TL;DR

- In accordance with K33 Analysis, BlackRock drives inflows in Bitcoin ETFs, stopping spot ETFs from registering internet outflows.

- The absence of BlackRock in future altcoin ETFs may restrict whole inflows and cut back the optimistic affect on underlying asset costs.

- Analysts estimate that the primary Solana and XRP ETFs may entice between $3 billion and $8 billion.

BlackRock stays the principle driver of flows in Bitcoin ETFs, and its hypothetical absence raises questions on precise efficiency.

K33 Analysis: No BlackRock, No Celebration

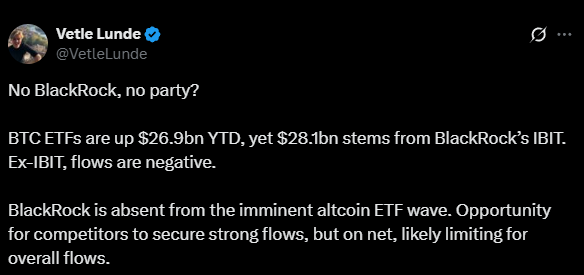

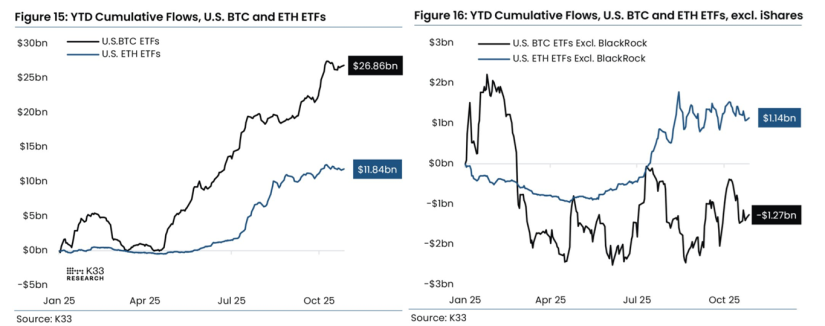

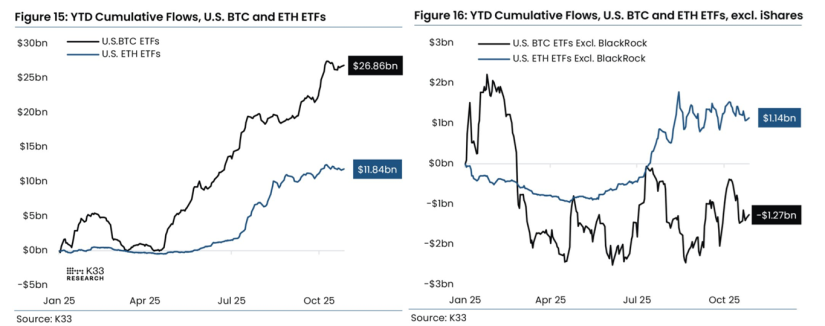

K33 Analysis stories that BlackRock’s iShares Bitcoin Belief obtained $28.1 billion in 2025, the one fund with optimistic year-to-date inflows, permitting spot Bitcoin ETFs to shut the 12 months with a cumulative internet influx of $26.9 billion. With out BlackRock’s participation, Bitcoin ETFs would have seen internet outflows of $1.27 billion.

This dependence exhibits that crypto ETF efficiency stays concentrated amongst main asset managers. Vetle Lunde, head of analysis at K33, warned that the approval of altcoin ETFs won’t generate the anticipated inflows with out the agency’s involvement. “No BlackRock, no celebration,” Lunde wrote, noting that its absence limits the potential of whole inflows and the optimistic affect on underlying asset costs.

The Potential of Altcoin ETFs

Nonetheless, some analysts foresee robust market curiosity within the subsequent technology of ETFs. The primary Solana staking ETF may entice as much as $6 billion in its first 12 months, based on Ryan Lee, chief analyst at Bitget.

JPMorgan estimates {that a} Solana ETF may draw between $3 billion and $6 billion, and an XRP ETF between $4 billion and $8 billion, based mostly on the preliminary adoption of Bitcoin and Ethereum ETFs. Of their first six months, Bitcoin ETFs achieved a 6% adoption fee, equal to 6% of BTC’s market capitalization, whereas ETH ETFs reached 3%.

Optimistic inflows from Bitcoin ETFs have been the principle driver of the cryptocurrency’s worth in 2025, based on Geoff Kendrick, Normal Chartered’s world head of digital belongings analysis. This confirms that, regardless of the rising provide of crypto funding merchandise, the presence of large-scale corporations stays essential to sustaining market attraction and liquidity.

K33 has recognized a possible problem for future altcoin ETFs aiming to capitalize on institutional curiosity. With out BlackRock’s participation, capital inflows may very well be restricted and concentrated, affecting these merchandise’ skill to drive altcoin costs