New York Fed President John Williams has proven his assist for extra Fed fee cuts this 12 months. The Fed official alluded to the weakening labor market, suggesting it ought to take precedence over upside dangers to inflation proper now. The crypto market additionally continues to cost in further fee cuts this 12 months, which has contributed to a current rally that pushed Bitcoin to a brand new all-time excessive (ATH).

John Williams Backs Extra Fed Fee Cuts This 12 months

The New York Fed president stated throughout a New York Instances interview that he expects decrease charges this 12 months, indicating that he would vote in favor of further cuts. Nevertheless, he refused to decide to the variety of additional cuts this 12 months, noting that it’ll all rely on the information.

John Williams’ assist for extra Fed fee cuts comes amid considerations of a weakening labor market. The Fed President famous that the shift over the previous few months has been on the employment aspect reasonably than within the inflation knowledge. He added that he’s very centered on the dangers of an additional slowdown within the labor market.

As CoinGape reported, the FOMC minutes confirmed that almost all Fed officers judged it applicable to make additional Fed fee cuts by year-end as a result of slowdown within the labor market. This was additionally what prompted the primary fee lower of the 12 months final month, because the current jobs knowledge confirmed that the labor market wasn’t as sturdy as most believed.

Focus Ought to Be On The Labor Market

Within the interview, Williams recommended that their focus must be extra on the labor market in the intervening time. He admitted that inflation was nonetheless above their 2% goal however that over the previous 12 months, they’ve seen underlying inflation transfer towards their objective. Then again, the Fed president famous that the totality of the information signifies the labor market has cooled over the previous 12 months, probably warranting additional Fed fee cuts.

The New York Fed president joins Fed Governors Michelle Bowman and Stephen Miran, who’ve indicated that their colleagues must be paying extra consideration to the labor market than to inflation. Miran just lately stated he’s extra “sanguine” concerning the inflation outlook than most of his colleagues, at the same time as he advocates for a collection of 50-basis-point (bps) cuts.

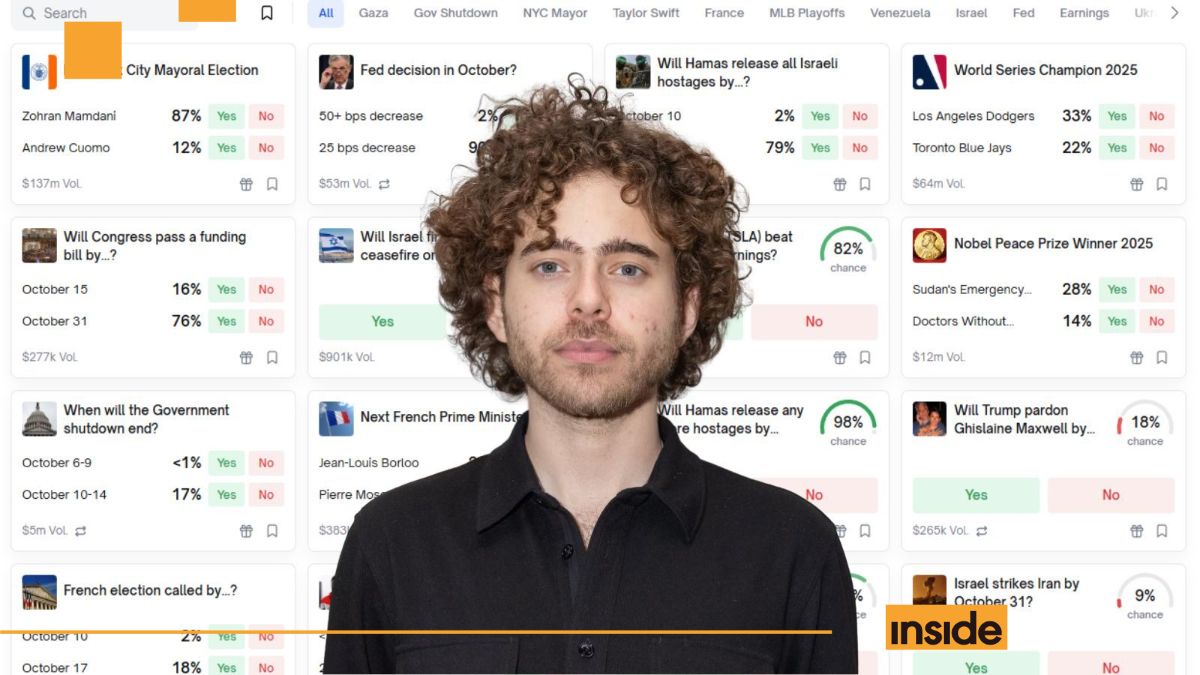

CME FedWatch knowledge exhibits a 94.6% probability that the Fed will lower charges by 25 bps on the October 29 assembly. In the meantime, there’s additionally a 79.8% probability that they may decrease charges once more by 25 bps on the December 10 FOMC assembly.