Higher China stays a cornerstone of NIKE Inc.’s NKE long-term development story. This makes the area’s 10% income decline in first-quarter fiscal 2026 a major setback for the model. The area noticed a double-digit dip throughout NIKE Direct and digital, whereas wholesale slid 9%, reflecting softer visitors, elevated promotions, and underperforming seasonal sell-through.

Nonetheless, administration burdened China’s strategic significance, noting robust native ardour for basketball, soccer and operating, and highlighting vivid spots corresponding to excessive single-digit development in operating, supported by improvements just like the Peg Premium and Vomero 18. Though the quarter underscores China’s structural challenges, NIKE reiterated its dedication to rebuilding momentum by means of sport-led retail refreshes and deeper native relevance.

Past China, NIKE’s international playbook continued to take form, pushed by its “Win Now” actions and the rollout of its new Sport Offense working mannequin. North America led the restoration with 4% income development, bolstered by double-digit positive aspects in operating, coaching and basketball, and strengthened wholesale relationships. EMEA and APLA delivered modest top-line progress, although each areas confronted pockets of heightened promotional exercise and softer digital demand.

The corporate emphasised that the Sport Offense, organizing groups by sport, model and channel, is already producing clearer shopper insights, sooner innovation cycles, and extra immersive retail experiences, together with refreshed Home of Innovation codecs which have pushed double-digit income lifts.

Trying forward, NIKE is relying on a extra globally synchronized product engine, sharper storytelling round key sports activities moments and improved market well being to create steadiness throughout geographies. Administration acknowledged a dynamic shopper surroundings, tariff-driven price pressures and uneven restoration timelines, notably in China and NIKE Digital. Even so, a stronger innovation pipeline, rising wholesale order books, and sport-driven model activations underpin NIKE’s confidence that its international playbook can offset regional weak spot and restore constant, worthwhile development over time.

How NKE’s Friends LULU & ADDYY Are Performing Globally

As NIKE navigates a combined international backdrop, traders are intently watching how friends like lululemon athletica inc. LULU and adidas AG ADDYY are performing throughout key markets.

lululemon delivered one other robust quarter in China, with Mainland income up 25% and comparable gross sales rising 16% in second-quarter fiscal 2025, supported by retailer enlargement and high-impact model activations like its summer time sweat video games. This power highlights the resilience of its worldwide technique, even because the U.S. stays pressured. Globally, LULU continues to broaden into new markets and construct consciousness, however its playbook is just not totally balanced but, given the distinction between sturdy worldwide momentum and softer North American developments.

adidas delivered 10% development in Higher China in third-quarter 2025, supported by robust DTC momentum and renewed demand throughout each Efficiency and Life-style classes. This regional power suits into its globally constant playbook, which emphasizes native relevance, deeper product ranges, and sport-led storytelling. With double-digit positive aspects throughout all main markets, adidas’ international technique seems effectively balanced, exhibiting broad-based traction reasonably than reliance on any single area.

NKE’s Worth Efficiency, Valuation & Estimates

Shares of NIKE have misplaced 14.4% 12 months to this point in contrast with the trade’s decline of 17.1%.

Picture Supply: Zacks Funding Analysis

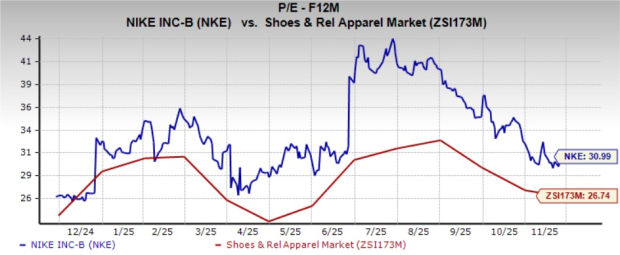

From a valuation standpoint, NKE trades at a ahead price-to-earnings ratio of 30.99X in contrast with the trade’s common of 26.74X.

Picture Supply: Zacks Funding Analysis

The Zacks Consensus Estimate for NKE’s fiscal 2026 earnings implies a year-over-year decline of 24.1%, whereas that for fiscal 2027 signifies development of 54.2%. Earnings estimates for fiscal 2026 have been southbound previously seven days. In the meantime, the consensus estimate for fiscal 2027 has been northbound in the identical interval.

Picture Supply: Zacks Funding Analysis

NIKE inventory presently carries a Zacks Rank #3 (Maintain). You’ll be able to see the whole checklist of as we speak’s Zacks #1 Rank (Robust Purchase) shares right here.

Quantum Computing Shares Set To Soar

Synthetic intelligence has already reshaped the funding panorama, and its convergence with quantum computing might result in probably the most important wealth-building alternatives of our time.

Right this moment, you will have an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Past AI: The Quantum Leap in Computing Energy, you may uncover the little-known shares we consider will win the quantum computing race and ship huge positive aspects to early traders.

NIKE, Inc. (NKE) : Free Inventory Evaluation Report

lululemon athletica inc. (LULU) : Free Inventory Evaluation Report

Adidas AG (ADDYY) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.