TL;DR

- HYPE has stabilized at $29.5 after briefly dropping under $30, exhibiting a average 1.5% restoration, although stress at key ranges stays.

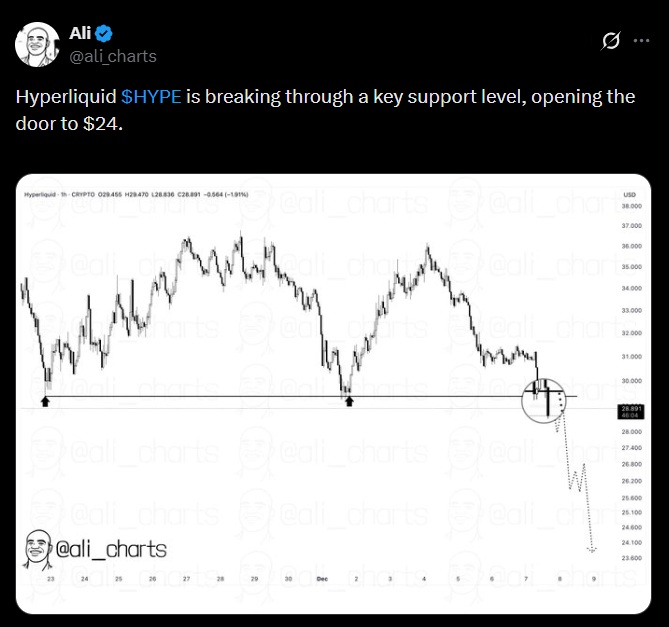

- The following assist ranges are at $26 and $24, and a few technical projections even level to $16, reflecting the vulnerability of the downtrend that started in September.

- The market stays centered on provide absorption and the soundness of essential ranges.

Hyperliquid (HYPE) has stabilized close to $29.5 following the latest dip under $30, however key ranges stay underneath stress. The token reveals a average restoration, rising 1.5% over the previous 24 hours, with value actions elevating uncertainty amongst merchants and analysts as a result of a mix of token unlocks and pockets exercise.

What Do HYPE’s Technical Alerts Present?

The drop under $30 marked the primary clear breach of this assist since November, and though the worth has rebounded, technical indicators point out the market stays weak. Analysts be aware that if HYPE fails to consolidate above $30–$32, it might check the subsequent assist ranges at $26 and $24. Some technical projections even counsel a possible drop to $16 within the medium term, reflecting persistent stress within the downtrend that started in September when the token traded above $55.

Pockets exercise and upcoming token unlocks preserve the market on edge. Not too long ago, $2.2 million price of HYPE was moved from crew wallets forward of the scheduled unlock of 10 million tokens. Whereas mergers and buyback packages generate demand, merchants warn that energetic provide nonetheless outweighs these absorption channels, rising short-term volatility.

Market Watches Token Circulation

From a technical perspective, HYPE stays close to the decrease Bollinger Band, with an RSI of 36 reflecting promoting stress however not excessive situations. Quantity has elevated on the latest pink candles, exhibiting heightened promoting exercise. Funding charges have cooled, indicating decrease leverage use and cautious positioning amongst high-volume merchants.

Individually, Hyperliquid Methods started operations on December 3 underneath the ticker $PURR. The fund holds 12.6 million tokens together with $300 million in money reserves, performing as a regulated treasury automobile that gives publicity to the token. This construction might add stability to the ecosystem as launched tokens are absorbed and assist ranges consolidate.

The market is intently watching how short-term stress components are managed. The restoration to $29.5 reveals resilience in opposition to the dip, however token circulation retains consideration on essential ranges. To forestall a deeper correction towards $24–$26, merchants want the token to strengthen above $30 within the coming days