We see the weak spot in financial institution shares following This autumn outcomes as primarily a sell-the-news phenomenon fairly than a perform of something basically problematic with the quarterly numbers and even administration’s outlook and steerage for the approaching durations.

Financial institution earnings aren’t nice, however they aren’t unhealthy both, and broadly reflective of a steadily bettering earnings outlook for the group. Our constructive view of the group’s This autumn outcomes is constructed out by how estimates for the present interval (2026 Q1) are evolving, as we present beneath.

Picture Supply: Zacks Funding Analysis

It’s nonetheless early within the 2025 This autumn reporting cycle, as two-thirds of the Finance sector’s market capitalization within the S&P 500 index has but to report quarterly outcomes. However these early indicators on the revisions entrance give us confidence that the traits already established will probably show enduring.

With respect to the financial institution earnings scorecard, we now have seen This autumn outcomes from 33.7% of the market capitalization within the S&P 500 index. Whole earnings for these Finance sector corporations are up +12.6% from the identical interval final yr on +6.9% larger revenues, with 91.7% beating EPS estimates and 66.7% beating income estimates.

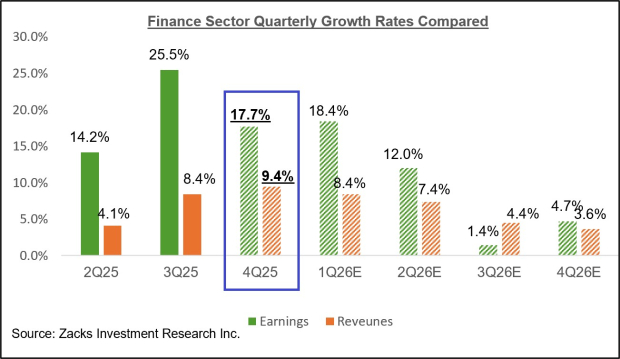

The comparability charts beneath put the sector’s This autumn earnings and income development charges for the 12 Finance sector corporations which have reported already (out of 94 within the Zacks Finance sector) in a historic context.

Picture Supply: Zacks Funding Analysis

The comparability charts beneath put the sector’s This autumn EPS and income beats percentages for a similar 12 Finance sector corporations in a historic context.

Picture Supply: Zacks Funding Analysis

As you may see above, the expansion charges are beneath what we had seen from this similar group of corporations within the previous interval, however in any other case throughout the vary for this era. The beats percentages are on the weak aspect, with income beats notably beneath the common for this group of corporations within the previous 20-quarter interval.

As famous earlier, loads of Finance sector outcomes are nonetheless to come back, together with these from main regional banks like Fifth Third and KeyCorp. U.S. Bancorp, Truist Monetary, and client finance operators like Capital One, Ally Monetary, and others.

This autumn as a complete, combining the precise outcomes which have come out with estimates for the still-to-come Finance sector corporations, complete earnings for the sector are anticipated to be up +17.7% from the identical interval final yr on +9.4% larger revenues.

Picture Supply: Zacks Funding Analysis

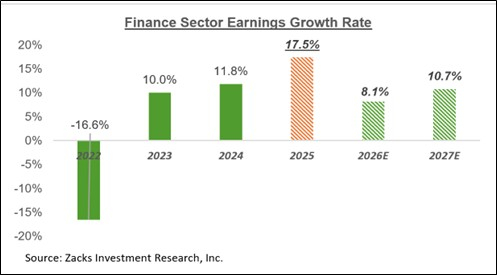

The chart beneath reveals the Finance sector’s development image on an annual foundation.

Picture Supply: Zacks Funding Analysis

This autumn Earnings Season Scorecard

By Friday, January 16th, we’ve got seen This autumn outcomes from 33 S&P 500 members. Whole earnings for these corporations are up +17.3% from the identical interval final yr on +7.6% larger revenues, with 87.9% beating EPS estimates and 69.7% beating income estimates.

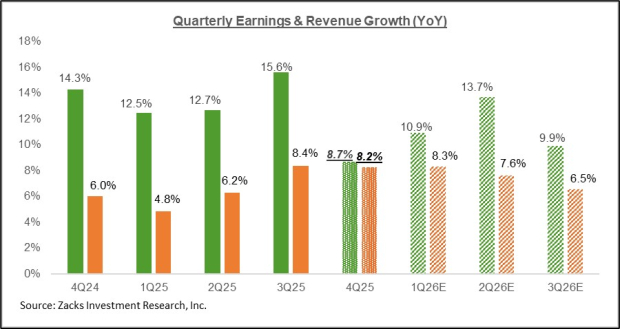

The comparability charts beneath present the expansion charges for these 33 index members in contrast with what we had seen from this similar group of corporations in different current durations.

Picture Supply: Zacks Funding Analysis

The comparability charts beneath present the This autumn EPS and income beats percentages for this group of corporations relative to what we had seen from them in different current durations.

Picture Supply: Zacks Funding Analysis

Loads of outcomes are nonetheless to come back. However at this early stage, the income beats share is monitoring beneath the historic common, with all the opposite metrics within the historic vary.

Key Earnings Outcomes This Week: Netflix & Capital One Monetary

Netflix (NFLX)

Netflix NFLX is scheduled to report outcomes after the market’s shut on Tuesday, January 20th. The corporate is anticipated to report 55 cents per share in earnings on $11.97 billion in revenues, representing year-over-year development charges of +27.9% and +16.8%, respectively. The inventory was down following the final quarterly launch on October 21st, with the Warner Brothers acquisition situation including to the inventory’s weak spot.

Netflix shares have been in a downtrend for the reason that begin of the second half of 2025 and have misplaced greater than -30% of their worth within the final 6 months, massively lagging the market’s +13.4% achieve. The continuing Warner Brothers deal will proceed to weigh on the inventory’s near-term trajectory, whereas developments on the corporate’s promoting technique shall be key to this earnings launch.

Capital One Monetary (COF)

Capital One Monetary COF shall be reporting This autumn outcomes after the market’s shut on Thursday, January 22nd. Current headlines about rate of interest caps have emerged as a cloth headwind for all client finance operators, together with Capital One. The inventory had led the broader market by way of January 6th, however has since misplaced -7.3% of its worth (vs. the market’s +0.4% achieve). Capital One is anticipated to report $4.07 per share in earnings on $15.3 billion in revenues, representing year-over-year modifications of +31.7% and +50.3%, with the sturdy development charges reflecting contribution from the acquired Uncover Monetary enterprise. The corporate has a historical past of sturdy quarterly outcomes, with the inventory usually rising on earnings releases.

The Earnings Massive Image

The chart beneath reveals the This autumn earnings and income development expectations within the context of the place development has been within the previous 4 quarters and what’s anticipated within the coming three quarters.

Picture Supply: Zacks Funding Analysis

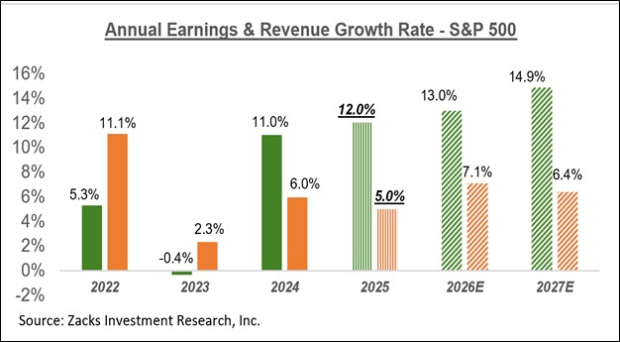

The chart beneath reveals the general earnings image on a calendar-year foundation, with double-digit earnings development anticipated in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

For an in depth have a look at the general earnings image, together with expectations for the approaching durations, please try our weekly Earnings Traits report >>>>This autumn Earnings Season Will get Off to a Strong Begin

Quantum Computing Shares Set To Soar

Synthetic intelligence has already reshaped the funding panorama, and its convergence with quantum computing might result in probably the most vital wealth-building alternatives of our time.

At the moment, you may have an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Past AI: The Quantum Leap in Computing Energy, you will uncover the little-known shares we consider will win the quantum computing race and ship huge positive factors to early traders.

Netflix, Inc. (NFLX) : Free Inventory Evaluation Report

Capital One Monetary Company (COF) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.