- Semaglutide – Nonetheless NVO’s Main Prime-Line Driver

- NVO Expands Footprint in Uncommon Illnesses and Liver Care

- NVO Focuses on Subsequent-Technology Medication for Weight problems

- NVO’s Inventory Worth, Valuation, Estimates

- NVO Inventory Underperforms the Trade, Sector & the S&P 500

- NVO Inventory Valuation

- NVO Estimate Motion

- Right here’s How you can Play NVO Inventory

- Quantum Computing Shares Set To Soar

Novo Nordisk NVO shares have climbed 10% prior to now month, supported by a mixture of sure inner elements and constructive market catalysts, which boosted investor confidence.

In early September, Novo Nordisk reported constructive real-world knowledge from its REACH examine, exhibiting that its blockbuster diabetes injection, Ozempic, outperformed Eli Lilly’s LLY Trulicity in lowering cardiovascular dangers amongst sort II diabetes (T2D) sufferers. Ozempic lowered the danger of main hostile cardiovascular occasions by 23% and stays the one GLP-1 remedy accredited to cut back kidney illness development and cardiovascular dying in sufferers with diabetes and power kidney illness.

Novo Nordisk additionally introduced a serious restructuring program geared toward streamlining operations and reinvesting in its core diabetes and weight problems companies. The plan consists of lowering its world workforce by about 9,000 staff, concentrating on annualized financial savings of round DKK 8 billion by 2026. Investor sentiment additional improved throughout the pharmaceutical sector following Pfizer’s landmark settlement with the Trump administration in September. The deal, which addresses long-standing considerations over drug pricing and tariffs whereas incentivizing U.S. manufacturing, has fueled optimism that different main drugmakers may benefit from comparable coverage assist. This favors NVO, which has been investing closely to develop its U.S. manufacturing capability for its GLP-1 drug portfolio, positioning the corporate to capitalize on potential regulatory and tariff benefits.

Nevertheless, warning is warranted as Novo Nordisk continues to face aggressive stress from Eli Lilly’s tirzepatide-based medicine, slower weight problems market development, and regulatory setbacks. LLY markets its tirzepatide medicines as Mounjaro for T2D and Zepbound for weight problems. Regardless of being available on the market for lower than three years, each medicine have turn out to be LLY’s key top-line drivers. Within the first half of 2025, they generated mixed gross sales of $14.7 billion, accounting for 52% of Eli Lilly’s whole revenues.

After reducing its 2025 gross sales and revenue outlook, Novo Nordisk now faces earnings threat and execution challenges regardless of its robust fundamentals and advancing pipeline. Whereas its long-term potential stays tied to the big, underpenetrated weight problems market, near-term headwinds make the inventory a dangerous guess at present ranges. Let’s dig deeper and perceive the corporate’s strengths and weaknesses to know the best way to play the inventory.

Semaglutide – Nonetheless NVO’s Main Prime-Line Driver

Novo Nordisk’s success lately has been pushed by the gross sales of Ozempic and Rybelsus (oral) for T2D, and Wegovy for weight problems. Regardless of current market turmoil, the corporate holds a powerful place in diabetes care, with one of many business’s broadest portfolios.

Wegovy is a serious income driver, recording gross sales of $5.41 billion (DKK 36.9 billion) throughout the first half of 2025, up 78% yr over yr on robust prescription development. Ozempic additionally continues to spice up total revenues. As of July 1, CVS Caremark, a serious pharmacy profit supervisor, has designated Wegovy as its most well-liked GLP-1 remedy for weight reduction.

Novo Nordisk is increasing semaglutide’s attain by means of new indications. Wegovy is now accredited for lowering main cardiovascular occasions, easing HFpEF signs, and relieving osteoarthritis-related knee ache in weight problems.

The FDA can also be reviewing Novo Nordisk’s software for a 25 mg oral semaglutide for weight problems, with a call anticipated by year-end. Oral capsules may enhance adherence over injections. Potential approval would give Novo Nordisk a notable benefit as the only producer of a marketed oral weight problems tablet, positioning it to seize important market share. Rybelsus’ label within the EU has been expanded to incorporate cardiovascular advantages in diabetes sufferers. The same submitting for Rybelsus is presently below overview in the US, with a call anticipated by year-end. A 7.2 mg Wegovy dose, exhibiting as much as 25% weight reduction within the STEP UP examine, is below EU overview. Label growth can also be being searched for Ozempic in treating peripheral artery illness in the US and the EU.

NVO Expands Footprint in Uncommon Illnesses and Liver Care

Past its GLP-1 portfolio, Novo Nordisk is broadening its presence in uncommon ailments. The corporate has submitted a regulatory submitting in search of approval for Mim8 in hemophilia A in the US and has secured EU approval for Alhemo to deal with hemophilia A and B with inhibitors. Alhemo can also be below EU overview for sufferers with out inhibitors. In the US, Alhemo is already accredited for each hemophilia A and B, with or with out inhibitors.

The FDA lately granted accelerated approval to Wegovy as the primary GLP-1 remedy to deal with noncirrhotic metabolic dysfunction-associated steatohepatitis with moderate-to-advanced liver fibrosis. This marked a big milestone in liver care by providing sufferers a remedy that may each halt illness exercise and reverse liver injury.

NVO Focuses on Subsequent-Technology Medication for Weight problems

Novo Nordisk can also be creating a number of next-generation weight problems candidates in its pipeline, particularly concentrating on the profitable U.S. market. Essentially the most superior weight reduction candidate in Novo Nordisk’s pipeline is CagriSema, a fixed-dose mixture of a long-acting amylin analog, cagrilintide, and Wegovy. The corporate is planning its regulatory submission in 2026. NVO can also be gearing as much as launch a devoted late-stage program evaluating cagrilintide as a monotherapy for weight problems.

Novo Nordisk can also be creating a small-molecule oral CB1 inverse agonist, monlunabant, in a mid-stage examine. The corporate is presently gearing as much as advance amycretin, an investigational unimolecular GLP-1 and amylin receptor agonist, for weight administration into late-stage growth. The section III program on amycretin is deliberate to be initiated throughout the first quarter of 2026. Lately, the corporate additionally signed a $2.2 billion cope with Septerna for creating and commercializing oral small-molecule medicines for treating weight problems, diabetes, and different cardiometabolic ailments.

NVO’s Inventory Worth, Valuation, Estimates

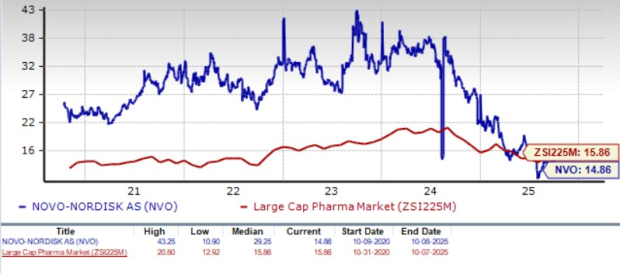

12 months up to now, Novo Nordisk shares have misplaced 30.7% towards the business’s 7.9% development. The corporate has additionally underperformed the sector and the S&P 500 throughout the identical time-frame, as seen within the chart beneath.

NVO Inventory Underperforms the Trade, Sector & the S&P 500

Picture Supply: Zacks Funding Analysis

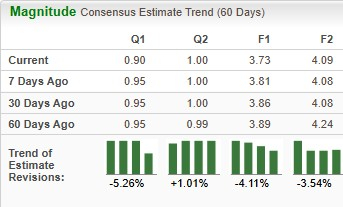

Novo Nordisk is buying and selling at a reduction to the business, as seen within the chart beneath. Going by the worth/earnings ratio, the corporate’s shares presently commerce at 14.86 ahead earnings, which is decrease than 15.86 for the business. The inventory is buying and selling a lot beneath its five-year imply of 29.25.

NVO Inventory Valuation

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Earnings estimates for 2025 have deteriorated from $3.89 to $3.73 per share over the previous 60 days. Throughout the identical time-frame, Novo Nordisk’s 2026 earnings per share estimates have declined from $4.24 to $4.09.

NVO Estimate Motion

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Right here’s How you can Play NVO Inventory

The current share value rally for Novo Nordisk, presently carrying a Zacks Rank #5 (Sturdy Promote), seems extra sentiment-driven than basically supported, as the corporate faces mounting operational and aggressive challenges. Whereas current real-world knowledge for Ozempic and ongoing restructuring initiatives have quickly lifted investor confidence, underlying headwinds stay important. Slower-than-expected Wegovy uptake in the US, uneven worldwide launches, and aggressive competitors from Eli Lilly’s tirzepatide-based medicine proceed to weigh on market share and earnings visibility. Novo Nordisk’s choice to chop its 2025 gross sales and revenue outlook underscores these pressures, whereas the 9,000 deliberate job reductions and associated restructuring prices add additional uncertainty. Within the close to time period, execution threat, pricing headwinds and mounting competitors within the GLP-1 panorama make the inventory unattractive for merchants in search of fast good points. You may see the whole record of immediately’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Competitors within the weight problems remedy market is intensifying because the house, projected by Goldman Sachs to succeed in $100 billion by 2030, attracts new contenders past leaders Eli Lilly and Novo Nordisk. Amgen AMGN and Viking Therapeutics VKTX are advancing GLP-1–based mostly therapies to problem the incumbents. Amgen has launched a broad section III program for its twin GIPR/GLP-1 agonist, MariTide, concentrating on weight problems and diabetes. In the meantime, Viking Therapeutics is progressing two late-stage research of its injectable VK2735 and reported blended mid-stage knowledge on the oral model in August, prompting a pointy inventory decline.

From a longer-term perspective, the funding case for Novo Nordisk stays equally weak at current. Regardless of its established management in diabetes care and ongoing pipeline efforts in next-generation weight problems and uncommon illness therapies, the corporate’s development trajectory is flattening amid rising competitors, margin compression and regulatory hurdles. With profitability below pressure and new product catalysts nonetheless away from contributing meaningfully, there’s a restricted risk-reward profile at current. Till Novo Nordisk delivers constant operational execution, demonstrates tangible post-restructuring profitability, and regains significant market share traction, traders — each short- and long-term — could be higher off avoiding the inventory.

Quantum Computing Shares Set To Soar

Synthetic intelligence has already reshaped the funding panorama, and its convergence with quantum computing may result in essentially the most important wealth-building alternatives of our time.

At present, you could have an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Past AI: The Quantum Leap in Computing Energy, you will uncover the little-known shares we imagine will win the quantum computing race and ship large good points to early traders.

Novo Nordisk A/S (NVO) : Free Inventory Evaluation Report

Eli Lilly and Firm (LLY) : Free Inventory Evaluation Report

Amgen Inc. (AMGN) : Free Inventory Evaluation Report

Viking Therapeutics, Inc. (VKTX) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.