- The Function of the WET Token

- Market Dynamics and Lengthy-Time period Concerns

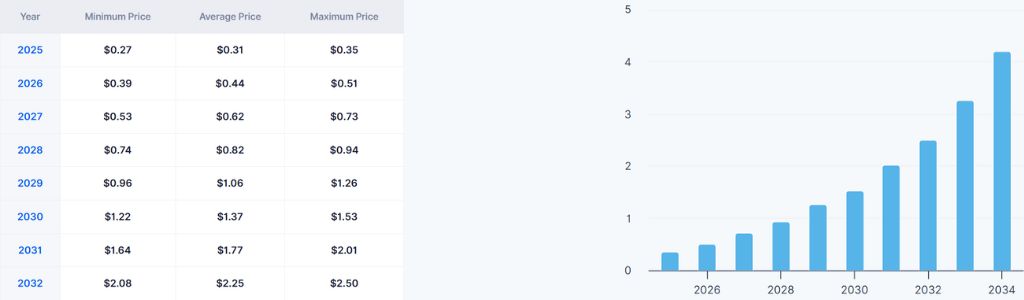

- HumidiFi (WET) 2026 – 2032 Value Prediction

- 2026: HumidiFi Early Market Indicators and Rising Tendencies

- 2027: HumidiFi Consolidation and Ecosystem Progress

- 2028: HumidiFi Shifts in Investor Sentiment

- 2029: HumidiFi Technological Developments and Community Growth

- 2030: HumidiFi Regulatory Affect and World Adoption

- 2031: HumidiFi Strategic Positioning in DeFi Markets

- 2032: HumidiFi Lengthy-Time period Sustainability and Future Outlook

- Conclusion

TL;DR

- HumidiFi Overview: Constructed on Solana, HumidiFi operates as a liquidity-optimizing AMM, integrating with main platforms to scale back slippage and improve commerce execution.

- WET Token Utility: WET powers governance, liquidity incentives, and ecosystem rewards, guaranteeing sustainability and long-term development inside HumidiFi’s DeFi framework.

- Value Predictions 2026–2032: Forecasts spotlight volatility but robust development potential, with WET starting from sub‑$0.20 ranges to above $3.00, reflecting various market situations.

HumidiFi is a decentralized finance (DeFi) protocol constructed on the Solana blockchain, designed to optimize liquidity and commerce execution throughout the ecosystem. Not like conventional decentralized exchanges, HumidiFi capabilities as a proprietary automated market maker (AMM) that integrates with platforms corresponding to Jupiter, DFlow, and OKX Router.

This positioning permits it to function a essential liquidity layer, facilitating environment friendly routing of trades and lowering slippage for customers. By dealing with important day by day buying and selling volumes, HumidiFi has established itself as one in every of Solana’s largest decentralized exchanges, reinforcing its function as a cornerstone within the community’s infrastructure.

The Function of the WET Token

On the coronary heart of HumidiFi lies the WET token, its native digital asset. WET is greater than a tradable cryptocurrency; it underpins the protocol’s governance, incentivization, and utility capabilities. Token holders can take part in governance choices, contribute to liquidity swimming pools, and profit from ecosystem rewards. The tokenomics of WET are structured to steadiness long-term improvement, group incentives, and ecosystem development, guaranteeing that the asset stays central to HumidiFi’s sustainability.

Market Dynamics and Lengthy-Time period Concerns

The cryptocurrency sector is formed by a mix of technological innovation, regulatory developments, and evolving investor sentiment. For initiatives like HumidiFi, these dynamics play an important function in figuring out how the ecosystem adapts to new challenges and alternatives. The WET token, because the protocol’s native asset, is straight influenced by liquidity developments, governance participation, and the general development of decentralized finance.

Inspecting long-term horizons corresponding to 2026–2032 highlights the significance of structural components moderately than short-term volatility. Parts like blockchain scalability, institutional adoption, and international financial circumstances can considerably impression the relevance of HumidiFi throughout the digital asset panorama.

HumidiFi (WET) 2026 – 2032 Value Prediction

2026: HumidiFi Early Market Indicators and Rising Tendencies

In 2026, evaluation from CoinCodex means that WET might commerce inside a broad channel ranging between $0.1419 and $0.5502, with a median annualized value positioned at $0.2442. This projection highlights the potential for important volatility, but additionally factors to the opportunity of notable returns, with estimates indicating a possible 172.07% ROI.

Complementary forecasts based mostly on technical evaluation current a narrower outlook, anticipating WET to achieve a minimal of $0.3254 and a most of $0.3614, with a median buying and selling value round $0.3362. This angle emphasizes a extra steady buying and selling setting, suggesting that WET might preserve consistency inside a tighter value band.

Youtubers Value Prediction

YouTube channel, Sincere Crypto Insights, lately shared a video predicting potential value predictions for WET for the ultimate weeks of 2025 and early 2026.

2027: HumidiFi Consolidation and Ecosystem Progress

By 2027, projections from DigitalCoinPrice point out that WET might start the yr at $0.52 and commerce close to $0.72. This anticipated motion represents a notable improve in comparison with the earlier yr, signaling stronger momentum throughout the market.

Technical evaluation offers one other perspective, suggesting that WET might attain a minimal of $0.26152 and a most of $0.44964, with a median buying and selling value round $0.33485. This outlook underscores the chance of regular development whereas highlighting the significance of market circumstances in shaping efficiency.

2028: HumidiFi Shifts in Investor Sentiment

In line with CoinDataFlow’s experimental forecast mannequin, WET might expertise development of roughly 53.12% in 2028, doubtlessly reaching $0.238473 beneath optimum circumstances. The mannequin outlines a buying and selling vary between $0.12376 and $0.238473, reflecting the chance of notable fluctuations throughout the yr.

One other evaluation envisions a extra optimistic situation, projecting that WET might attain a minimal of $0.651 and climb to a most of $0.7831, with a median buying and selling value round $0.6696 all through 2028. This outlook highlights the potential for sustained appreciation, pointing to circumstances the place WET maintains stability whereas reaching incremental development.

2029: HumidiFi Technological Developments and Community Growth

In 2029, projections recommend that WET might commerce inside a channel starting from $0.2067 to $0.4082, with a median annualized value positioned at $0.2840. This situation factors to the potential for a 102.60% return on funding. Such figures emphasize the affect of liquidity, adoption, and investor sentiment.

Analysts additionally envision a extra optimistic outlook, indicating that WET is unlikely to fall beneath $0.4218, whereas the utmost peak might attain $0.83165, with a median buying and selling worth round $0.57464. This angle underscores the chance of stronger upward momentum.

2030: HumidiFi Regulatory Affect and World Adoption

In line with deep technical evaluation of previous value information, WET is projected to achieve a minimal of $1.32 in 2030, with the potential to climb to a most of $1.65. The typical buying and selling value is anticipated to hover round $1.37, suggesting a comparatively robust efficiency in comparison with earlier years.

Extra projections, constructing on prior analyses, envision a unique situation the place WET might file a minimal of $0.53991 and a most of $1.131, with a median buying and selling value close to $0.75278. This outlook offers a extra conservative vary.

2031: HumidiFi Strategic Positioning in DeFi Markets

By the start of 2031, forecasts and technical evaluation recommend that WET might attain $1.77, sustaining this stage towards the top of the yr. As well as, the token might climb to round $1.63 throughout sure intervals. The span from 2025 to 2031 is anticipated to be a pivotal stage for WET’s development.

One other experimental prediction mannequin outlines a unique situation, indicating that WET might rise by roughly 57.95%, reaching $0.607391 beneath essentially the most constructive circumstances. The value is anticipated to stay inside a spread of $0.248161 to $0.607391 all year long.

2032: HumidiFi Lengthy-Time period Sustainability and Future Outlook

In line with experimental forecast fashions, WET is anticipated to rise by roughly 63.55% in 2032, with the very best potential value reaching $1.03. All year long, the token’s worth might fluctuate inside a spread of $0.417267 to $1.03, reflecting the opportunity of reasonable volatility.

Different analyses current a extra bullish situation, forecasting that WET might attain a minimal of $2.79 and climb to a most of $3.27, with a median buying and selling value round $2.87 throughout 2032. This outlook underscores the potential for sustained appreciation, pointing to circumstances the place WET maintains stability whereas reaching important development.

Conclusion

HumidiFi’s WET token demonstrates robust potential as a cornerstone of Solana’s DeFi ecosystem. Forecasts from 2026 to 2032 spotlight each volatility and development alternatives, formed by liquidity, adoption, and regulation. Lengthy-term sustainability relies on scalability, institutional participation, and investor sentiment, positioning WET for significant relevance in decentralized finance’s future.

The Value Predictions printed on this article are based mostly on estimates made by trade professionals; they aren’t funding suggestions, and it needs to be understood that these predictions might not happen as described.

The content material of this text ought to solely be taken as a information, and you must at all times perform your individual evaluation earlier than making any funding.