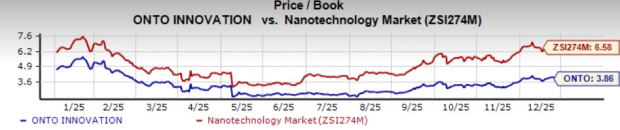

Onto Innovation Inc. ONTO shares have soared 51.8% prior to now six months, outperforming the Zacks Nanotechnology trade’s progress of 47.6%. The corporate has additionally outpaced the Zacks Pc and Expertise sector and the S&P 500 composite’s progress of 17.8% and 12.5%, respectively. The inventory has risen 9.8% prior to now three months.

Picture Supply: Zacks Funding Analysis

The corporate is gaining from a diversified portfolio and rising foothold in AI-driven superior packaging in opposition to a softer semiconductor backdrop. Profitable 3Di and Dragonfly {qualifications}, product uptake and offshore manufacturing ramp-up place it for stable sequential and long-term progress.

Let’s take a more in-depth take a look at ONTO’s fundamentals, progress drivers, aggressive benefits and potential dangers to evaluate its progress potential in 2026.

Packaging Demand Fuels Onto’s Progress

Onto is well-positioned to profit from its vital product vary and buyer relationships. The corporate invests in analysis and growth to supply differentiated services, which add worth to its prospects’ manufacturing processes. Backed by its experience within the core applied sciences of optics and software program, the fast and ongoing growth of recent merchandise and enhancements to present merchandise permits it to rapidly reply to dynamic trade tendencies in addition to aggressive challenges, resulting in continued buyer wins. Onto’s packaging prospects are signaling as much as 20% greater device demand in 2026 to assist expansions and new 2D subsurface and 3Di inspection purposes.

Onto Innovation Inc. Worth and Consensus

Onto Innovation Inc. price-consensus-chart | Onto Innovation Inc. Quote

Whereas quarterly outcomes could fluctuate, the corporate expects sequential progress within the first half of 2026 and stronger momentum within the second half, pushed by new merchandise and capability expansions. The ramp-up of Onto’s expanded Asian factories is progressing nicely. Greater than 30% of third-quarter instruments had been shipped from these websites, with capability anticipated to exceed 60% of complete manufacturing by first-quarter 2026.

These initiatives will strengthen competitiveness, scale back tariff publicity, improve flexibility and assist gross margin growth. Administration expects roughly 18% income progress on the midpoint of its fourth-quarter steering, pushed by almost doubling of gross sales to 2.5D packaging prospects on sturdy Dragonfly system demand. Superior node income can also be projected to rise with greater DRAM and logic spending.

ONTO’s Strategic Acquisitions Bode Effectively

Onto Innovation has a historical past of buying corporations to increase its product choices. In November 2025, Onto Innovation closed its $495 million acquisition of key Semilab product strains, including FAaST, CnCV and MBIR instruments to strengthen its inline wafer contamination monitoring, supplies evaluation and floor cost metrology capabilities. Semilab’s supplies evaluation enterprise has witnessed about 20% CAGR since 2021 and is projected to generate $130 million in income by 2025. Its integration into Onto is predicted to enhance gross margin, working margin and non-GAAP EPS by greater than 10% within the first yr and create sturdy shareholder worth at a 10x EBITDA a number of. Administration plans to mix its AI Diffract modeling engine with Semilab’s supplies and contamination monitoring instruments. Together with Onto’s metrology options, it will assist chipmakers pace up yield studying and enhance course of optimization for superior nodes.

The addition of Lumina in 2024 expanded its inspection capabilities into laser-based options for unpatterned wafers, superior packaging and rising supplies, rising its serviceable market by an estimated $250 million yearly and supporting the event of a next-generation inspection platform. Onto additionally acquired Kulicke and Soffa’s lithography enterprise, gaining invaluable mental property and deep technical experience, which boosts its JetStep panel lithography and metrology choices. Collectively, these acquisitions are anticipated so as to add as much as $100 million in annual income over the subsequent three years and change into earnings accretive inside a yr.

Headwinds

Onto is dealing with headwinds corresponding to excessive buyer focus, dependency on restricted suppliers and macroeconomic challenges as a consequence of its in depth geographic footprint. The continuing commerce tensions associated to U.S. tariffs are an added concern. The continuing commerce restrictions and strained relations between the USA and China are impediments to progress. The corporate is weighed down by tariffs, principally from imported elements that make up almost 90% of its prices, together with added strain from outbound tariffs. Regardless of avoiding tariffs on tooling gross sales, the corporate nonetheless faces added prices within the fourth quarter from inbound tariffs. Administration expects fourth-quarter gross margin to be at 53.5–55%, pressured by about one proportion level, or roughly $2.5 million, as a consequence of inbound tariffs on uncooked materials imports.

ONTO’s Undervaluation is Interesting

The inventory trades at a price-to-book (P/B) ratio of three.86, beneath the trade’s common of 6.58.

Picture Supply: Zacks Funding Analysis

Finish Notice

With synergies from acquisitions, greater demand from a number of finish markets, elevated adoption of Dragonfly platforms and margin growth, ONTO continues to supply engaging upside regardless of the inventory’s near-term headwinds. Therefore, traders can take into account including it to their portfolio now.

At current, ONTO carries a Zacks Rank #2 (Purchase). You’ll be able to see the whole record of immediately’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Different Shares to Think about

Another top-ranked shares from the broader know-how area are Palantir Applied sciences Inc. PLTR, BlackBerry Restricted BB and Five9, Inc. FIVN. PLTR presently sports activities a Zacks Rank #1, whereas BB & FIVN carry a Zacks Rank #2.

Palantir Applied sciences’ earnings beat the Zacks Consensus Estimate in every of the trailing 4 quarters, with the typical shock being 16.27%. Within the final reported quarter, PLTR delivered an earnings shock of 23.53%. Its shares have surged 122.5% prior to now yr.

BlackBerry’s earnings beat the Zacks Consensus Estimate in three of the trailing 4 quarters, with the typical shock being 125%. Within the final reported quarter, BB delivered an earnings shock of 25%. Its shares have inched up 3% prior to now yr.

FIVN’s earnings beat the Zacks Consensus Estimate in every of the trailing 4 quarters, with the typical shock being 16.09%. Within the final reported quarter, Five9 delivered an earnings shock of 6.85%. Its shares have declined 27.6% prior to now six months.

Quantum Computing Shares Set To Soar

Synthetic intelligence has already reshaped the funding panorama, and its convergence with quantum computing may result in probably the most vital wealth-building alternatives of our time.

Right this moment, you will have an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Past AI: The Quantum Leap in Computing Energy, you may uncover the little-known shares we consider will win the quantum computing race and ship large positive aspects to early traders.

Five9, Inc. (FIVN) : Free Inventory Evaluation Report

BlackBerry Restricted (BB) : Free Inventory Evaluation Report

Onto Innovation Inc. (ONTO) : Free Inventory Evaluation Report

Palantir Applied sciences Inc. (PLTR) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.