Coinbase COIN inventory could also be popping up on buyers’ radars as a buy-the-dip goal amid weak spot within the cryptocurrency market and broader valuation issues within the tech sector. Buying and selling at round $257 a share, COIN is now greater than 40% from its 52-week and all-time excessive of $444.

Contemplating its fortunes are intently tied to digital belongings, Coinbase inventory has plunged over 25% this month with the value of Bitcoin (BTCUSD) droppping additional beneath $100,000.

Though Coinbase is more likely to profit from increased buying and selling volumes as the most important cryptocurrency operator within the U.S., the unstable drop in these asset costs has diminished investor sentiment because it pertains to diminished payment income, which might in the end result in weaker development prospects.

Picture Supply: TradingView

Coinbase’s Outlook & EPS Revisions

Regardless of the pullback in COIN, Coinbase most lately exceeded its Q3 expectations in late October and alluded to a cautiously optimistic outlook amid crypto volatility. Coinbase famous that the Crypto bull market nonetheless has room to run, emphasizing resilient liquidity circumstances and a supportive macro backdrop that features clearer regulatory frameworks.

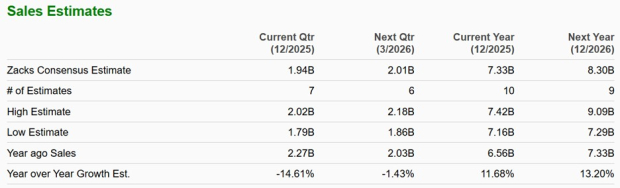

Primarily based on Zacks’ estimates, Coinbase’s complete gross sales are actually anticipated to rise 11% this yr and are projected to extend one other 13% in fiscal 2026 to $8.3 billion.

Picture Supply: Zacks Funding Analysis

On the underside line, Coinbase’s annual earnings are at the moment slated to be up 5% in FY25 to $8.01. Nevertheless, FY26 EPS is projected to fall to $5.87 with analysts anticipating decrease buying and selling exercise, payment compression, and better working bills regardless of sturdy person development.

Being attentive to the development of earnings estimate revisions, FY25 EPS estimates are up 14% within the final 30 days, with FY26 EPS projections barely down.

Picture Supply: Zacks Funding Analysis

Monitoring Coinbase’s Steadiness Sheet

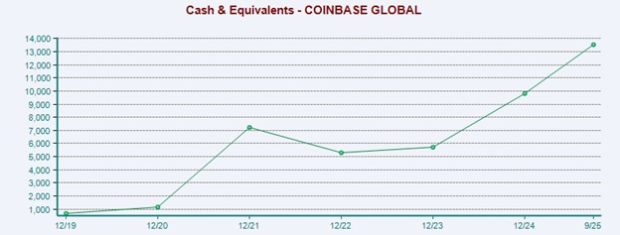

Reassuringly, Coinbase’s money & equivalents have ballooned to over $13.5 billion. Moreover, the corporate has $31.35 billion in complete belongings, which is properly above its complete liabilities of $15.32 billion.

Picture Supply: Zacks Funding Analysis

Coinbase’s Extra Affordable P/E Valuation

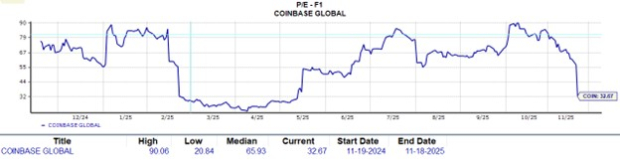

In fact, essentially the most interesting side of probably shopping for the dip in Coinbase inventory is that COIN is beginning to commerce at a much more affordable valuation. When it comes to worth to ahead earnings, COIN is now buying and selling at 32X in comparison with a lofty one-year excessive of 90X and a median of 65X.

Picture Supply: Zacks Funding Analysis

Backside Line

It’s straightforward to see how Coinbase is shaping as much as be one of the crucial interesting buy-the-dip candidates to think about, however for now, COIN lands a Zacks Rank #3 (Maintain). Even with Coinbase inventory buying and selling at a extra enticing worth, an uptick in FY26 EPS revisions will possible be wanted to solidify a purchase ranking.

To that time, this might preserve Coinbase at a extra soothing ahead earnings a number of; in any other case, COIN might finally look overvalued once more, contemplating the anticipated drop in its backside line.

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unbelievable demand for information is fueling the market’s subsequent digital gold rush. As information facilities proceed to be constructed and continuously upgraded, the businesses that present the {hardware} for these behemoths will turn into the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to reap the benefits of the following development stage of this market. It focuses on semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is strictly the place you need to be.

See This Inventory Now for Free >>

Coinbase World, Inc. (COIN) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.