Quantum Computing QUBT, often known as QCi, recorded a 15.6% decline in its inventory worth over the previous three months, an underperformance relative to the business’s 10% drop. The inventory doubtless fell as a result of QUBT issued a lot of new shares to lift over $1.5 billion in capital, inflicting dilution, whereas nonetheless producing restricted revenues. Nevertheless, the corporate’s third-quarter 2025 outcomes spotlight strategic progress which will place the inventory for long-term restoration.

Let’s delve deeper.

QUBT’s Lengthy-Time period Power Shines Amid Close to-Time period Weak spot

Whereas the inventory has confronted short-term stress, the corporate is advancing on a number of fronts like capital, expertise, manufacturing readiness and buyer adoption, suggesting that its long-term prospects stay compelling regardless of current market volatility.

QCi strengthened its stability sheet by elevating greater than $1.5 billion in capital, enabling aggressive funding in engineering, manufacturing and commercialization.

Administration reiterated that its room-temperature built-in photonic structure, providing important dimension, weight, energy and value benefits, continues to distinguish QCi in a market nonetheless scuffling with scalability. Industrial traction is constructing, supported by income contributions from NASA’s LiDAR initiative, new engagements within the automotive and monetary sectors and increasing foundry exercise in Tempe. With Fab 1 now totally operational and the groundwork for a high-volume Fab 2 underway, QCi is transitioning from prototype improvement towards scalable manufacturing.

The corporate additionally delivered significant monetary enhancements within the third quarter of 2025, underscoring stronger operational execution. Revenues grew to $384,000 from $101,000 a 12 months earlier, pushed by an growing variety of higher-value analysis, improvement and customized {hardware} contracts, in addition to the primary contributions from cloud entry to its DIRAC-3 quantum optimization system.

Gross margin expanded sharply to 33% from 9% final 12 months, reflecting improved contract combine and extra environment friendly supply, though margins could fluctuate with a small contract base. Notably, QCi reported a web earnings of $2.4 million within the third quarter in opposition to a $5.7 million loss within the prior 12 months interval, a shift aided by curiosity earnings generated from its strengthened money place and a acquire from the mark-to-market of spinoff liabilities. Collectively, these enhancements sign that the corporate is progressing not solely technologically but in addition financially, reinforcing confidence in its execution capabilities.

Three Months Value Comparability

Picture Supply: Zacks Funding Analysis

Over the previous three months, the inventory has underperformed the business, sector and the S&P 500. It has additionally underperformed rivals like IonQ IONQ and D-Wave Quantum QBTS throughout this era.

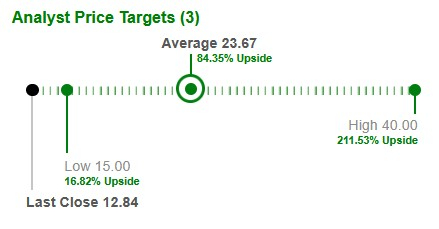

Common Goal Value Reveals Sturdy Close to-term Upside

Primarily based on short-term worth targets, Quantum Computing is at present buying and selling 84.4% under its common Zacks worth goal.

Picture Supply: Zacks Funding Analysis

Estimate Revision Pattern

Estimates for QUBT have narrowed from a lack of 25 cents per share to a lack of 19 cents per share for 2025 over the previous 30 days.

Picture Supply: Zacks Funding Analysis

Purchase QCi Now

Regardless of near-term inventory volatility largely resulting from dilution-related stress, QUBT is transferring quickly from early-stage improvement to scalable commercialization, backed by greater than $1.5 billion in recent capital, increasing buyer adoption, a differentiated room-temperature photonic structure and significant monetary enhancements. With the inventory buying and selling far under its common goal worth and earnings estimates trending upward, the present pullback seems extra like a reset than a mirrored image of deteriorating enterprise high quality. Traders with a long-term horizon could take into account this Zacks Rank #2 (Purchase) inventory, given its technological edge, manufacturing ramp, rising institutional engagement and improved monetary footing. You’ll be able to see the entire record of in the present day’s Zacks Rank #1 (Sturdy Purchase) shares right here.

Radical New Know-how May Hand Traders Large Good points

Quantum Computing is the subsequent technological revolution, and it could possibly be much more superior than AI.

Whereas some believed the expertise was years away, it’s already current and transferring quick. Massive hyperscalers, akin to Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Prepare dinner reveals 7 rigorously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early consultants who acknowledged NVIDIA’s huge potential again in 2016. Now, he has keyed in on what could possibly be “the subsequent massive factor” in quantum computing supremacy. Right this moment, you might have a uncommon probability to place your portfolio on the forefront of this chance.

See High Quantum Shares Now >>

Quantum Computing Inc. (QUBT) : Free Inventory Evaluation Report

IonQ, Inc. (IONQ) : Free Inventory Evaluation Report

D-Wave Quantum Inc. (QBTS) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.