A dealer works, as a display broadcasts a press convention by U.S. Federal Reserve Chair Jerome Powell following the Fed fee reduce announcement, on the ground of the New York Inventory Change (NYSE) in New York Metropolis, U.S., Oct. 29, 2025.

Brendan McDermid | Reuters

The S&P 500 was comparatively unchanged on Wednesday forward of the Federal Reserve’s rate of interest resolution.

The broad market index traded up 0.1%. The Dow Jones Industrial Common rose 240 factors, or 0.5%, whereas the Nasdaq Composite declined 0.2%. Beneficial properties within the S&P 500 have been stored in verify by a greater than 2% decline in shares of Microsoft.

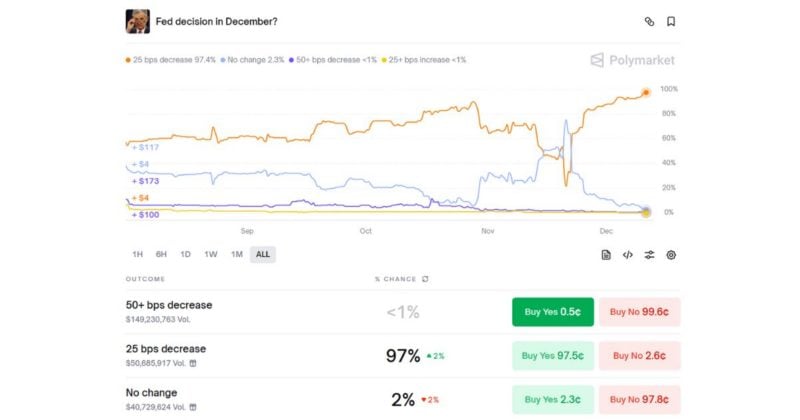

Shares have been teetering between slight beneficial properties and losses in current classes as buyers await this week’s key Fed assembly, which is the ultimate one of many 12 months. The Fed is broadly anticipated to ship its third straight rate of interest reduce of 1 / 4 share level, with fed funds futures suggesting a roughly 90% probability of a lower, in response to CME’s FedWatch software.

Sentiment amongst members of the rate-setting Federal Open Market Committee stays divided, nonetheless, as some favor cuts to stave off additional labor market weak spot and others consider one other reduce might worsen inflation. Traders wish to gauge members’ sentiment from the post-meeting assertion and Chair Jerome Powell’s extremely anticipated information convention Wednesday afternoon.

“Market expectations for the Fed have turned sharply dovish, elevating the danger of outsized reactions if the Fed delivers a hawkish shock,” stated Financial institution of America analyst Vittoria Volta. “Towards a backdrop of a possible Fed chair announcement and a wave of post-shutdown financial information, December could ship extra surprises, and volatility, than traditional.”

The earlier session noticed lackluster strikes within the broader market, the place the broad-based S&P 500 and 30-stock Dow closed within the pink, whereas the tech-heavy Nasdaq rose barely.

The S&P 500 sits simply round 1% beneath its final report shut posted on Oct. 28, which was the day earlier than the final Fed resolution. On Oct. 29, the Fed reduce charges, however Powell signaled that one other discount was not sure for December. That despatched shares decrease that day and began a tough patch for equities via most of November till some Fed members started to sign a December reduce could also be so as. The benchmark then rebounded again to the near-record stage its at present at.

A sector rotation has emerged, nonetheless. The Russell 2000 index of small-cap firms hit a contemporary all-time intraday excessive on Tuesday, strengthened by the prospect of upcoming fee cuts. Smaller firms have a tendency to learn from fee cuts as a result of their borrowing prices are extra linked to market charges, and will subsequently enhance their revenue margins.

Wells Fargo Funding Institute world fairness strategist Doug Beath famous that the Russell 2000 is underperforming the S&P 500 this 12 months, however has rallied since Nov. 21 and outperformed the broad-market index since that date.

“The favorable change for small-cap equities is in line with our view that fairness market breadth is widening,” Beath stated. “We consider buyers are trying past the present financial mushy patch in anticipation of accelerating financial progress via 2026 due to optimistic secular tendencies already in place — tax cuts that may ship what must be the biggest refunds since 2021, deregulation, extra Fed fee cuts, and continued know-how capex progress.”