 2025.

Adobe’s AI technique facilities on Firefly, its commercially protected generative AI mannequin skilled solely on licensed content material, Adobe Inventory imagery, and public area works. This method addresses crucial enterprise considerations round copyright and authorized legal responsibility that plague rivals utilizing web-scraped coaching information. The September 2025 launch of Acrobat Studio represents Adobe’s imaginative and prescient for an AI-powered productiveness hub, integrating Acrobat, Adobe Categorical, and AI capabilities right into a unified workspace. The platform’s PDF Areas characteristic and Categorical creation instruments reveal Adobe’s execution in delivering sensible AI purposes that improve day by day workflows.

The introduction of Adobe Expertise Platform Agent Orchestrator in September 2025 marks a major development in agentic AI, enabling specialised AI brokers to execute complicated decision-making duties at scale with human oversight. This positions Adobe on the forefront of enterprise AI agent deployment, addressing the $18.5 billion addressable marketplace for advertising automation and buyer expertise platforms.

Adobe’s partnerships introduced all through 2025 reveal broad enterprise adoption. The multi-year Premier League collaboration brings Firefly generative AI to 1.8 billion world soccer followers, whereas integrations with AWS, Google Cloud, and Microsoft Azure develop Adobe’s attain throughout cloud ecosystems. The launch of LLM Optimizer addresses the rising problem of name visibility in AI-powered browsers and chat interfaces, with information displaying 3,500% year-over-year will increase in AI-driven site visitors to retail websites. Nevertheless, mounting aggressive stress from Canva, Figma, and rising AI-native design platforms has tempered investor enthusiasm, elevating considerations about Adobe’s capacity to defend its inventive software program dominance and maintain pricing energy.

Adobe Inc. Worth and Consensus

Adobe Inc. price-consensus-chart | Adobe Inc. Quote

Valuation and Worth Efficiency Comparability

Oracle trades at a trailing P/E ratio of 62.22x, representing a major premium to its 5-year historic common of 23.52. Adobe trades at a trailing P/E of 19.75x. Oracle’s premium valuation is justified by distinctive progress fundamentals and market place, whereas Adobe’s compressed valuation displays real headwinds relatively than non permanent dislocation. Oracle’s $455 billion remaining efficiency obligations present extraordinary income visibility, de-risking future progress projections.

ORCL vs. ADBE: P/E TTM

Picture Supply: Zacks Funding Analysis

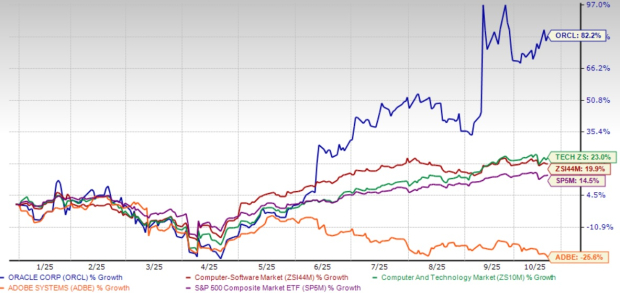

Oracle shares have surged 82.2% 12 months up to now, approaching a $1 trillion market valuation. Conversely, Adobe inventory has declined 25.6% over the identical interval, regardless of strong fundamentals and AI integration progress. Persistent aggressive threats and slower AI monetization in comparison with infrastructure performs have saved traders cautious.

ORCL Outperforms ADBE, Sector YTD

Picture Supply: Zacks Funding Analysis

Conclusion

Oracle’s strategic positioning because the AI infrastructure spine, evidenced by the transformative OpenAI partnership and 359% RPO progress, creates sustainable aggressive benefits and income visibility unmatched in enterprise software program. Oracle’s cloud infrastructure trajectory towards $144 billion by 2030, mixed with technical management demonstrated via OCI Zettascale10 and large datacenter investments, establishes the corporate because the clear winner within the AI infrastructure race. Traders should purchase Oracle inventory to capitalize on the AI infrastructure alternative, whereas adopting a maintain stance on Adobe or ready for a extra compelling entry level as the corporate navigates aggressive pressures and proves sustainable AI-driven progress. Oracle carries a Zacks Rank #2 (Purchase), and Adobe carries a Zacks Rank #3 (Maintain) at current. You’ll be able to see the entire record of in the present day’s Zacks #1 Rank (Robust Purchase) shares right here.

Free Report: Cashing in on the 2nd Wave of AI Explosion

The subsequent part of the AI explosion is poised to create vital wealth for traders, particularly those that get in early. It’s going to add actually trillion of {dollars} to the economic system and revolutionize practically each a part of our lives.

Traders who purchased shares like Nvidia on the proper time have had a shot at enormous features.

However the rocket experience within the “first wave” of AI shares might quickly come to an finish. The sharp upward trajectory of those shares will start to stage off, leaving exponential progress to a brand new wave of cutting-edge firms.

Zacks’ AI Increase 2.0: The Second Wave report reveals 4 under-the-radar firms which will quickly be shining stars of AI’s subsequent leap ahead.

Entry AI Increase 2.0 now, completely free >>

Oracle Company (ORCL) : Free Inventory Evaluation Report

Adobe Inc. (ADBE) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.