Exxon Mobil Company XOM, a U.S.-based built-in vitality firm, earns a big a part of its revenues from its upstream enterprise. The corporate’s involvement within the upstream phase makes it weak to volatility in oil and gasoline costs. Nevertheless, ExxonMobil’s high-return property within the Permian Basin and Guyana are anticipated to assist its earnings even throughout low commodity costs, because of their low price of manufacturing.

The corporate is ramping up manufacturing from its most advantaged property in Guyana and the Permian Basin, serving to maintain earnings progress regardless of softer crude realizations. These advantaged property have low breakeven prices, permitting XOM to take care of secure efficiency and generate constructive money flows even when oil costs are low.

In its most recentearnings name XOM talked about that it has reached manufacturing ranges of 700,000 barrels per day in Guyana within the third quarter. The corporate has sanctioned its seventh improvement in Guyana, named Hammerhead, which is anticipated to start out manufacturing in 2029. By 2030, XOM intends to succeed in a manufacturing capability of 1.7 million Boe from the eight offshore developments within the Stabroek block. Moreover, within the Permian Basin, the corporate has acquired 80,000 internet high-quality acres from Sinochem Petroleum. This transaction expands its presence within the basin, permitting full management over new drilling places the place it will probably implement its expertise to generate higher returns.

ExxonMobil’s upstream enterprise is poised to generate sustainable money flows and ship long-term shareholder worth, owing to its concentrate on manufacturing progress from its advantaged property and structural price discount.

The Core of COP and EOG’s Aggressive Edge

ConocoPhillips COP and EOG Assets, Inc. EOG are two international vitality companies that may thrive even throughout difficult commodity value environments.

ConocoPhillips’ portfolio consists of property within the prolific shale basins of america, the oil sands in Canada and standard property in Asia, Europe and the Center East, which assist low-cost manufacturing. Notably, within the U.S. Decrease 48, COP has an advantaged stock place that may assist operations at a breakeven price as little as $40 per barrel WTI. Even when crude oil costs decline considerably, ConocoPhillips will be capable of preserve its monetary efficiency and generate constructive money flows.

EOG Assets is a number one unbiased exploration and manufacturing firm with operations targeted on the prolific acres in america in addition to a number of resource-rich worldwide basins. EOG boasts a high-return, low-decline asset base and stands out among the many low-cost producers in america. The corporate’s concentrate on sustaining a resilient stability sheet and decreasing manufacturing prices ought to allow it to climate oil value volatility.

XOM’s Value Efficiency, Valuation & Estimates

Shares of ExxonMobil have risen 12.9% over the previous six months in contrast with the 13.3% improve of the composite shares belonging to the trade.

Picture Supply: Zacks Funding Analysis

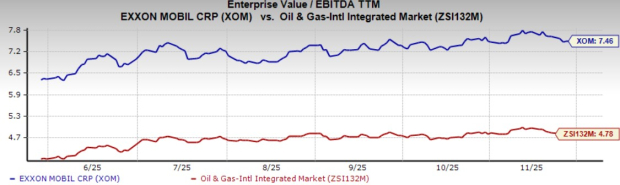

From a valuation standpoint, XOM trades at a trailing 12-month enterprise worth to EBITDA (EV/EBITDA) of seven.46X. That is above the broader trade common of 4.78X.

Picture Supply: Zacks Funding Analysis

The Zacks Consensus Estimate for XOM’s 2025 earnings has been revised upward over the previous seven days.

Picture Supply: Zacks Funding Analysis

XOM, COP and EOG every at present carry a Zacks Rank #3 (Maintain). You may see the whole listing of in the present day’s Zacks #1 Rank (Robust Purchase) shares right here.

Radical New Know-how Might Hand Traders Large Positive factors

Quantum Computing is the subsequent technological revolution, and it could possibly be much more superior than AI.

Whereas some believed the expertise was years away, it’s already current and shifting quick. Giant hyperscalers, equivalent to Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Cook dinner reveals 7 rigorously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early consultants who acknowledged NVIDIA’s monumental potential again in 2016. Now, he has keyed in on what could possibly be “the subsequent massive factor” in quantum computing supremacy. Immediately, you’ve a uncommon likelihood to place your portfolio on the forefront of this chance.

See Prime Quantum Shares Now >>

Exxon Mobil Company (XOM) : Free Inventory Evaluation Report

ConocoPhillips (COP) : Free Inventory Evaluation Report

EOG Assets, Inc. (EOG) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.