In line with a CryptoQuant evaluation, Bitcoin has entered its most bearish part for the reason that present bull market started two years in the past.

For context, Bitcoin (BTC) continues to slip, pulling the broader crypto market down with it. After reaching a excessive above $126,000 on Oct. 6, the crypto firstborn has now dropped greater than 28%, erasing roughly $710 billion in market worth, because it trades close to $90,197.

Bitcoin In Its Most Bearish Section Since January 2023

Amid the downtrend, CryptoQuant, in its newest weekly replace, reported that Bitcoin now sits in its most bearish circumstances for the reason that bull cycle started in January 2023.

The agency famous that this pullback appears completely different from earlier corrections within the cycle. Notably, it identified that its Bull Rating Index fell to a deeply bearish studying of 20 out of 100 final week as a result of weaker spot demand, adverse worth momentum, and a slowdown in stablecoin liquidity.

Along with this, CryptoQuant confirmed a main technical change. Particularly, Bitcoin just lately moved beneath its 365-day shifting common, a stage that marked the affirmation of the 2022 bear market.

The agency emphasised that Bitcoin had stayed above this trendline throughout each different correction within the present bull run, which makes the latest breakdown particularly vital.

Because of this, CryptoQuant believes the market has entered a clearly bearish part. This comes a number of days after the CryptoQuant CEO, Ki Younger Ju, prompt that Bitcoin had nonetheless not entered a bear market.

Demand From Treasuries and ETFs Weakening

The corporate additionally spotlighted the demand aspect, explaining that Treasury firms now not assist costs the way in which they did earlier within the 12 months. Their market values have fallen by 70% to greater than 90% in latest months, which prevents them from promoting new shares to lift capital for added Bitcoin purchases.

Furthermore, regardless of buying 8,178 BTC earlier this week, CryptoQuant highlighted that Michael Saylor’s Technique has additionally decreased its personal shopping for as a result of its inventory market cap has dropped towards the worth of its Bitcoin holdings.

The agency additionally reviewed ETF exercise, stressing that ETF inflows can sluggish and even reverse. Notably, some establishments purchase spot Bitcoin by way of ETFs whereas shorting futures to seize the unfold. When that unfold tightens, they unwind the commerce and promote spot Bitcoin. For perspective, Bitcoin ETFs have seen outflows price $2.89 billion this month.

Will the Present Bitcoin Cycle Stretch to 2026?

The report then known as consideration to the concept of Bitcoin’s four-year cycle. For context, earlier cycles spanned 2014 to 2017 and 2018 to 2021, so many anticipated the present one to finish in 2025.

CryptoQuant famous that this sample initially got here from the halving’s provide shock, however that impact has weakened as extra tradable Bitcoin enters the market.

Some analysts now anticipate the cycle to stretch into 2026, arguing that institutional traders, slightly than retail merchants, now drive a lot of the demand. Nonetheless, CryptoQuant warns that institutional demand can disappear simply as rapidly, as proven by the sudden pullback amongst Treasury firms.

Bullish Catalysts Already Priced in

CryptoQuant argued that Bitcoin’s cycle will depend on demand surges slightly than halvings or calendar patterns. It believes the present demand wave has largely performed out.

In 2024, Donald Trump’s election win pushed Bitcoin above $100,000 for the primary time. In 2025, the rise of a number of Bitcoin Treasury firms lifted the value above $120,000 in the course of the summer time.

CryptoQuant famous that these catalysts have already run their course, and potential new triggers both look unlikely or seem largely priced in.

Nevertheless, the report admitted that this case doesn’t assure a pointy crash. Particularly, Bitcoin has fallen 28% and now trades close to sturdy assist between $90,000 and $92,000.

The agency identified that even throughout bear markets, Bitcoin typically rallies 40% to 50% inside a number of months. Nonetheless, as a result of the value now sits beneath the 365-day shifting common, CryptoQuant expects the extent close to $102,600 to behave as heavy resistance.

Is a Bitcoin Reversal Doable Now?

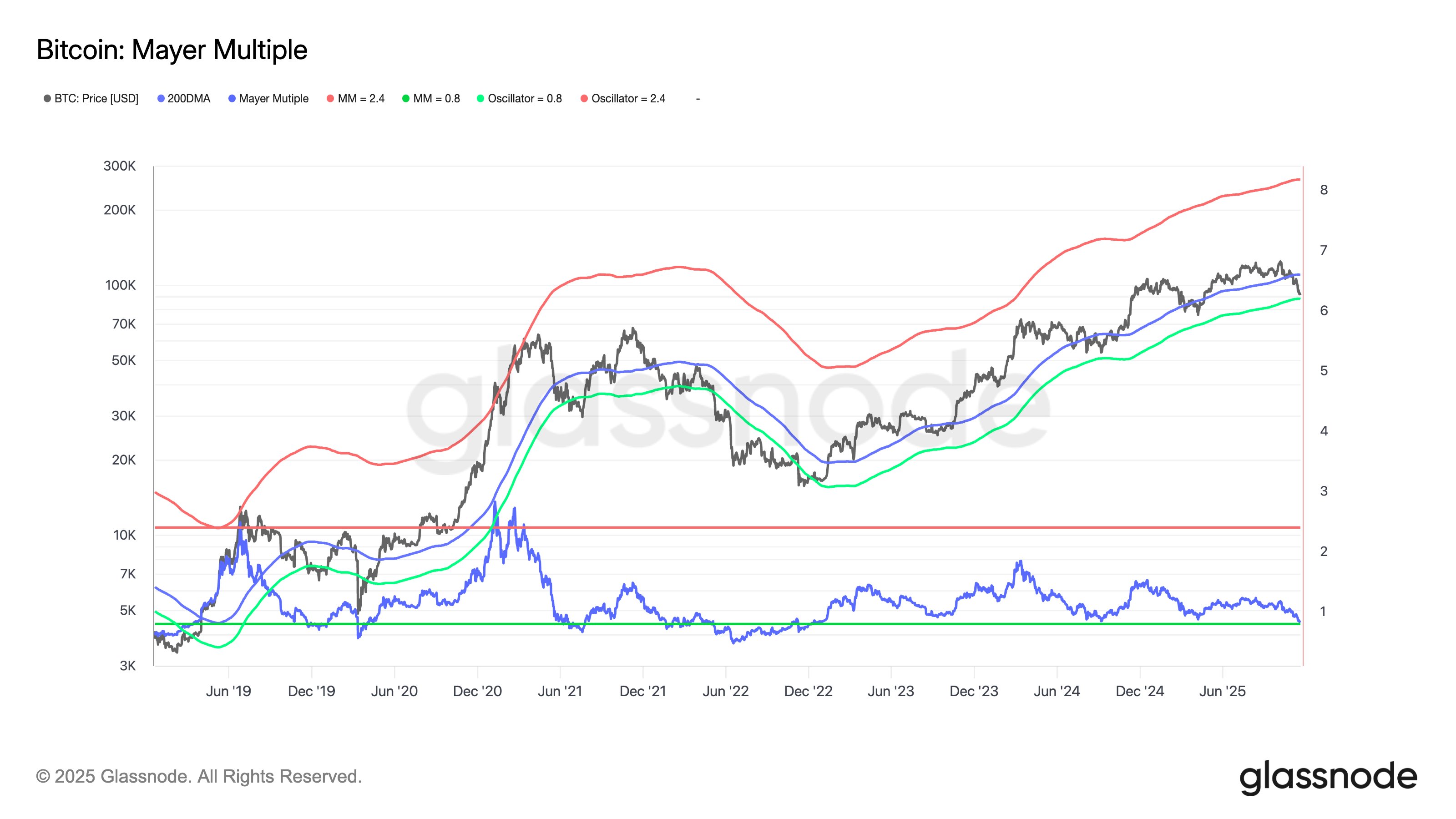

In the meantime, in a separate disclosure, Glassnode famous that Bitcoin’s Mayer A number of has dropped towards the decrease finish of its long-term vary. The agency stated this shift signifies slowing momentum and the early levels of a value-driven part the place consumers are likely to re-enter.

Additionally, analyst Cas Abbé expects a short-term rebound as a result of day by day and weekly RSI readings now present oversold circumstances, and most panic sellers have probably exited. Abbé believes this setup might permit Bitcoin to push again above $100,000 quickly.

$BTC short-term bounce appears extremely prone to occur.

Every day and weekly RSI is oversold, and a lot of the panic promoting has occurred.

It looks like Bitcoin might rally above the $100,000 stage from right here. pic.twitter.com/02rlEfhbny

— Cas Abbé (@cas_abbe) November 20, 2025

DisClamier: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article might embody the creator’s private opinions and don’t replicate The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Primary isn’t chargeable for any monetary losses.